No.2475

Global Automotive Display Component Market: Key Research Findings 2020

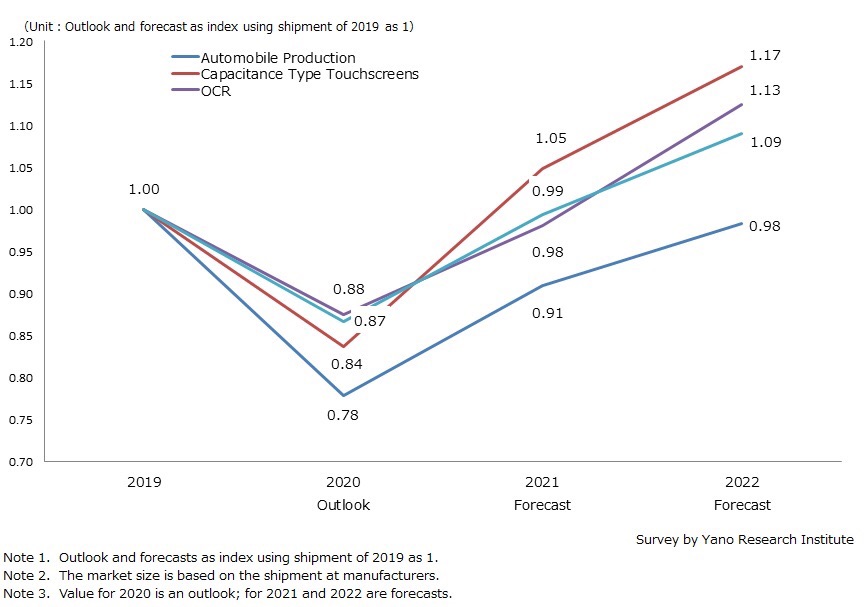

Demand Expected to Recover Sooner for Automotive Display Components than for Production of Automobiles owing to Increase of the Number of Displays per Automobile and Demand for Larger Screen Displays

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a study on the global automotive display components market, and found out the trend by segment, the trend at market players, and the future perspectives. Here, the forecasts on automobile production and the shipment quantity of major components such as touchscreens, front panels, and OCR are covered.

Market Overview

In the last couple of years, global production of automobiles remained at 88-89 million units. However, a sharp decline is expected for 2020 due to the novel Coronavirus pandemic (COVID-19). Although in-vehicle display panels kept momentum, some component makers assume that global production of automobiles for 2020 will attain 80% of the previous year at best, while anticipating a drop to 60-70% if the market witnesses multiple negative factors.

Downturn for in-vehicle displays, in-vehicle touchscreens (touch panels), front panels, OCA(Optical Clear Adhesive)/OCR (Optical Clear Resin) and optical films is bound to happen due to slowdown in automobile production. Nevertheless, against the backdrop of CASE (a concept which stands for “Connected”, “Autonomous”, “Shared & Service”, and “Electric”) promoted by automobile makers, the number of in-vehicle displays per automobile is increasing, and due to the trend of touchscreen dashboards and CID (Center Information Display) installations, adoption of new types of displays, such as HUD (Head Up Displays) and mirror displays for side mirrors and rear view mirrors are expected to rise.

Moreover, along with the upturn in the number of in-vehicle display installations, demand is increasing for larger sized screens. From 2019, display panels larger than 10 inches became a mainstream instead of conventional 7-8 inch displays. In addition, multi-display, a single touchscreen cover (front panel) with multiple touchscreens, has been introduced to meet the trend of seamless interior design. Number of displays, touchscreen covers (front panels), and use of OCA/OCR for attaching them together are all turning for the better.

Global shipment of major components for in-vehicle displays has no choice but to shrink for 2020 because of the COVID-19 pandemic; still, the level of drop won’t be as bad as for automobile production. On the presumption that automobile production for 2021 will recover to 0.91 compared to 2019, the global shipment of major components for 2021 is projected to make an upward turn to the level of 2019.

Noteworthy Topics

Expectations for In-vehicle Displays Adaptable to New Normal during Coronavirus Pandemic

In May 2020, the Ministry of Health, Labor, and Welfare in Japan has announced a guideline for “New Normal”, indicating practices for new lifestyle to prevent further outbreak of COVID-19. At overseas, too, many companies and cities have begun seeking for new ways of living; it is regarded that the post-Corona world will be different from the world before.

At this moment, how much the new normal may affect demand of automobiles or in-vehicle displays is uncertain. Nevertheless, as a behavior to avoid direct contact with others for preventing infection pervades, the needs for touchless sensors rise, to shift from touch-sensor displays which used to be common for in-vehicle electric components like car navigation systems, display audios, and CID which combines navigation and audio. To secure demand after the COVID-19 pandemic is contained, some in-vehicle touchscreen makers are developing products adaptable to the new normal.

Future Outlook

Except for some technologies like touchless sensors which garnered attention after the outbreak of COVID-19, most needs for in-vehicle displays and related components remain unaltered for years: Visibility improvement, large-screens/curved screens, weight saving, and seamless design.

Makers of in-vehicle display components, i.e. functional films such as touchscreens, front panels, antireflection films and OCA/OCR, are expected to be fully committed to meet the needs in developing/proposing products, and to underpin product development theme of Tier-1 and OEM automobile makers like traveling safety and CASE.

Research Outline

2.Research Object: Automotive display component makers

3.Research Methogology: Face-to-face interviews by our expert researchers and literature research

Global Automotive Display Component Market

Automotive display components in this research refers to in-vehicle touchscreens (resistive film type, capacitance type), front covers for displays and touchscreens (front cover panels), in-mold decorated films for displays, OCA (Optical Clear Adhesive)/OCR (Optical Clear Resin), and other optical films (antireflection films, moth-eye films).

<Products and Services in the Market>

Front cover panels (glass, resin boards, molded items), decorative films (for insert molding), optical films for in-vehicle displays, OCA/OCR, and touchscreens.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.