No.3755

Online Payment Service Market in Japan: Key Research Findings 2025

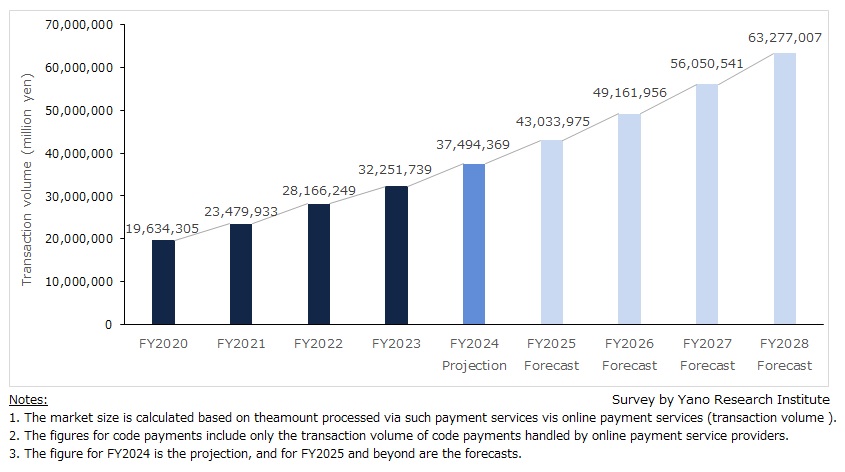

Online Payment Service Market in FY2023 Valued at 32,251,700 Million Yen/ Forecasted to Reach 63 Trillion Yen-Level by FY2028

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the domestic online payment service market, and found out the current status, the trends of market players, and future perspectives.

Market Overview

Online payment service indicates an intermediary service that completes payment operation, primarily credit card payment and code payment, on behalf of EC site operator. With the diversification of payment methods and the expansion of service offerings, the target business of online payment service providers is expanding. Given the situation, the online payment service market is showing growth.

Online payment service providers are encouraging merchants that wish to attract a broader range of customers to introduce and use their payment services by supporting a variety of payment methods, including coded payments. They provide services to online B2C retailers who sell physical goods in the traditional manner, as well as to those who sell digital content or offer services. Furthermore, some online payment service providers have expanded their focus to include offline (physical) retail stores and unattended checkout machines, as well as the B2B transactions including BPSP* and payment on invoices.

Against these backgrounds, the online payment service market in FY2023 was valued at 32,251,700 million yen (114.5% year-over-year) and projected to reach 37,494,400 million yen in FY2024 (116.3% year-over-year).

* BPSP is a short for Business Payment Solution Provider, a type of provider that offers B2B solution enabling payment between an enterprise (buyer) that wishes to pay by credit card and an enterprise(seller) that do not accept credit card payment.

Noteworthy Topics

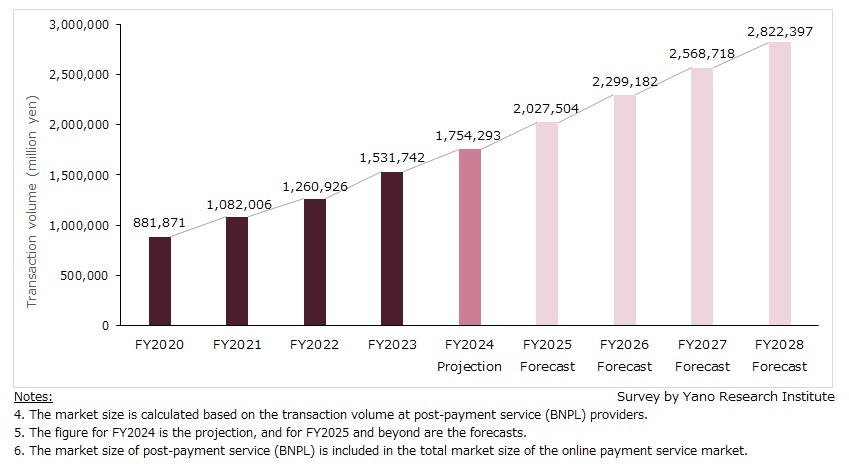

Expansion of Post-payment Services (BNPL)

The market for Buy Now Pay Later (BNPL) services is expanding steadily. It is projected that the market size will increase by 21.5% in FY2023 compared to the previous fiscal year, reaching 1,531,700 million yen.

BNPL initially gained traction primarily among consumer groups without credit cards, such as young adults and stay-at-home moms. However, the market has observed consumers utilizing credit cards and BNPL on a case-by-case basis in recent years; for example, credit card users use BNPL when they make purchases at unfamiliar online retailers.

Post-payment services are attempting to boost the amount per transaction and enhance convenience by providing installment payments. Moreover, they are expanding the use of post payment services for the purchase of services and in face-to-face payments. With such an expansion of use cases, the domestic BNPL market is projected to grow to around 2.8 trillion yen by FY2028.

Future Outlook

With the growth of services in business-to-consumer (B2C) e-commerce, encompassing digital content and services, as well as in business-to-business (B2B) scenarios and offline (in-person) payments, the market for online payment services is expected to expand steadily. By FY2028, the domestic market for online payment services is forecasted to reach 63 trillion yen.

It is expected that online payment service providers are anticipated to continue diversifying their offerings, incorporating value-added benefits beyond traditional scope of payment processing.

Research Outline

2.Research Object: Online payment service providers and related businesses

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews) and literature research

<What is the Online Payment Service? >

In this research, online payment service indicates an intermediary service that completes payment operation, primarily credit card payment and code payment, on behalf of EC site operator.

<What is the Online Payment Service Market? >

In this research, the size of the online payment service market is calculated based on the amount processed via online payment services (transaction volume).

<Products and Services in the Market>

Payment processing services provided by payment agencies, payment service providers, post-payment services/BNPL service providers, etc.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.