No.3696

Life Insurance Distribution Channels in Japan: Key Research Findings 2024

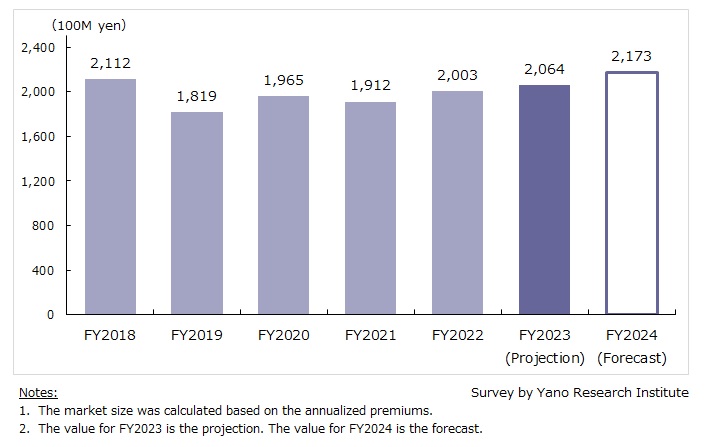

Insurance Shops Market Expected to Grow by 3.0% YoY to 206,400 Million Yen for FY2023

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the distribution channel strategy of domestic insurance companies and business strategies of independent insurance agents. This press release announces the market size of insurance shops (based on the annualized premiums).

Market Overview

Consumer activities have returned to pre-pandemic levels after the reclassification of the novel coronavirus to Class 5 under the Infectious Diseases Act in May 2023. However, as many customers still enjoy the convenience of online consultations, a significant increase in the number of new shop openings is not expected. On the other hand, asset management need is increasing against the backdrop of the “Doubling Asset-based Income Plan”. Given the circumstances, the size of the market for insurance shops (based on annualized premium) in FY2023 is projected to increase by 3.0% from the previous year to 206,400 million yen.

With an increased focus on medical insurance offering generous coverage at low premiums, alongside higher interest rates for cash value insurance and the growing momentum of "Savings to Investments" driven by the launch of the new NISA, foreign-currency-denominated cash value insurance remains highly popular in FY2024. While consumers may still face psychological barriers when selecting insurance policies online, the demand for insurance shops and online consultation services continues to rise.

Against these backgrounds, the market size of insurance shops in FY2024 is projected to grow by 5.3% from the previous fiscal year to 217,300 million yen. This marks a return to the pre-pandemic market levels of FY2018.

Noteworthy Topics

Penetration of Online Services and Potential of AI

The Covid-19 pandemic prompted life insurance companies to adopt web conferencing system and chat services for their sales reps (captive agents that are full-time employees). Even as society has returned to pre-pandemic conditions, these companies have maintained these systems, allowing agents to engage with clients both online and offline, based on client preferences. This shift indicates that the use of online systems has now become an established sales medium.

Independent insurance agents also embraced online consultations during the pandemic and have since integrated AI-powered systems for tasks such as policy quotations, employee training, and consulting support.

The growing utilization of AI within the insurance sector is seen as a significant development. There's a noticeable gap between the number of people who express interest in purchasing insurance online and the number who actually complete the transaction. If the industry can leverage AI technologies to better support potential customers in selecting and purchasing policies online, it could be a game changer.

Future Outlook

The declining birthrate and aging population present significant challenges to the insurance industry, contributing to a downward market trend. To address this, it is crucial to attract new customers by offering value propositions that go beyond traditional insurance offerings.

As the Japanese population anticipates a lifespan of 100 years, major life insurers are becoming particularly active in developing offerings that go beyond traditional insurance. Through collaborations with, or acquisitions of, non-insurance entities, they aim to provide "services that facilitate health and wellbeing" alongside "insurance to help customers prepare for risks." Insurance companies are also starting to offer embedded insurance, the insurance that allows customers to include or add on insurance coverage when buying products or services. By expanding into both non-insurance products and embedded insurance, insurers hope to reach customers who would not have been targeted through conventional life insurance sales channels.

Meanwhile, independent insurance agents are struggling to meet the evolving needs of customers, driven by changes in the economic environment. They are expected to transition from being “insurance policy kiosks” to becoming financial consultants capable of offering advice to help individuals manage their money and plan for their financial futures.

Research Outline

2.Research Object: Companies that sell insurance policies including conventional life-insurance companies, online life insurers, and independent insurance agents (insurance shops, online shops, home visiting agencies)

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews) and literature research

About Insurance Shops

Insurance shops in this research refer to independent insurance agents that sell insurance policies at physical retail location, which work with multiple insurance companies to offer a variety of life insurance policies. The market size is calculated based on the annualized premiums at operating companies.

<Products and Services in the Market>

Consumer insurance and commercial insurance, life insurance and non-life insurance (general insurance)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.