No.2262

Insurance Shops Market in Japan: Key Research Findings 2019

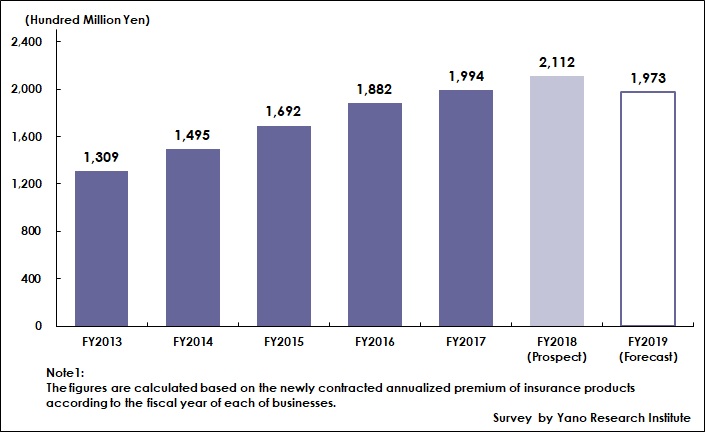

Insurance Shops Market for FY2018 Projected to Increase by 5.9% to Achieve 211,200 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic insurance shops market and has found out the market trends, the market size (based on the newly contracted annualized premium of insurance products according to the fiscal year of each of businesses), number of new contract deals, and the future outlook.

Market Overview

Revision of the Insurance Business Act enacted in May 2016 was a significant turning point for the industry of insurance shops which are operated by joint insurance agencies dealing in insurance products from multiple insurance companies. In the year before, many major insurance shop operators started business in cooperation with life insurance companies aiming to strengthen the financial base, foreseeing the revision of the act. Later, there also were some alignments by some local major insurance shop operators with local major banks or stock brokerage firms.

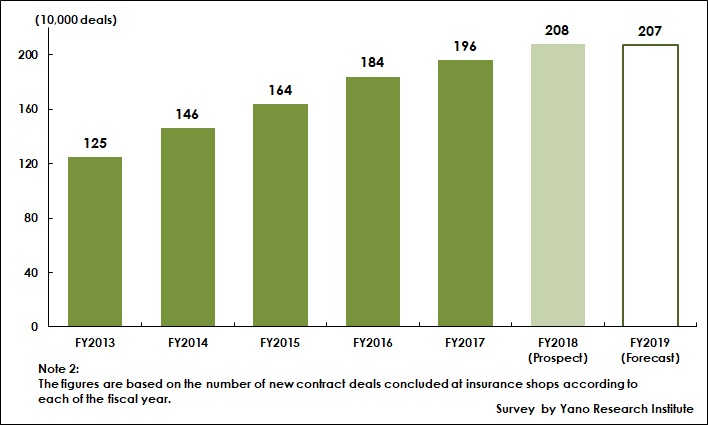

In FY2017, the market suffered from some of discontinued products and risen insurance premium rate, which stemmed from reduction in the standard yield for life insurance. This caused decrease in operating income at some insurance shop operators. On the other hand, exploration of new customer demands expanded the sales of insurance products especially asset-building types and those with the benefits to be paid before the death of insured. Furthermore, the promotions of life insurance products for enterprises expanded the sales to recover the market as a whole. Therefore, the insurance shops market in FY2017 rose by 6.0% to attain 199,400 million yen, based on the newly contracted annualized premium of insurance products according to the fiscal year of each of businesses. The number of new contract deals concluded at insurance shops during FY2017 was estimated to be 1,960 thousand.

The market in FY2018 was affected by reduced premium for death protection products, due to assumed mortality rate being reduced. However, continuously favorable sales of asset-building insurance products and those products with the benefits to be paid before the death of insured led the market potential to remain high. On the other hand, the growth rate slightly declined as the number of insurance shops as well as the number of customers visiting the shops fell. The insurance shops market in FY2018 is likely to increase by 5.9% to achieve 211,200 million yen. The number of new contract deals concluded at insurance shops during FY2018 is projected to be 2,080 thousand.

Noteworthy Topics

Decrease in Number of Insurance Shops Likely to Expand throughout the Industry, but Cooperation with Retailers from Other Industries Progressively Increasing

According to the surveys conducted this year and the last for the number of insurance shops, it was found out that 185 insurance shop operators had 2,644 shops as of April 2018 which decreased by 147 shops to total 2,497 as of June 2019.

While new establishment of insurance shops decelerated last year and the year before last, as insurance shop operators trying to cope with the revision of the Insurance Business Act, fiercer competition with neighboring shops and less number of customer visits further affected to decrease the number of shops. It led to integration of shops even at some of mid-size and large insurance shop operators, not to mention some small operators managing small number of shops in local areas. In the industry, the locations to open new shops used to be in the suburbs, or close to the railway stations, or within the commercial facilities, but recently, such a locational strategy has become a deadlock. There have been new attempts for opening new shops, and cooperating with other retailers from different industries is one of such attempts.

Future Outlook

For FY2019, while the commission fees at insurance shops are to be overhauled, there are some insurance shop operators continuously increasing new contract deals while some others slowing down.

Because of the recent vigorousness in door-to-door insurance sales, and of no prospect for insurance sales for enterprises to reach the last fiscal-year results, let alone continuous decrease in the number of shops, the insurance shops market for FY2019 is likely to decrease to 197,300 million yen, 93.4% of the size of the previous fiscal year, based on the newly contracted annualized premium of insurance products according to the fiscal year of each of businesses. Although the forecast for the market size in FY2019 is to diminish, the market size has been stably stayed at around 200,000 million yen for the past several years. The number of new contract deals concluded at insurance shops during FY2019 is projected to decline to 2,070 thousand, 99.5% of FY2018.

Research Outline

2.Research Object: Joint agencies operating insurance shops, life insurance companies, and etc.

3.Research Methogology: Face-to-face interviews by the expert researchers

What are Insurance Shops?

Insurance shops in this research shall be the joint agencies selling insurance products from multiple insurance companies. The market size is calculated based on the newly contracted annualized premium of insurance products according to the fiscal year of each of businesses.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.