No.2798

POCT (Point of Care Testing) Market in Japan: Key Research Findings 2021

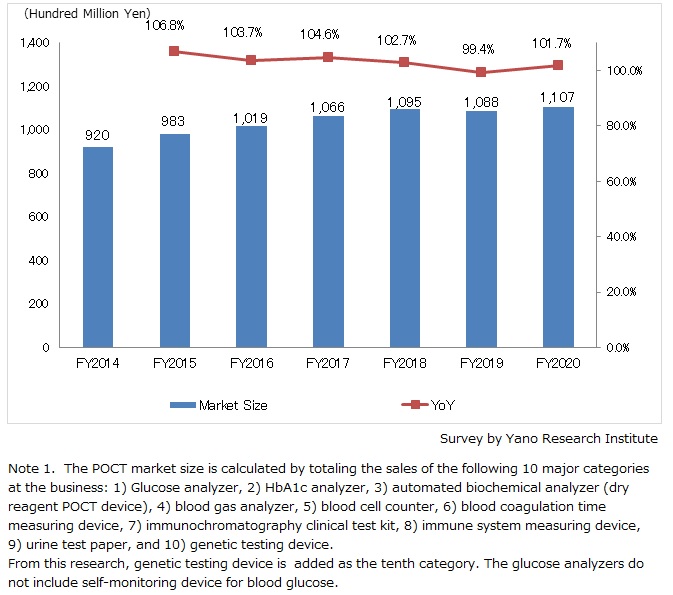

POCT Market in FY2020 Grew by 1.7% YoY to Reach 110,700 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the domestic POCT (point-of-care testing) market and found out the market size, the trend of market players, and future perspectives.

Market Overview

The domestic POCT (point-of-care testing) market size (as the total sales of 10 categories at the businesses) in FY2020 grew by 1.7% year on year to attain 110,700 million yen.

Demand for test kits like influenza rapid test kits shrunk considerably in FY2020 compared to the previous fiscal year. Meanwhile, multiple companies launched COVID-19 antigen test kits that are based on immunochromatography, and their sales made considerable growth. As demand is growing for miniaturized test devices and clinical reagent to confirm infection of novel coronavirus, the new market of point-of-care genetic testing has been formed.

Despite sluggish growth of the conventional POCT market, surging demand for COVID-19 testing boosted the entire market for FY2020.

Noteworthy Topics

A Wave of Entries to COVID-19 Antigen Test Kit Market

Following the first release of COVID-19 antigen test kit in May 2020, new test kits were launched in August and October. These three test kits were predominant in the market for FY2020.

In 2021, ten more companies entered the market by August, while almost all companies that had been developing test kits for influenza also released COVID-19 antigen test kits. As the test kits are easy to perform and provide results within minutes, frequency of using them for screening purposes is rising. Nonetheless, due to intensified competition, the unit price is falling at recent.

Future Outlook

Test kits related to detection of novel coronavirus continues to provide a thrust to the POCT market.

It has been pointed out that diagnostic accuracy of COVID-19 antigen rapid test kits based on immunochromatography may be lower compared to PCR tests in general. To respond to this challenge, some companies have released high-accuracy testing devices, and future trend of such products is worth noting. Moreover, as demand for simultaneous detection of infectious diseases like influenza is expected to rise, differentiating with value-added product will be an increasing trend.

In addition, in the field of genetic testing, there was an emergence of the market of point-of-care genetic testing using miniaturized devices and clinical reagents to confirm infection of novel coronavirus. Taking into account possibilities of the point-of-care genetic testing products to be adopted by general practitioners, it is likely to become a market driver for the clinical reagents and devices industry.

Research Outline

2.Research Object: Companies developing clinical reagents and devices (Japanese companies as well as Japanese subsidiaries of overseas companies)

3.Research Methogology: Face-to-face interviews by the expert researchers (including online interviews), surveys via telephone and email

POCT (Point of Care Testing) Market

POCT (Point-of-care testing) is the laboratory tests (such as on blood, urine, feces, tissues, etc.) carried out by medical institutions not at central laboratory of a hospital or external testing center, but the rapid testing conducted close to the patient by the medical staff.

The POCT market size is calculated by totaling the sales of the following 10 major categories at the business: 1) Glucose analyzer, 2) HbA1c analyzer, 3) automated biochemical analyzer (dry reagent POCT device), 4) blood gas analyzer, 5) blood cell counter, 6) blood coagulation time measuring device, 7) immunochromatography clinical test kit, 8) immune system measuring device, 9) urine test paper, and 10) genetic testing device.

From this year’s research, genetic testing device is added as a tenth to category. The glucose analyzers do not include self-monitoring device for blood glucose.

<Products and Services in the Market>

1) Glucose analyzer, 2) HbA1c analyzer, 3) automated biochemical analyzer (dry reagent POCT device), 4) blood gas analyzer, 5) blood cell counter, 6) blood coagulation time measuring device, 7) immunochromatography clinical test kit, 8) immune system measuring device, 9) urine test paper, and 10) genetic testing device.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.