No.3157

Automotive Leasing Market in Japan: Key Research Findings 2022

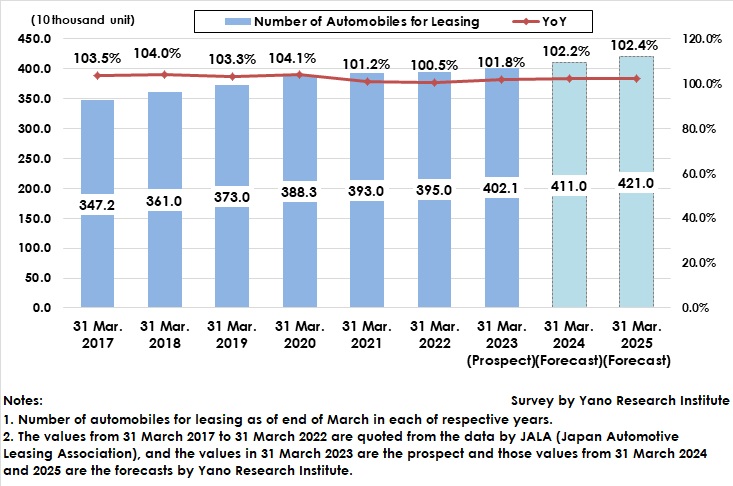

Number of Vehicles Secured for Automotive Leasing as of End of March 2023 Increases on YoY Basis to 4,020 Thousand Units

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic automotive leasing market, and found out the current market status, the trend of market players, and the future perspectives.

Market Overview

According to Japan Automotive Leasing Association, the number of vehicles for automotive leasing as of end of March 2022 managed to have remained flat on YoY basis, but the growth rate slowed down.

Corporative demand was affected by higher cost consciousness, changes in working style including spread of remote working, and sluggish supply by automakers after breakout of coronaviruses. The number of vehicles for automotive leasing for companies has been declining since the end of March 2021.

On the other hand, personal demand has grown stably, boosted by renewed recognition of automobiles as a safe traveling method to prevent 3Cs and increase in lease products as well as subscription services by automakers and dealers.

Noteworthy Topics

Real Solution to Support Customers in Decarbonization is a Combination of 'HEV-centric Proposals' and 'Building a System to Provide BEVs’

Because of the heightening social momentum toward decarbonization and carbon neutrality, automotive leasing companies are pressing ahead with building and strengthening of a system to provide electric vehicles aiming to support reduction of CO2 at their client companies.

The rate of EVs among all vehicles for leasing at major automotive leasing companies account for about 20 to 40%, of which most of them are HEVs*. (*Source: Yano Research Institute)

Due to a certain amount of time already passed after the market launch of HEVs, the used car market has already been established, so that the initial cost is lower than BEVs and PHEVs, and many of private maintenance companies are able to handle HEVs. In addition, when considering achieving the goal of carbon neutrality (a state of net-zero carbon dioxide emissions) set by the Japanese government, there is a perspective of HEVs having higher effect in reducing CO2 emissions in the light of power supply configuration and life cycle assessment than BEVs that need electricity produced by emitting CO2 from raw materials at the time of manufacturing batteries or during charging.

On the other hand, EVs including BEVs and PHEVs are yet to have solved the problems of implementation cost, charging infrastructure, driving distance, price setting after depreciation, etc. Still, it is evident that the distribution of BEVs, etc. is to expand due to higher consciousness toward decarbonization worldwide. Therefore, each automotive leasing company is focusing on building a one-stop system to provide peripheral services comprehensively, such as charging equipment and systems (including card-types), energy management, etc. For BEV provisions hereafter, it will be important to align with various partners, because securing of sales channels after battery performance assessment or expiration of leasing period becomes the key.

Thus, the pragmatic solution for automotive leasing companies to help their client companies to support decarbonization or other environmental issues is to present dual plans, i.e., the HEV-centric plan, and BEV or PHEV plan under alignment with partner companies.

Future Outlook

For FY2022, disruption in supply chains for automotive production has continued from the previous fiscal year, which has left the new car supplies to stagnate. Corporate clients have reduced new car leases and driven forward the renewing of leasing contracts as well as the leaseback (alteration of ownership of automobiles from the client to a leasing company). On the other hand, automotive leasing companies have focused on proposals for replacement with new car leases from early on, and some have successfully connected the brisk personal market to their company growth.

Based on these, the number of automobiles for leasing as of the end of March 2023 has been estimated as 4,020 thousand units (101.8% on YoY).

In addition, when considering demands to be generated from the statuses of new car sales, recovery of economic activities from the corona crisis, and hosting of large-scale events such as World Expo 2025 in Osaka, the number of automobiles for leasing is projected to be 4,110 thousand (102.2% on YoY) by the end of March 2024, and 4,210 thousand (102.4% on YoY) by the end of March 2025.

Research Outline

2.Research Object: Leading automotive leasing companies, and automotive maintenance companies

3.Research Methogology: Face-to-face interviews (including online) by our expert researchers, survey via telephone and email, and mailed questionnaire

What is Automotive Leasing?

Automotive leasing is a contract to lease a user-specified vehicle to the user through leasing company that purchased the vehicle on behalf of the user. It has expanded chiefly by corporate users that received some advantages in accounting where reduction of initial cost and levelized cost are expected in capital investment, in finance where efficient fund operations and secured borrowing limits from financial institutions can be available, and in management where manpower can be reduced for vehicle management. Currently, the vehicle leasing market has been expanding not only for corporations but for individual users (including individual business owners).

For the numbers of automobiles secured for leasing, the values from 31 March 2017 to 31 March 2022 have been quoted from the data by JALA (Japan Automotive Leasing Association), and the values in 31 March 2023 are the prospect and those values from 31 March 2024 and 2025 are the forecasts by Yano Research Institute.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.