No.2395

Fashion Reuse Market in Japan: Key Research Findings 2020

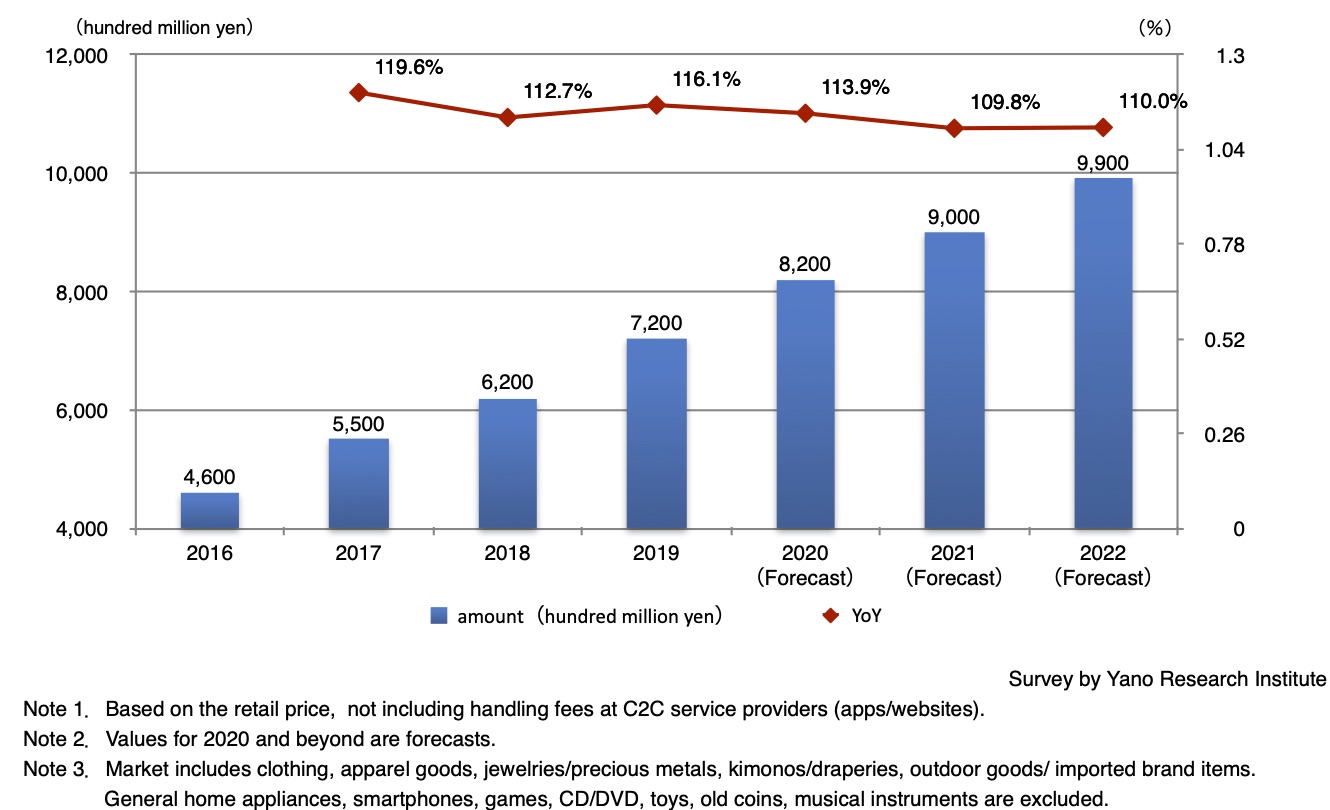

Domestic Fashion Reuse Market Attained 720 Billion Yen in 2019, Up 16.1% YoY

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the fashion reuse (secondhand) market in Japan, and found out the trends by business category [B2C, C2C etc], the trends by item, the market size, and the future outlook.

Market Overview

Domestic fashion reuse (secondhand) market in 2019 based on retail price is estimated as 720 billion yen, 116.1% of the previous year.

Owing to pervasion of various C2C services including flea market applications, convenience of the trade improved and market recognition rose; direct commerce between individuals on personal possessions (C2C) is increasing. Retailers and distributors that mainly operate B2C businesses are influenced particularly by the decrease in demand for their secondhand goods. Meanwhile, sales of consumables like cosmetics which did not use to be handled in the secondhand market, have taken root in C2C flea market applications especially among the young generation. Items privately imported from overseas are also traded in C2C marketplace.

Under such circumstances, commercial distribution of fashion-related items is expected to expand more through direct marketing channels; i.e., not through wholesalers or secondhand retailers that used to take advantage of distinctiveness through exclusive distributorship and the like.

Noteworthy Topics

Demand Trends of Inbound Tourists (Foreigners Visiting Japan)

For the domestic distribution/retail market, department stores and specialty stores that handle luxury brand items, the demand trends of inbound tourists continue to be an important factor in 2019 for increase/decrease of their sales. In the “Consumption Trend Survey for Foreigners Visiting Japan” by Japan Tourism Agency, the total amount of purchase by foreign visitors in 2019 was reported as 1,669 billion yen, 105.9% of the preceding year. According to Japan National Tourism Organization (JNTO), the number of foreign tourists visiting Japan in 2019 counted 31.88 million, 102.2% year-on-year; despite the slowdown in growth rate, the amount of purchase itself is making an upturn from 2018.

Nonetheless, composition rate of shopping among entire spending by inbound tourists is shrinking. Preferred style of traveling is shifting from group tours to independent trips: Major tourist segments such as visitors from China are losing interests in conventional group tours in which travel agencies guide them to stores for bulk buying, and it is assumed that repeaters in particular value experience (more than things). Moreover, customer needs for shopping has been changing drastically over the last couple of years due to external reasons, such as tightened regulations in China on the quantity of souvenirs upon returning home. It is unlikely to expect the emergence of a new inbound tourist segment with shopping as the main purpose of visit.

Impact of the coronavirus outbreak is expanding in Japan: Due to the decrease of the number of inbound tourists and temporary store closures, retailers that usually benefit from inbound demands, such as department stores, anticipate sharp drop in sales. Although government response such as supplementary budget to fund measures and businesses for economic recovery in tourism attracts attention, the impact of pandemic is likely to remain strong in the industries like retail and tourism.

Future Outlook

Considering increase in the number of people using secondhand fashion-related items hereafter and new strategies for secondary distribution to be taken by C2C service providers like Mercari, there is still room for growth in the fashion reuse market hereon. Nevertheless, while secondhand supplies expand due to activation of secondary distribution from 2021 on, the growth rate is likely to stabilize at around 10%. The domestic fashion reuse market based on the retail price is estimated to reach 990 billion yen by 2022.

Research Outline

2.Research Object: Companies that handle fashion-related items and secondhand products, C2C service operators

3.Research Methogology: Face-to-face interview by the expert researchers, questionnaires by mail, and literature research.

Fashion Reuse Market in Japan

In this research, target products for the fashion reuse (secondhand) market refers to secondhand fashion-related items (clothing, apparel goods, jewelries/precious metals, watches, kimonos/draperies, outdoor goods/imported brand items). General home appliances, smartphones, games, CD/DVD, toys, old coins, and musical instruments are not included.

Market size is calculated based on the retail price; it does not include handling fees at service providers that facilitate online platform for C2C (apps/websites).

<Products and Services in the Market>

Clothing (men’s, women’s, baby’s/children’s), apparel goods (bags, leather items, shoes, ties, etc.), jewelries/precious metals, watches, kimonos/draperies, outdoor goods/imported brand items, etc.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.