No.2031

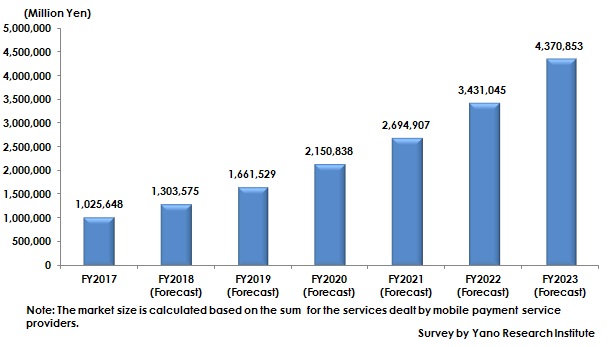

Domestic Mobile Payment Market to Expand from 1 Trillion Yen in FY2017 to 4.3 Trillion Yen by FY2023

Mobile Payment Market in Japan: Key Research Findings 2018

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic mobile payment market and has found out the current status, trends by payment category, and the future outlook.

Market Overview

Size of the domestic mobile payment market (Total values from mobile contactless payment and QR code payment) in FY2017 has expanded to 1 trillion yen. In addition to rapid expansion of mobile contactless payment stemming from Apple Pay being introduced and Google Pay fully developed its business in the Japanese market, wider acceptance and expanding number of users of QR code payment have led the entire mobile payment market to be on the rise.

QR code payment has been adopted at many member stores in Japan, aiming to acquire customers by attracting vast number of users of Alipay and WeChatPay already prevailing in China. Since the beginning of 2018, QR-code payment service providers have rapidly grown in number in Japan. Such providers have been working on increasing the number of enterprises to adopt QR code payment by appealing lowness of adoption cost as well as commission rate. Also, QR codes have such characteristics that can go well with some marketing projects and that they can be available in the form of smartphone applications where increasing number of users have begun being benefitted by the services combined with point-reward systems.

Noteworthy Topics

When looking at the domestic mobile payment market by category, mobile contactless payment has recently gained momentum as Apple Pay introduced to the Japanese market since October 2016, and as Google Pay having fully started the payment services in Japan since 2018 and being available at real stores as well as for e-commerce. In the future, the users are to be able to use Google Pay not only at the member stores of nanaco and Rakuten Edy, but also of Suica, WAON, and QUICPay.

As already mentioned above, QR code payment is easy to adopt for the retailer side due to low adoption cost and low commission rate. Therefore, it is promising for those small to middle-size shops and retailers to adopt it, unlike when they were unable to use credit-card payment systems. By integrating QR code payment services into smartphone applications, QR code service providers give some benefits to the users such as point reward services and sales promotional email, aiming to acquire customers through such marketing measures.

In such a status, so-called house money, which refers to electronic money that can only be used at specific retailers, stores, or shops, as opposed to those generic electronic money, has increasingly come to be used without cards. In addition, the government has started encouraging cashless nationwide. The category of mobile payment using smartphones is likely to be the pillar of cashless payment in the future.

Research Outline

2.Research Object: Major contactless payment service providers, QR code payment service providers, multiple payment service providers, and etc.

3.Research Methogology: Face-to-face interviews by the expert researchers, surveys via telephone and email, and literature research

What is the mobile payment market?

The mobile payment market is the total markets of mobile contactless payment and QR code payment. The former is the service where users can pay by just waving the smartphones and other devices equipped with NFC over a reader at the point of sale terminal. The latter is the payment service using QR codes as payment media. The market size is calculated based on the sum for the services dealt by mobile payment service providers.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.