No.3807

End of Life Planning (Shu-katsu) Business in Japan: Key Research Findings 2025

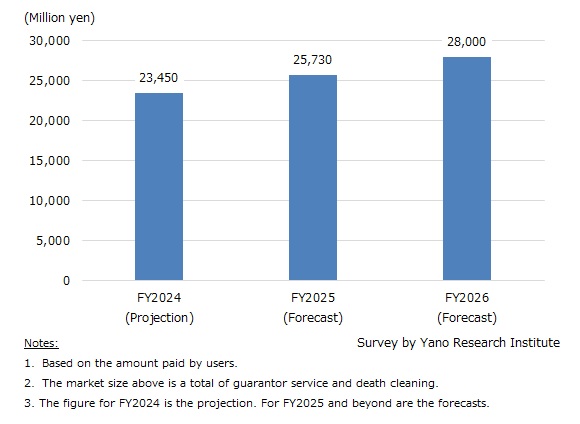

End of Life Planning Businesses (As A Total of Guarantor Service and Death Cleaning) Projected to Reach 23,450 Million Yen in FY2024

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic businesses that relate to end of life planning, and found out the market player trends and future perspectives. This press release announces the total market size of two major business fields, guarantor service and death cleaning.

Market Overview

In this survey, “shukatsu” refers to the process of preparing for one’s own death, particularly among those who place importance on how they spend the final stage of their lives. End of life planning business refers to the businesses pertaining to “shu-katsu”, which encompasses services like guarantor service, death cleaning, estate administration, and inheritance tax management. The market size of end-of-life planning business as a total of two fields (guarantor service and death cleaning) in FY2024 is projected to reach 23,450 million yen.

Although the term “shu-katsu” is relatively new, services like guarantor service, death cleaning, preparation of an “ending notebook”, will writing, pre-need funeral arrangements, and closure of family graves have become increasingly recognized and are now widely accepted by the general public.

Noteworthy Topics

Platformers Providing Convenience to Both Businesses and Consumers

The end-of-life planning industry can broadly be divided into two categories: businesses that provide services directly to consumers (end users), and platform businesses that connect consumers with service providers online. The former typically includes companies offering a single service or a set of closely related services. The latter functions as an online hub, either operated by information providers focused on promoting fair and transparent relationships between businesses and consumers, or by companies offering multiple services as a one-stop shop. For example, a user who finds a guarantor service for applying to a nursing home may later return to the same platform to hire a death cleaning service, avoiding the need to search multiple websites.

Platform providers are actively working to maximize synergy among the services offered on their portals. To enhance convenience for consumers, they engage both end-of-life service providers and general users, aiming to expand the range of available services.

Future Outlook

The market size of end-of-life planning, as a total of 2 major business fields (guarantor service and death cleaning) is forecasted to reach 25,730 million yen in FY2025, which represents 109.7% of the preceding fiscal year. As awareness of 'shukatsu' grows and the industry continues to evolve, we believe the end-of-life planning market will see further expansion.

Research Outline

2.Research Object: Companies in business pertaining to end of life planning

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone and email, and literature research

What are the End of Life Planning Businesses?

The term “end-of-life-related business” in this survey refers to businesses that people approaching their end of life, or their families/related persons, may use or consider, to prepare for their own death. Such services include guarantor service, posthumous affairs service, death cleaning (decluttering and organizing possessions; ‘Swedish death cleaning’), closure of family graves, estate administration, will writing, preparation of “ending notebook” (a notebook to write one's will for preparation for end-of-life and after-death), arrangements to communicate funeral and cremation preferences, preparation of charitable bequests and donations, etc. The market size in this survey is calculated as a total of two fields, guarantor service and death cleaning.

- Guarantor service refers to a service that primarily supports elderly persons by assuming the role of a guarantor when one is required, such as in the process of hospital admissions or moving to nursing facilities.

- Death cleaning refers to services that help individuals sort through (declutter and organize) belongings at home, decide what to keep, donate, sell, recycle or discard, before one moves to a nursing home or a long-term care hospital (not just for practical reasons but also with the goal of making it easier for loved ones to deal with your estate after they are gone.)

<Products and Services in the Market>

Guarantor service, posthumous affairs service, death cleaning, closure of family graves, estate administration, will writing, preparation of “ending note”, communicating funeral and cremation preferences, preparation of charitable bequests and donations, inheritance tax management, pre-need services (funeral planning and reservations, buying a cemetery plot and gravestone, Buddhist household altar, etc.), online services that serve as platforms to connect individuals with these services

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.