2022/02/08

Comparative Study of Japan and China Conducted in 2021 on InsurTech Used by Insurance Agencies ~While difference between Japan and China is small for major life insurance companies, large difference is seen in “InsurTech companies operating also as insurance agencies”~

Yano Research Institute Ltd. (the President, Takashi Mizukoshi) and ZATech Japan (the CEO, Xuanbi Bill SONG) jointly carried out the comparative studies of Japan and China with regard to the DX of insurance operation run at insurance agencies.

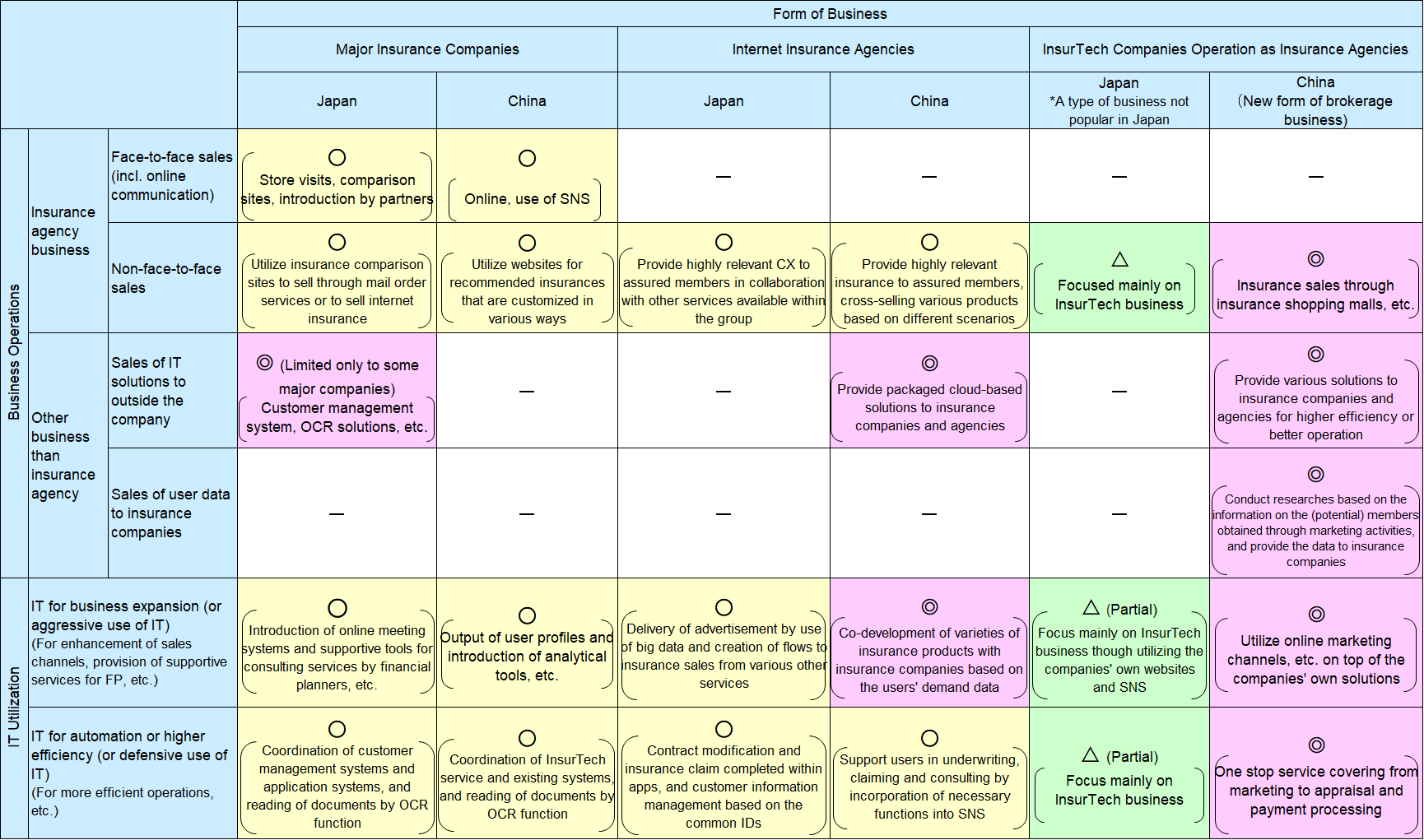

Table 1. Comparison between Insurance Agencies in Japan and Those in China in Terms of Business Operation and IT Utilization

Summarized by Yano Research Institute/ ZATech Japan

NOTE:

- The above table was prepared by Yano Research Institute Ltd. and ZATech Japan based on the study results.

- ◎: Large difference is seen between Japan and China, 〇: Operations are similar between Japan and China, △: Only limited amount of operations are being done, -: No relevant operations were confirmed.

- “OCR” is the abbreviation of Optical Character Reader and also the term referring to automatic reading solutions including business forms (such as a list of medical treatments) that utilize OCR.

- “CX” is the abbreviation of Customer Experience. It represents a certain situation where customers become able to gain different consumer experiences with high affinity/relevancy by being appropriately offered relevant products and services that the customers may need when they decide to take some sorts of actions such that they apply for a travel service at a travel agency, for which a travel insurance offered by the same group of the agency shall be concurrently recommended.

1. Market Overview

A comparative study was conducted of Japan and China of major insurance companies, internet insurance agencies and InsurTech companies operating as insurance agencies respectively, from perspectives of business operations and IT utilization. The study was carried out of major insurance companies first, which revealed a fact that some Japanese companies have an in-house system development division and capability to develop necessary systems for their own operations. Further, the Japanese companies often sell their systems to other corporate groups, while their counterparts in China normally outsource the system development necessary for their operations.

