No.3430

Global Automotive Lithium-ion Battery Market: Key Research Findings 2023

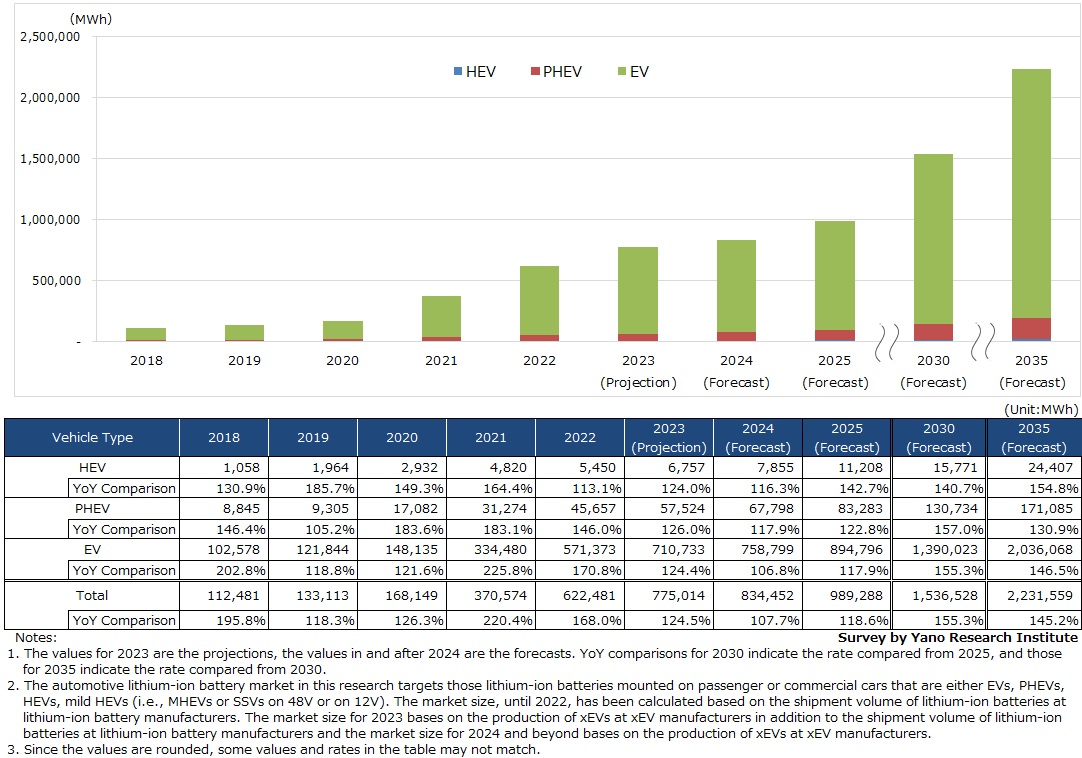

Global Automotive Lithium-ion Battery Market Expected to Reach 1TWh by 2025

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the global market of automotive lithium-ion batteries and found out the trends by product segment, the trend of market players, and the future perspectives. This press release discloses the market size forecasts for global automotive lithium- ion batteries.

Market Overview

The estimated global automotive lithium-ion battery market size by capacity for 2023 has grown to 775GWh, 124.5% of the size of the previous year. The growth has been in tandem with the increase in global production of xEVs (i.e., electric vehicles [EVs], plug-in hybrid electric vehicles [PHEVs], and hybrid electric vehicles [HEVs.])

The xEV market has continued growing even after the COVID-19 crisis, with the growth area expanding to Europe and North America, following China. While the global automotive market (as a whole) has not recovered to the level before COVID, the production of xEVs has come to exceed 10% of entire production by 2022, viewing to reach 15% level for 2023.

Noteworthy Topics

Signs of Changes in Acceleration for xEV Promotion Plans and Goals

The European Commission proposed to ban the sales of new internal combustion engine (ICE) vehicles from 2035 as a part of the FIT for 55 package (announced in 2021), and in 2022 the European Parliament adopted the bill for all passenger and commercial cars to be zero CO2 emissions by 2035, which were to be discussed by the board of directors that consists of member countries. In 2023, though the European Parliament has adopted the bill to ban the sales of new ICE vehicles from 2035, Germany and other countries have expressed opposition. As a result, the sales of vehicles using synthetic fuels (e-fuel) that are regarded to emit zero GHG have been admitted, which, in effect, meant a revocation of the ban to sell new ICE vehicles. The UK, too, has announced that it has put off the ban of selling new gasoline or diesel cars within the country targeted by 2030 to 2035.

