No.2574

Global ADAS/Autonomous Driving System Sensors Market: Key Research Findings 2020

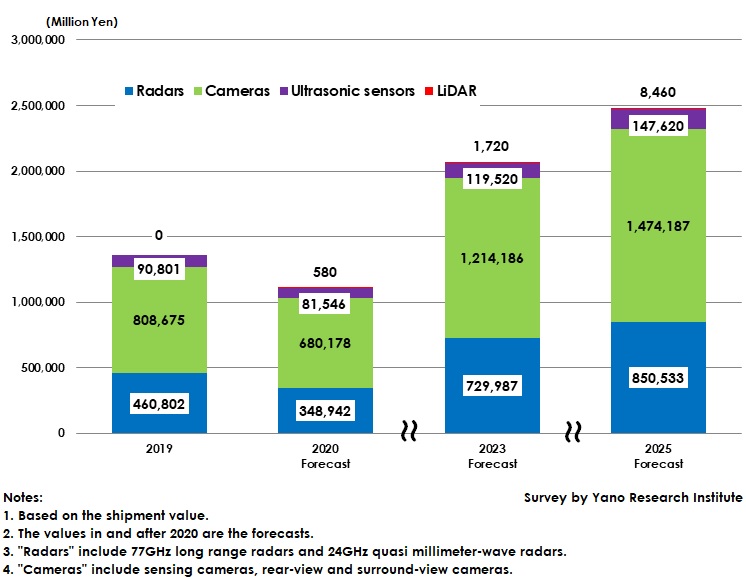

Global Number of Sensors for ADAS & Autonomous Driving Systems Forecasted to Reach 2.4 Trillion Yen by 2025

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the global markets of key devices and components comprising ADAS (Advanced driver-assistance systems) and autonomous driving systems, and analyzed the market outline, technological trends, and trend of installation at auto parts manufacturers regarding the sensors embedded in ADAS and autonomous driving systems. This press release discloses the forecasts of global market sizes by sensor type until 2025.

Market Overview

The global market size of sensors for ADAS (Advanced driver-assistance systems) and autonomous driving systems in 2019 based on the shipment value at manufacturers reached 1,360,200 million yen, continuously expanding since 2017. Just like in Japan, Europe and the U.S. where AEB (Automatic emergency braking) systems have become a standard feature, those vehicles with AEB installed have also been rapidly increasing in China.

This has expanded the shipment volume of sensing cameras as well as 77GHz long range radars detecting any objects in front of the vehicle, which led the global market size of radars to attain 460,800 million yen and of cameras 808,600 million yen.

* While "radars" include 77GHz long range radars and 24GHz quasi millimeter-wave radars, "cameras" include sensing cameras, rear-view and surround-view cameras.

Because of the COVID-19 pandemic, the global number of new cars sold is expected to significantly decrease in 2020, diminishing the market size of ADAS-installed vehicles in Japan, the U.S, Europe, and China. In particular, large decrease can be observed in Europe and the U.S., with 20% or more of reduction expected. Therefore, the global market size of sensors for ADAS and autonomous driving systems in 2020 is projected to decline by 18.3% from the previous year to be 1,111,200 million yen.

Noteworthy Topics

Upgraded Functions and Performance of Sensing Cameras

The functions and performance of sensing cameras installed at the front of a vehicle have entered the second stage. The topic of such cameras during 2019 and 2020 were “three-lens cameras” and “higher resolutions of CMOS image sensors.”

Three-lens cameras, featuring three different lenses (a telephoto lens and a wide-angle lens being added to a standard 52° field-of-view lens) configured into a single camera module, have been adopted in the vehicles with automation level 2 or higher (level 2+) that are released in 2019. By adding a telephoto lens and a wide-angle lens, the detection area of a camera has significantly widened, enabling early recognition of speed acceleration and deceleration and cut-in by preceding vehicles as well as of the road shapes, thereby allowing the vehicle to smoothly accelerate and decelerate and to achieve automatic steering, letting the driver’s hands off from the steering. (*Automatic steering or hands-off driving requires not only three-lens cameras but also a high-precision map and V2X [Vehicle to X] telecommunication functions.)

As for higher resolution of CMOS image sensors, those sensing cameras embedded with 1.7M-pixel CMOS image sensors have started being installed in vehicles. By enhancing from conventional 1.3M pixel to 1.7M pixel, the cameras can cover wider angle of 100° from the standard 52° field of view, enabling AEB (Automatic emergency braking) systems to function at intersections. Also, stereo cameras with 2M-pixel have started being adopted. Hereafter, more selections of automotive CMOS image sensors with advanced pixels and of camera types are projected to be utilized according to the level of driving support systems, vehicle segment, and grades.

Future Outlook

The global market size of sensors for ADAS and autonomous driving systems is forecasted to achieve 2,480,800 million yen by 2025 based on the shipment value at manufacturers. Although projected to decline temporarily due to the outbreak of COVID-19 infections in 2020, the market size is likely to be on the way to recovery in 2021, leading the shipment volume of radars and sensing cameras for ADAS to be on the rise, as Japan and the U.S. aiming at exceeding 90% for the vehicles with ADAS installed, while Europe aiming at exceeding 80%, and China 70%.

In addition, increase of the vehicles with automation level 2 or higher (level 2+) are likely to boost the sensor market size. As the hands-off automatic steering function available only on highways has started being adopted chiefly in high-end vehicles with level 2+ automation, they are to be released more at major automakers until around 2023.

For automation level 2+ vehicles, in order to attain hands-off driving, not only long-range radars and sensing cameras, but also some short-range radars have begun placed at the front, back and both sides of the vehicle, aiming to widen the detection ranges in the front and the rear. Therefore, expansion of automation level2+ vehicles will boost the shipment volume of short-range radars. Because manufacturing cost for short-range radars is likely to be reduced through CMOS processes, automation level 2+, mainly low-speed hands off, is expected to be available even to the middle-class vehicles during 2024 and 2025. The global market size of radars is projected to achieve 850,500 million yen by 2025.

Research Outline

2.Research Object: Automakers, manufacturers of auto parts, and automotive semiconductors

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), surveys via telephone, and literature research

What are ADAS/Autonomous Driving System Sensors?

Advanced Driver Assistance Systems (ADAS) aim to prevent road accidents and the associated casualties by monitoring the surrounding environment through the sensors installed at the front, sides, and rear parts of the vehicle. An autonomous driving system is the ADAS technologies being advanced. The system presides over driving of a vehicle on behalf of the driver by using the installed sensors, a high-precision map, and telecommunication functions according to the level specified out of the six levels of the automated driving system.

The sensors for ADAS and autonomous driving systems in this research indicate those sensor units (radar, cameras, ultrasonic sensors, and LiDAR [Laser Imaging Detection and Ranging]) installed at the front, sides and the rear of the vehicle. The sensors in the market size are those installed at passenger cars and commercial cars weighing 3.5tons or less. However, those sensors at MaaS (Mobility as a Service) vehicles with the autonomous level 4 or more, and the sensors for LSV (low-speed vehicles) that no humans can ride, are excluded.

<Products and Services in the Market>

77GHz long range radars, 24GHz quasi millimeter-wave radars, sensing cameras, rear-view and surround-view cameras, infrared laser, ultrasonic sensors, and LiDAR

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.