No.3627

Cosmetics Market in Japan: Key Research Findings 2024

Clear Recovery in Cosmetics Market, With Remarkable Growth in Makeup and Flagrance Products

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic cosmetics market, and found out the market trends by product category and by sales channel, the trends by market player, and future perspective.

Market Overview

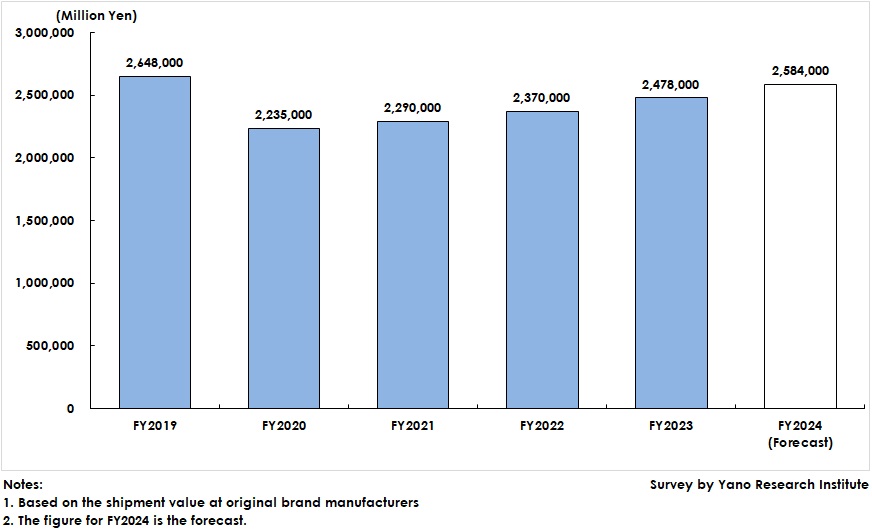

As the Japanese government has resumed the acceptance of private travelers from abroad as well as visa exemptions in 2022, inbound tourism demand is on the way to recovery. Added with COVID-19 viruses having degraded to class 5 under the Infectious Disease Control Law in 2023, consumers’ outing opportunities have increased, which has raised consciousness on being neat and has grown cosmetics demand. The domestic cosmetics market size (based on the shipment value at manufacturers) for FY2023 reached 2,478,000 million yen, 104.6% of the previous fiscal year.

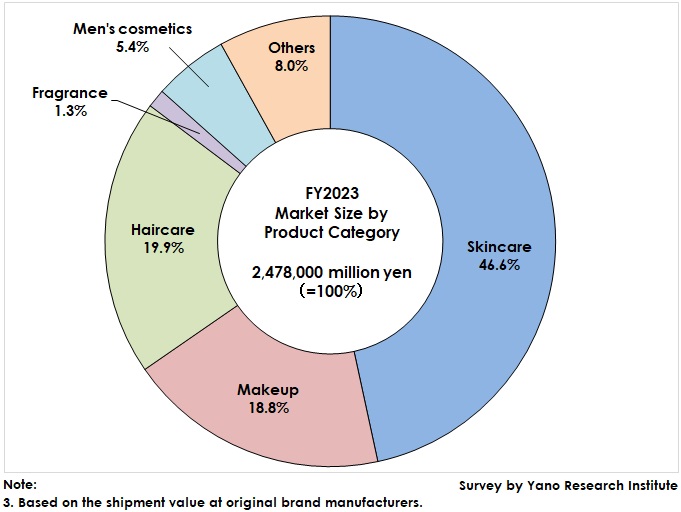

In view of the cosmetics market in FY2023 by product category, skincare products represent the largest portion in the composition ratio at 46.6% (1,155,000 million yen), followed by haircare products 19.9% (493,000 million yen), makeup products 18.8% (465,000 million yen), men’s cosmetics 5.4% (133,000 million yen), and fragrance 1.3% (32,600 million yen).

Noteworthy Topics

Latest Trend of Attention-Attracting Asian Cosmetics

In Japan, Asian cosmetics products from South Korea, China, Thailand, and Taiwan have been on the spotlight.

According to Trade Statistics of Japan, announced by the Ministry of Finance, one of indicators to find the scale of Asian cosmetics, the import value of cosmetics from South Korea in 2023 was 95,962 million yen (123.8% YoY), the largest amount in the import value by country, outperforming France. In 2023, the import value of Asian cosmetics has continued growing, with that from China recorded 49,853 million yen (116.9% YoY), Thailand 33,287 million yen (107.3% YoY), Taiwan 322 million yen (98.0% YoY), showing major presence in Japan.

Future Outlook

Demand is expected to continue returning after FY2024, showing prominent recovery of the cosmetics market in Japan. Because of soaring costs for raw materials, rising unit price per product due to more in number of value-added products, and revival of inbound demand, the market is projected to expand to 2,740,000 million yen by FY2028, 110.6% of the size of FY2023.

Research Outline

2.Research Object: Cosmetic brand manufacturers, cosmetic contract manufacturers (OEMs), cosmetics importers, cosmetics ingredients suppliers/trading companies

3.Research Methogology: Face-to-face interviews by the expert researchers (including online interviews) and survey by telephone

The Cosmetics Market

The cosmetics market in this research refers to products of skincare, makeup, haircare, fragrance, and men’s cosmetics. The market size is calculated based on the shipment value of domestic brand manufacturers. Cosmetics categorized as quasi-drugs and imported cosmetics are also included.

<Products and Services in the Market>

Skincare products, makeup products, haircare products, fragrance products, and men’s cosmetics

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.