No.3441

Alcoholic Beverages (Liquor) Market in Japan: Key Research Findings 2023

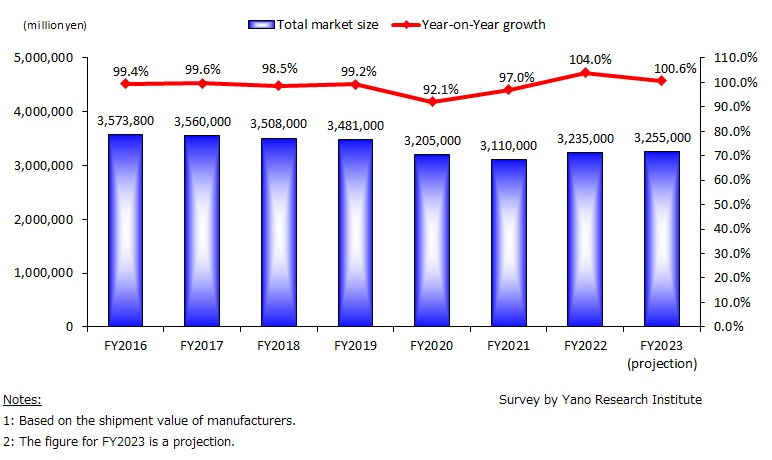

Total Size of Alcoholic Drinks (Liquor) Market in FY2022 Showed Year-on-Year Expansion for First Time in 9 Years to 3,235 Billion Yen, Up by 4.0% from FY2021

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic alcoholic drinks (liquor) market, and found out the trends by product category, the trends by distribution channel, the trends of market players, and future perspective.

Market Overview

The size of alcoholic drinks market in FY2022 grew to 104.0% of the previous fiscal year to 3,235 billion yen, showing a year-on-year growth for the first time in 9 years since FY2013. The main reason for the upturn was the recovery of commercial demand. As Japan ended its quasi-state of emergency in March 2022, which banned the availability of alcoholic beverages at food services, customer traffic gradually restored, and consequently the consumption of alcoholic drinks with high commercial demand such as beer and whisky increased.

However, at-home consumption of alcoholic beverages, which was fueled by the voluntary staying-at-home during the COVID crisis, began to decline as outing for drinking increased. Despite years of growth, sales of low-alcoholic drinks shrank for the first time in 15 years. Furthermore, as makers increased sales promotion on regular beers in response to the 2023 revision of the Liquor Tax Law (which reduced tax on regular beers while raising tax on beer-like beverages), sales of less focused products, such as ‘new genre beers’ intended primarily for home consumption, were hampered.

On top of that, the market expansion of FY2022 is only a comparison against FY2021, when the country was amidst the pandemic. The market has not returned to the pre-pandemic level of FY2019.

Noteworthy Topics

Trends of Non-alcoholic Beverages Market

Growing interest in health consciousness has shed the light on the idea of "sober curious", a term that refers to an attitude of people that opt not to drink even if they can. As the trend has accelerated during the COVID crisis, opportunities to drink non-alcoholic beverages are increasing.

The market size of non-alcoholic beer-tase drinks (non-alcoholic beer drinks) in FY2022 has turned to worse for the first time since its first product launch in 2009. Nonetheless, this is most likely a temporary drop, a recoil of the double-digit growth seen in FY2021 led by a rise of health consciousness during the pandemic. We believe the market is still growing.

Moreover, although the non-alcoholic beverages market originally indicated non-alcoholic beers, in the last couple of years non-alcoholic products other than beer flavor are increasing. Non-alcoholic RTD (ready to drink) is a prime example. Demand is flowing from beer to low-alcohol beers, from low-alcohol beers to non-alcoholic RTD. Even though the market of non-alcoholic RTD is still small compared to the non-alcoholic beers market, it is growing for sure.

Future Outlook

The overall trajectory of the alcoholic drinks (liquor) market in FY2023, particularly for items intended for commercial use, is encouraging. The summer's unprecedented heat wave has increased growth, providing a tailwind for beer consumption. On the other hand, demand for alcoholic beverages intended for home use is predicted to fall to the level of FY2022, as consumers cut back on spending due to inflation concerns caused by repeated price hikes in foods, including alcoholic beverages. All-in-all, the total alcoholic drinks (liquor) market in FY2023 is expected to show a slight year-on-year growth to 3,255 billion yen (100.6% of FY2022) as the reduction of tax on beer propels consumption, while price revisions increase the total market size by value.

Research Outline

2.Research Object: Manufacturers and wholesalers of alcoholic drinks (liquors), related businesses

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone, questionnaire, and literature research

What is the Alcoholic Drinks (Liquor) Market?

In this research, the alcoholic drinks (liquor) market include the following 10 categories: 1) Beer (regular beer), 2) happoshu (low-malt beer), 3) ‘new genre’ beer (beer-like drinks made without malt), 4) Japanese sake, 5) high-class shochu, 6) second-class shochu, 7) whisky, 8) wine, 9) low-alcoholic drinks, and 10) others. The market size does not include non-alcoholic beverages.

<Products and Services in the Market>

Beer (regular beer, happoshu, ‘new genre’ beer), Japanese sake, high-class shochu, second-class shochu, whisky, wine, low-alcoholic drinks

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.