No.2316

Clinical Laboratory Test Reagents and Equipment Business in Japan: Key Research Findings 2019

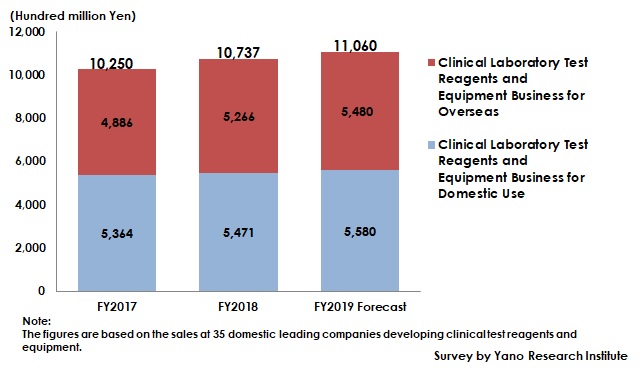

Business Size of Clinical Laboratory Test Reagents and Equipment at Domestic Leading Companies in FY2018 Rose by 4.8% on Y-o-Y to Attain 1, 073,700 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the business of clinical laboratory test reagents and equipment developed at leading 35 companies in Japan, and has found out the related markets, the trends of market players, and the future perspectives.

Market Overview

The business size of clinical laboratory test reagents and equipment at leading companies in Japan in FY2018, based on the sales of domestic 35 leading companies developing clinical test reagents and equipment, rose by 4.8% from the previous fiscal year to attain 1,073,700 million yen.

When separating the said business into that for domestic use and that for overseas, the business for domestic use grew by 2.0% from the preceding fiscal year to 547,100 million yen, while that for overseas increased by 7.8% from the previous fiscal year to attain 526,600 million yen. The brisk business for overseas stemmed from the stable OEM sales for clinical laboratory test reagents and from the temporarily increased demand for clinical test equipment supplied at a specific company overseas.

Noteworthy Topics

Business of Clinical Laboratory Test Reagents and Equipment for Domestic Use Keeps Marginal Rise

Because of spreading of various infectious diseases, in addition to growing senior population and preventive medicine continuously being the priority measures for the government, the business size of clinical laboratory test reagents and equipment for domestic use in FY2018 rose by 2.0% from the preceding fiscal year.

When observing the market by item, NT-proBNP for diagnosing of and understanding the disease state of heart failure, D-dimer for diagnosing thrombosis, and test reagents for osteoporosis and the like are showing stable growth. Also, HbA1c which can be the indicator for diagnosing and managing diabetic has continued growing, as the number of testing has been increasing at clinics, especially laboratory testing equipment and kits in the field of POCT (point of care testing) keep the favorable sales.

Future Outlook

The business size of clinical laboratory test reagents and equipment developed at leading companies in Japan in FY2019, based on the sales of 35 domestic leading companies developing clinical test reagents and equipment, is likely to increase by 3.0% from the previous fiscal year to attain 1,106,000 million yen, out of which the business for domestic use grew by 2.0% and that for overseas by 4.1% from the previous fiscal year.

In the background where both the laboratory test reagents and equipment stably supplied for OEM sales overseas, the business growth for overseas demand is likely to outperform that for domestic use again for FY2019, as more Japanese companies continue increasing the sales in China by forming alliance with Chinese local companies to strengthen the sales, for locally produced items are preferred in China.

With regard to the business for domestic use, the demand for testing of cancer, lifestyle related diseases, and osteoporosis which has many elderly female patients keeps being on the rise. In addition, the increasing demand in the area of infectious diseases, not only testing of influenza but also peripheral testing of tuberculosis and German measles, is likely to bring about the clinical laboratory test reagents and equipment business by the domestic leading companies to slightly grow for some time hereafter.

Research Outline

2.Research Object: Leading 35 companies developing clinical laboratory test reagents and equipment in Japan (Japanese companies and subsidiaries in Japan for overseas parent companies)

3.Research Methogology: Face-to-face research by the expert researchers, surveys via telephone and email

Clinical Laboratory Test Reagents and Equipment Business Size

It is the size of the business regarding clinical test reagents and equipment used for laboratory tests (blood, urine, feces, tissues, and other specimen) at medical institutions and inspection centers, calculated by adding up the sales of clinical laboratory test reagents and equipment both for domestic and overseas demand at 35 leading companies in Japan.

<Products and Services in the Market>

Clinical Laboratory Test Reagents and Equipment, laboratory test, clinical test,

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.