No.2949

Global Collaborative Robot (Cobot) Market: Key Research Findings 2021

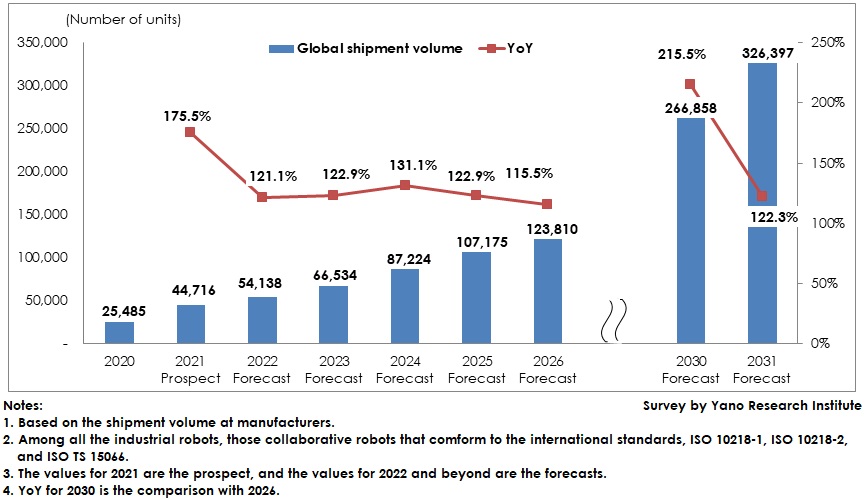

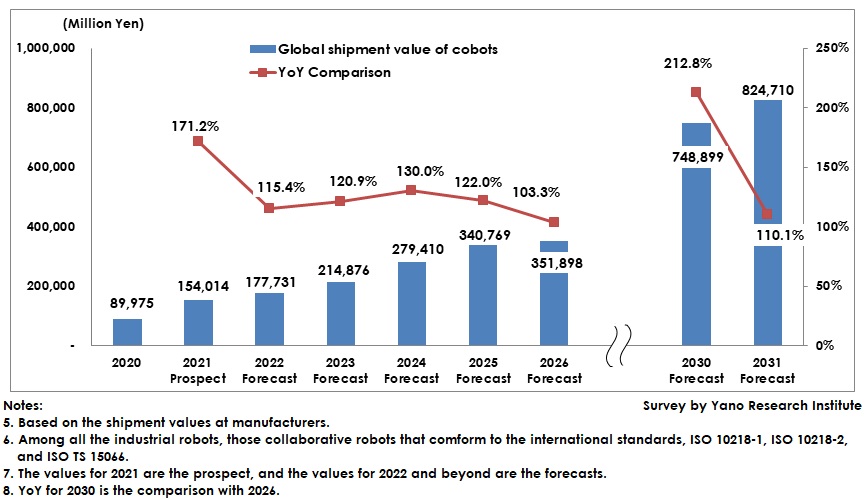

Global Cobot Shipment Volume to Reach 326,397 Units and Shipment Value to Attain 824,710 Million Yen by 2031

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the global market of collaborative robots (cobots) and found out the related policies and support systems at major companies, the trend of market players, and the future perspectives.

Market Overview

The global collaborative robot (hereafter “cobot”) market size in 2020 was estimated as 25,485 units by shipment volume at manufacturers, or 89,975 million yen by shipment value. In the situation of where production activities were prominently affected by the U.S.-China economic friction and shortage in parts such as of semiconductors, etc. in the global supply chain affect, new coronavirus crisis restricted the movement of people, making it difficult to perform sales activities and installing of robots, which slowed down the market in 2020.

On the customer (user-company) side, automation by means of introducing cobots has been in demand as a measure against labor shortages, for maintaining social distance, and for BCP for stabilizing production activities, but the postponement of capital investment plans due to the economic downturn resulted to the market slump. When observing those industries with cobots introduced, in the automobile and related parts industries, the number of cobots installed at major customers declined, as production plans were postponed due to parts shortages, and although demand gradually recovered from the second half of 2020, it remained below the level of the previous year for the full year.

When observing the market by country, China and South Korea differed from other countries in that they increased the shipment volume even in the COVID-19 calamity. China overcame the pandemic faster than other countries, and recovered the capital investments not only in manufacturing industry but also in service industry and in new application fields, in which adoption of cobots stably increased. In South Korea, deployment of cobots has been in progress as an “Untact (i.e. un-contact)” measures against prevention of coronaviruses infections mainly in the food & beverage service industry. This has brought about favorable shipment of cobots that was able to cover the demand shortage in the manufacturing industry. The global cobot market in 2021 was projected to rise to 44,716 units by shipment volume, 175.5% of that of previous year, and to 154,014 million yen by shipment value both at manufacturers, 171.2% of that of previous year.

Noteworthy Topics

Due to Spread of EVs, Demand for Production Automation in Peripheral Industries Expanding

When observing the global shipment volume of cobots in 2021 by industry introduced, the automobile industry was estimated to have occupied the largest market share at 22.7%, followed by the electronics industry accounting for 18.8%.

The governments around the world are pressing ahead with spreading of EVs as one of approaches to achieve carbon neutral to curb CO2 emission causing global warming. In association with increased production volume of parts and components used for EVs, demand for not only industrial robots but also cobots is projected to expand, aiming for production automation and quality stabilization.

Future Outlook

Hereafter, by introducing new technologies such as AI and 5G to cobots, and by making robot peripherals and main components to be more sophisticated and functional, the cobot-adopting industries as well as the application fields are expected to expand furthermore.

As automation demand increases in various industries, expansion of market and increase of market players are likely to occur, which lead the global cobot market to grow to 326,397 units in shipment volume and 824.710 million yen in shipment value both at manufacturers by 2031.

Research Outline

2.Research Object: Major manufacturers of cooperative robots and peripheral appliances, robot SIers, rental service companies, collaborative robot users (demander), government agencies, industrial organizations, etc.

3.Research Methogology: Face-to-face interviews (online included) by the expert researchers, and literature research

What are Collaborative Robots?

Collaborative robots or cobots are one of industrial robots that are designed to directly work with humans within a prescribed workspace. They are the industrial robots installed in the same working space as humans and can work collaboratively with humans.

Cobots in this research refer to “manipulating industrial robots” that include vertical articulated robots and horizontal articulated robots, meaning that those machinery that have three or more of axes, move by automatic control, have reprogrammable multi-purpose manipulation functions, and conform to the international standards ISO 10218-1, ISO 10218-2, and ISO TS 15066.

<Products and Services in the Market>

Industrial robots, collaborative robots, cobots, vertical articulated robots, horizontal articulated robots, SCALA (Selective Compliance Assembly Robot Arm), robot system integration

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.