No.3209

Global Collaborative Robot (Cobot) Market: Key Research Findings 2023

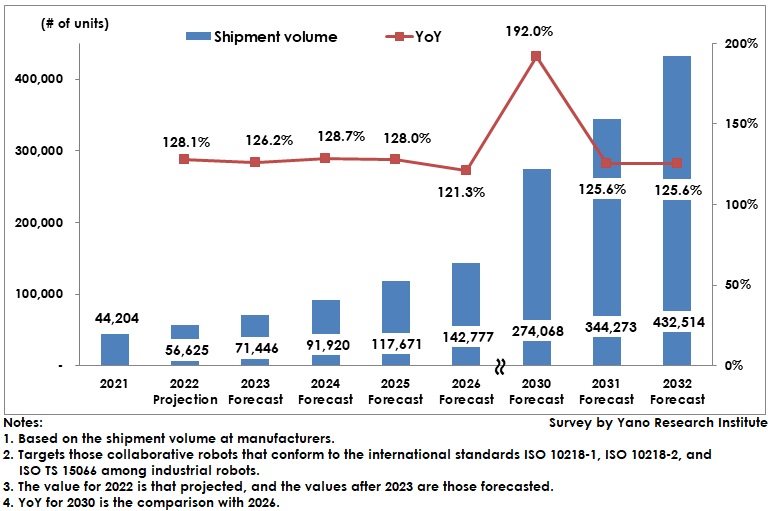

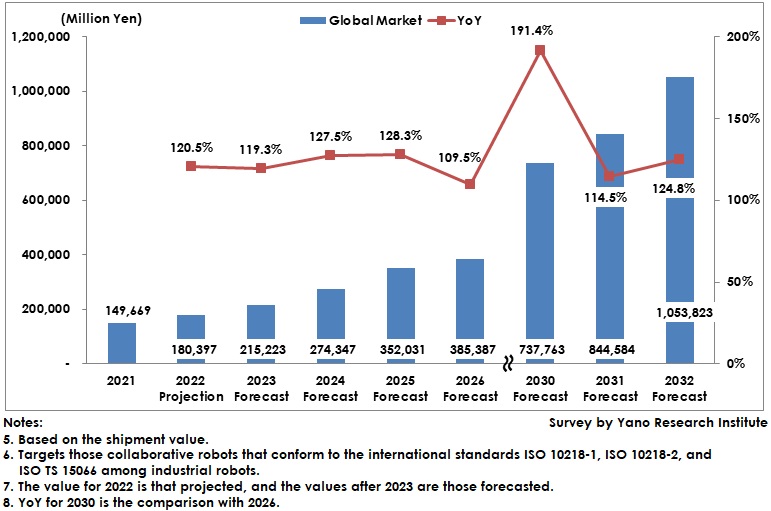

Global Cobot Shipment Volume to Reach 430 Thousand Units and Shipment Value to Attain 1,053,800 Million Yen by 2032

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the global market of collaborative robots (cobots) and found out the related policies and support systems at major countries, the trend of market players, and the future perspectives.

Market Overview

The estimated global collaborative robot (hereafter “cobot”) market size in 2021 was 44,204 units by shipment volume or 149,669 million yen by shipment value at manufacturers.

Although global shortage of semiconductors and electronic components has somewhat affected the production of cobots as well as peripheral equipment, demand for automating production and manufacturing processes has been expanding. Despite sluggish production in the manufacturing industry, deployment of cobots has increased worldwide as a measure against labor shortage, to maintain social distance for infection prevention, to reduce production cost, to improve manufacturing quality, and other factors for stable production.

When observing the market by country, China and European countries are leading the market. China faces difficulty in exporting to the US and European countries because of its expansion in protective trade stemming from the U.S.-China economic friction. However, as recognition and understanding toward the cobot values have deepened, deployment of cobots in China has been in progress not only in manufacturing but also in service industry.

Although there have been some concerns over decreasing demand for cobots caused by stagnant global economy inducing continuous shrinkage in production output and number of new orders, as well as decrease in capital investment, deployment of cobots seemed to have stably expanded worldwide, except for the European market where shipment value remained at slight increase in 2022. Cobot market is expected to expand hereafter, especially in China and Southeast Asian countries where global manufacturing industries concentrate, Americas (particularly in the U.S.) where labor shortage is significant, and South Korea, the powerhouse of battery and semiconductor manufacturing.

Noteworthy Topics

R&D for Cobots’ Work Speed Improvement in Progress

Because cobots are designed as industrial robots capable of collaborative work in the same space as humans, their TCP (Tool Center Point) speed is set at 250mm/s or slower, on the assumption that they can stop safely. On the other hand, if setting the work speed lower, the safety can be assured, but can reduce productivity.

In recent years, there are increasing numbers of manufacturers that sell those products available to work at the similar speed level as usual industrial robots when a worker is not in the vicinity. By being equipped with sensors such as laser scanners that detect obstacles, cobots can work at a maximum speed when workers are not around, and decelerate whenever they detect a worker closing in, thereby to secure both the productivity and safety. Hereafter, development of technologies is expected to enable more accuracy in obstacle detection and speed shifting, which are projected to encourage the cobots to be widespread.

Future Outlook

As demand for automation by means of robots is on the rise, expansion of the cobot market and increase in the number of market players are expected, which may reduce the cost for related components, and eventually reduce the prices of cobot bodies to around 30% of the 2022 level by 2032.

By reducing costs, the industries introducing cobots as well as the fields of demand for cobots can further expand. The global cobot market is projected to grow to 432,514 units by shipment volume at manufacturers and to 1,053,823 million yen by shipment value.

Research Outline

2.Research Object: Cooperative robots manufacturers, manufacturers of peripheral appliances, robot SI companies, collaborative robot rental service providers, collaborative-robot corporate users, government agencies, universities, R&D institutions, industrial associations, etc.

3.Research Methogology: Face-to-face interviews (online included) by expert researchers, and literature research

About Collaborative Robots

Collaborative robots or cobots are one of industrial robots that are designed to directly work with humans within a prescribed workspace. They are the industrial robots installed in the same working space as humans and can work collaboratively with humans.

Cobots in this research refer to “manipulating industrial robots” that include vertical articulated robots and horizontal articulated robots, meaning that those machinery that have three or more of axes, move by automatic control, have reprogrammable multi-purpose manipulation functions, and conform to the international standards ISO 10218-1, ISO 10218-2, and ISO TS 15066.

<Products and Services in the Market>

Industrial robots, collaborative robots (cobots), vertical articulated robots, horizontal articulated robots, SCALA (Selective Compliance Assembly Robot Arm), robot system integration

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.