Secondly, it was observed that internet insurance agencies both in Japan and China have common characteristics that they operate different businesses and services within their own ecosystems (i.e. the systems or economies where different businesses co-exist and co-prosper beyond the bounds of industries within a corporate group) on one hand. On the other hand, the companies in China do not only provide necessary/relevant services only to their own ecosystems but also sell packaged cloud-based solutions to other insurance companies and agencies, and they even develop insurance products in cooperation with insurance companies based on the user data.

Thirdly, we also studied of InsurTech companies operating as insurance agencies. While this type of business is often found in China, there are few such companies in Japan, which should be one of the major differences between Japan and China.

2. Noteworthy Topics

Large difference is seen between China and Japan as to the InsurTech companies operating as insurance agencies (the insurance brokerage businesses of new form)

In China, there is a type of companies with functions as both InsurTech companies and insurance agencies, which is called “the insurance brokerage business of new form.” The new form of businesses is originated from InsurTech companies who have gradually expanded their businesses from the services for business users to those for consumers as they have attempted to grow their businesses.

YunBao (established in 2014) and CheChe Technology (established in 2016), the representative players of the insurance brokeragebusiness of new form, have already attained a large volume of sales as the value of insurance premium, while they have been operating only for several years. YunBao had generated cumulative sales of 133 billion JPY* by 2020, and CheChe Technology registered the sales of 20 billion JPY* solely in 2020. Also in terms of the number of employees, CheChe Technology with almost 1,000 people working for the company, has showed rapid growth only in the last several years. (*Data cited from the publicized data)

In Japan, though there are some InsurTech companies operating also as insurance agencies, most InsurTech companies mainly operate only InsurTech businesses, and “the insurance brokerage business of new form” is not a common type of business now. Nevertheless, there should be possibilities that the new business form grows and becomes more popular in Japan as one of the potential future businesses since the InsurTech companies may tie up with brokerage businesses for financial services to grow further or may develop insurance products for younger generations in cooperation with insurance companies by use of the data owned by those InsurTech companies, which could be methods of cultivation of potential customers.

[Study Outline]

|

1. Study Period: March to October 2021 2. Study Object: 12 Japanese companies (covered by Yano Research Institute) and 9 Chinese companies (covered by ZATech Japan) 3. Study Methodologies: Face-to-face interviews with Japanese companies by the consultants from Yano Research Institute, and with Chinese companies by the consultants from ZATech Japan, interviews via telephone and/or e-mail, and information collection via literature/ internet

< Outline of the comparative study of Japan and China on DX (digital transformation) for insurance operations at insurance agencies > We categorized insurance agencies into 3 types: 1) Major insurance companies, 2) internet insurance companies, e.g. insurance agencies owned by internet companies such as Yahoo Rakuten and Alibaba Insurance, 3) InsurTech companies operating as insurance agencies, e.g. YunBao and CheChe Technology, and then conducted a comparative study of Japan and China on the DX of insurance operations to analyze the related activities from the perspectives of both business operations and IT utilization, a part of which is introduced on this press release. InsurTech is a term coined by combining “Insurance” and “Technology” and refers to life insurance services offered by use of information technologies for development of insurance products and services and for higher efficiencies and sophistication in insurance operations, which conventional life insurance could not successfully provide. In this comparative study, InsurTech means insurance consultation and sales support services, and services related to infrastructure (such as insurance cloud services, API (Application Programming Interface)). |

[Published Report]

|

Report Title: InsurTech at Insurance Companies --Comparison between Japan and China 2021 Date of Publication:October 27th, 2021 Format/ No. of Pages: A4/ 190 pages Price (w/tax): 198,000 JPY (180,000 JPY (w/o tax)) |

[Company Overview]

- Yano Research Institute Ltd. (The President, Takashi Mizukoshi)

Address: Nakanosakaue Central Bldg., 2-46-2 Honcho, Nakano-ku, Tokyo, 164-8620 JAPAN

URL: https://www.yano.co.jp/

Yano Research Institute Ltd. is a marketing consulting firm established in 1958, who covers almost all industry fields. The company publishes approximately 250 titles of market reports and carry out over 600 ad-hoc consulting projects annually. It has already expanded their study networks beyond Japan to entire Asian region, including establishment of Seoul office in 1995, a subsidiary in Shanghai in 2004, and a liaison office in Taipei 2007 as the key milestones.

- ZATech Japan (the CEO, Xuanbi Bill SONG)

Address: 7-2-1 Tsukiji, Chuo-ku, Tokyo, 104-0045 JAPAN

URL: https://zatech.com/

ZATech Japan is a subsidiary of ZhongAn Group. ZhongAn Insurance is the first Internet insurance company in China and was established in November 2013 as a joint venture between Alibaba Group, the largest cross-border e-commerce company in China, Tencent, the world's largest gaming company with a strong presence in SNS, and PingAn Insurance, the second largest insurance company in China. ZATech Japan landed in Japan in July 2018. The company provides InsurTech services and solutions not only in Japan but also in other ASEAN countries, and it has already partnered with many insurance companies and internet platformers to promote Digital Insurance.

[Contact for Inquiries]

- Public Relations, Yano Research Institute Ltd.

E-mail: press@yano.co.jp

- Operation Marketing Team, ZATech Japan

E-mail: marketing_jp@zatech.com

The copyright and all other rights pertaining to this report belong to Yano Research Institute and ZATech Japan.

Please contact Public Relations of Yano Research Institute or Operation Marketing Team of ZATech Japan when quoting the report contents for the purpose other than media coverage.