No.3582

15 Categories of Logistics Industry in Japan: Key Research Findings 2024

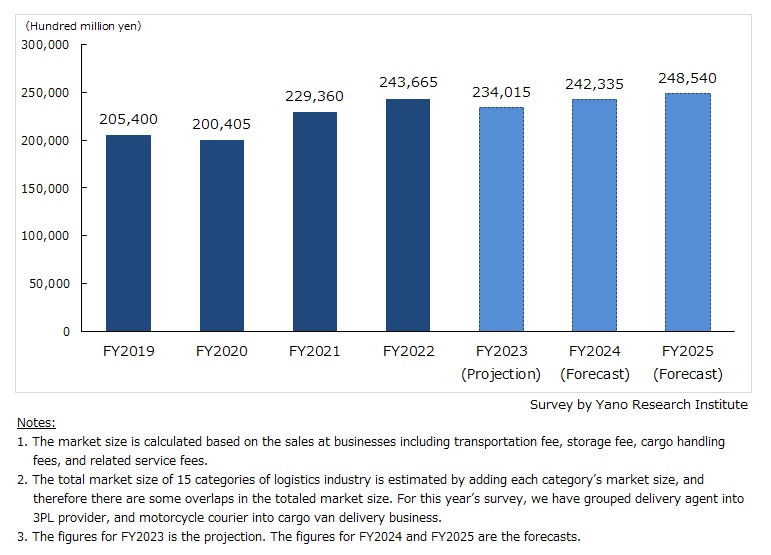

Weak Freight Volume Due to Slumping Global Consumption Declined Total Market Size of 15 Categories of Logistics Industry to 23.4 Trillion Yen for FY2023, Down by 4.0% YoY

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the total market size of 15 categories of logistics industry, and found out the trends per category, the trends of market players, and future perspectives.

Market Overview

The total market size of 15 categories of logistics industry was estimated at 24,366,500 million yen for FY2022, 106.2% of the preceding fiscal year (estimated by adding each subcategory’s market size, based on the sales of businesses; there may be some overlaps in the totaled market size).

Viewing the market by category, international shipping by vessel operating common carriers (VOCC) expanded due to strong freight markets until around September 2022 and the weak yen. A significant recovery was also observed in 3PL providers, which attributes to mergers and acquisitions, including overseas companies. Underpinned by the growth of VOCC and 3PL, which occupy a significant portion of the total logistics market, even though the level of growth was not as high as FY2021 (114.4%), the total market size of 15 categories of logistics industry expanded for FY2022.

However, according to the statistics of the Ministry of Land, Infrastructure, Transport and Tourism, neither domestic nor international cargo traffic in FY2022 recovered to pre-pandemic FY2019 levels. As seen in the previous fiscal year, the growth was chiefly driven by the price rise, not by the volume.

Noteworthy Topics

Market Size Expands, Yet Freight Volume Remain Weak

Following the downgrading of the new coronavirus to Category 5 infectious disease in May 2023, gradual recovery from pandemic-led decline is observed in freight volume, warehouse traffic (the activity of incoming goods and outgoing goods or commodities), and 3PL operations. Nonetheless, freight volume has not returned to the pre-pandemic FY2019 levels.

Domestic cargo traffic had been trending downward inherently due to declining population, falling birthrate, aging population, and hollowing out. Even when the influence of the COVID crisis lessens, domestic freight volume is not expected to grow significantly. On top of that, sluggish consumption from around FY2022 as the consequence of price hikes have impeded the recovery of freight volume.

On the other hand, logistics companies that have overseas business earned more thanks to the weak yen that worked positively on the dollar-denominated freight rates. In particular, shipping companies operating ocean going vessels increased sales significantly, as ocean freight is mostly denominated in dollars. In addition, soaring fuel cost and labor cost gave a rise to ocean freight rates.

Recent expansion of the logistics market stemmed from price hikes, not from freight volume. We believe this trend persists for years to come.

Future Outlook

The total market size of 15 categories of logistics industry is projected to diminish to 23,401,500 million yen for FY2023, 96.0% of the preceding fiscal year.

Global demand for logistics is expected to decline because of inflation-led weak consumption in Europe and economic downturn in China. Similarly, the growth of domestic freight volume is likely to be weak against the backdrop of sluggish consumption due to price hikes.

By category, the markets of 3PL, warehousing business, moving companies, and cargo van delivery business foresee year-on-year growth. Nevertheless, the total market size of 15 categories of logistics industry is expected to fall for FY2023 because of a downward trend in categories that occupy relatively high share in the total market, such as VOCC, freight forwarder, and general port & harbor transportation business.

Research Outline

2.Research Object: Leading domestic logistics companies, etc.

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone, and literature research.

What are the 15 Categories of Logistics Industry?

In this research, 15 categories of logistics industry encompasses special group cargo motor trucking business, domestic home delivery service, international courier service, 3PL provider (including delivery agent), vessel operating common carrier (oceangoing & coastwise transport), general port and harbor transportation business (including stevedoring service), air cargo business (common carrier), freight forwarder, rail freight business, rail freight forwarding business, cargo van delivery business (including motorcycle courier), general merchandise warehousing business, cold storage warehousing business (including freezer warehouse), moving business, and other businesses. From this year’s survey, we have decreased the number of categories from 17 to 15, by grouping delivery agent into 3PL provider, and motorcycle courier into cargo van delivery business.

What is the "Total Market Size of 15 Categories of Logistics Industry"?

The total market size of 15 categories of logistics industry is calculated by adding up each category’s market size, which is calculated based on the sales at businesses including transportation fee, storage fee, cargo handling fees, and related service fees. Because of this estimation method, there are some overlaps in the totaled market size.

<Products and Services in the Market>

Special group cargo motor trucking business, domestic home delivery service, international courier service, 3PL provider (including delivery agent), vessel operating common carrier (oceangoing & coastwise transport), general port and harbor transportation business (including stevedoring service), air cargo business (common carrier), freight forwarder, rail freight business, rail freight forwarding business, cargo van delivery business (including motorcycle courier), general merchandise warehousing business, cold storage warehousing business (including freezer warehouse), moving business, and other businesses

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.