No.3094

Automotive Films & Sheets Market in Japan: Key Research Findings 2022

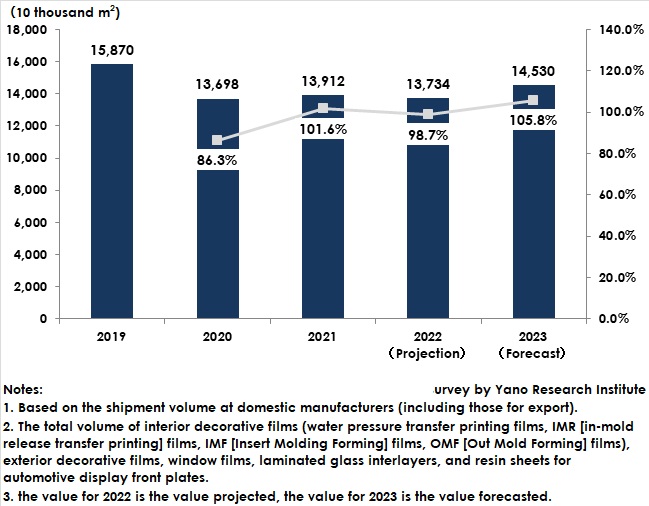

Shipment Volume of Automotive Films & Sheets in 2022 Projected to Decline to 98.7% from Previous Year to 137,340 Thousand Square Meters

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic automotive films & sheets market trends, and found out the trend by product segment, trend of market players, and future perspectives.

Market Overview

Automotive films and sheets market size (based on shipment volume in domestic manufacturers, including those for export) in 2021 rose to 139,120 thousand square meters, 101.6% of the previous year. The details were as follows: Interior decorative films 117,090 thousand m2 (98.6% on YoY), exterior decorative films 42,850 thousand m2 (101.7% on YoY), window films 3,200 thousand m2 (101.3% on YoY), laminated glass interlayers 119,200 thousand m2 (101.7% on YoY), and resin sheets for automotive display front plates 730 thousand m2 (112.3% on YoY).

Demand for automotive films and sheets is overall associated with the number of automobiles produced. After substantial decline in accordance with decreased number of automobiles produced in 2020, the demand has somewhat recovered in 2021, but, is expected to decrease again in 2022, because of urban lockdown in Shanghai and Guangzhou due to increased omicron variant of coronaviruses in China where more than 30% of worldwide automobiles produced and where both the production and distribution of automobiles being stagnant, together with lengthy Ukraine invasion by Russian and rising interest rates causing sluggish consumption in the US market. Still, as China has lifted the lockdown from the latter half of 2022 the distribution of components and vehicle bodies has activated, which has led the automobile production on the way to rapid recovery, making the automotive films and sheets market in 2023 to seemingly expand to 105.8% of the previous year.

Noteworthy Topics

Laminated Glass Interlayers

Automotive laminated glass interlayers can be classified into normal films equipped with basic natures such as safety, security, and ultraviolet light cut, and functional films equipped with sound insulation and thermal insulation in addition to basic natures. In recent years, functional films are more in demand, such as sound-insulation films that suppress noise when driving, and wedge-shaped films for HUDs (Head-Up Displays).

While a HUD system is effective in improving safe driving experiences, projector images from a projector onto standard windshields look overlapped and blurry (so-called ghosting images) due to refraction of light, which reduces visibility and spoils the safety supposed to be assured. Interlayer film manufacturers try to control the optical refraction by precisely designed wedged angled surfaces of a film, thereby achieving clear projection images enabling high visibility.

Unlike the conventional HUDs offering limited information such as speed and driving routes, demand for installing AR-HUDs has increased in recent years to project alert information and navigation images onto the actual scenery available from a driving seat, or important road information based on real-time data collected from sensors, has increased the demand for preventing ghost images in wider areas than wedged interlayers. For such demand, development and suggestions of ghost-image-preventative films with wider view angles for AR-HUDs are underway.

Future Outlook

Development of wider ranges of products not limited to the markets of E-CASE (Connected, Autonomous, Share & Service, Electric + Environment) and existing OEM allows film & sheet manufacturers to discover new market buds. In addition to product development and market exploration that can be done not just by following the needs but by changing the conventional ideas, they also need to enter new-generation automotive-related markets about to be generated outside the existing supply chains such as OEMs Tier1, Tier2, etc.

It is projected to take more time until next-generation automobiles such as extra-small mobilities and flying cars to widespread. Because the market entry from the initiation period goes through small market size, it is highly possible for sales expansion not to come right away. Still, co-development with other newly-entered companies is expected to lead to new demand acquisition that is unachievable in the world of conventional automobiles.

Automotive films & sheets manufacturers have long developed and suggested products to meet the quality demanded by OEMs and Tier1 companies. With regard to matured products, prices are the significant factor for them to choose the suppliers. On the other hand, in the next-generation automotive-related market, IT or venture companies from different industries are involved from early on, making manufacturers of components including films and sheets tend to position as development partners rather than user-and-supplier relationships. Therefore, there is room for films & sheets manufacturers to press ahead with technological suggestions and co-development. The keys hereafter are to achieve co-generation of next-generation mobility that is ahead of E-CASE by combining the technologies from each company with new ideas obtained through growth of the new market, and how to propel technological development and suggestions that can contribute in there.

*E-CASE is the coined word from capital letters of Connected, Autonomous, Share & Service, and Electric, 4 innovative fields for automotive industry and that of “Environment” field being added, defined by Yano Research Industry as new theme for the entire automotive industry.

Research Outline

2.Research Object: Manufacturers of automotive interior decorative films (water pressure transfer printing films, IMR transfer printing films, films for IMF or for OMF), manufacturers of automotive exterior decorative films, window film manufacturers, manufacturers of laminated glass interlayers, and of resin sheets for automotive display front plates.

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, and literature research

About Automotive Films & Sheets Market

The automotive films & sheets market in this research refers to the market targeting interior decorative films, exterior decorative films, window films, laminated glass interlayers, and resin sheets for automotive display front plates, used for automobiles, with the market size calculated based on the shipment volume (including those shipped for export) by domestic manufacturers.

Note that interior decorative films include water pressure transfer printing films that prints the pattern onto molded products by the use of water pressure, OMF (Out Mold Forming) films that laminate and transfer the decorative films onto molded products outside the mold, IMR (In Mold Release)

<Products and Services in the Market>

Interior decorative films (water pressure transfer printing films, IMR [in-mold release transfer printing] films, IMF [Insert Molding Forming] films, OMF [Out Mold Forming] films), exterior decorative films, window films, laminated glass interlayers, and resin sheets for automotive display front plates

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.