The xEV promotion policy has been underway in the US under the Biden administration, setting the target of 50% of new car sales to be xEVs (EVs and PHEVs) and fuel cell vehicles (FCVs) by 2030 in Presidential Decree. The state of California has determined a proposed regulation on all-out ban for selling new gasoline cars including HEVs by 2035 (PHEVs with 80kms or more of the range are approved as zero-emission vehicles (ZEVs)). On the other hand, automakers have shown withdrawal or scale back in their xEV battery plans, as General Motors Co. dropped the joint-venture plan for a battery cell manufacturing factory with a lithium-ion battery manufacturer, and as Ford Motor scaled back the investment for an electric-vehicle battery plant.

China stipulated in “the Energy-saving and New Energy Vehicle (NEV) Technology Roadmap 2.0 (released in 2020)” that, by 2035, all new cars to sell must be eco-friendly (i.e., 50% are new energy cars, chiefly EVs, and the other 50% are HEVs). In China, “Wuling Hongguang Mini EV” that flourished during 2021 and 2022 has shown a slowdown in growth by 2023.

In Japan that targets zero sales for new ICE cars except for HEVs by mid-2030s, the incentives to support the xEV promotion policy are becoming generous, as the subsidies to fuel the implementation of clean-energy cars have enormously expanded to 129.1 billion yen in the FY2023 supplementary budget.

Future Outlook

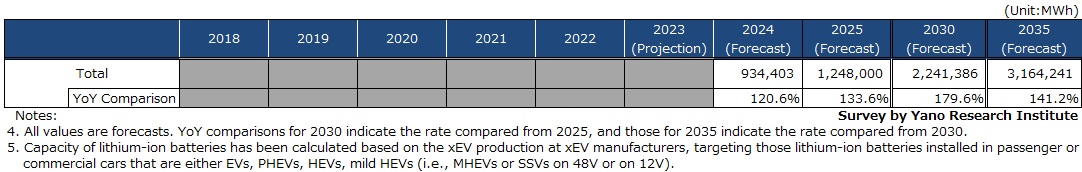

The growth forecasts of the global automotive lithium-ion battery market have been carried out with two scenarios, i.e., the one based on governmental policies (the aggressive forecast that tends to result in higher growth rate) and the other on market environment (the conservative forecast that tends to be lower growth rate), taking xEV market environments into account.

The aggressive forecast expects relatively high growth rate, as it anticipates by and large achievements against the targeted xEV implementations by each country, because of their stricter environmental regulations worldwide and xEV promotion policies, and the shift to produce more electric vehicles by automakers in response to such policies. In the aggressive forecast, the global automotive lithium-ion battery market size based on the capacity is projected to be 1,248 GWh by 2025, 2,241 GWh by 3030, and 3,164GWh by 2035.

Meanwhile, the conservative forecast predicts lower growth rate, as it anticipates longer time to solve various problems for expanding xEV deployment, including the issues to meet the consumer demand for user-friendliness and affordability.

It is considered that the market growth for PHEVs and EVs remains to be dependent on the governmental policies, except for China.

A slowdown in the market growth is observed for PHEVs and EVs in Europe, as subsidies have either been discontinued or reduced in the UK, Germany, and other countries. The hurdles for promoting PHEVs and EVs have become even higher, as 2022 saw price rise of automotive lithium-ion batteries caused by increased costs for lithium-ion battery components, rise of energy costs caused by the Russia and Ukraine situations, and further inflations. As some European automakers seem to consider reviewing their PHEV plans, the xEV market may not grow as expected.

In North America, there have been a series of moves to postpone the commencement of EV production or to review the plans for joint venture plants with lithium-ion battery manufacturers. While the subsidy policy for the U.S. Inflation Reduction Act (IRA) is considered as encouragement for the market, the recent EV sales have not grown as well as the target first set by automakers, who are sometimes urged to reconsider the plan strategies due to the IRA that has an aspect of eliminating Chinese suppliers. Although the xEV market is expected to grow in North America, as the area is the proactive advancement target by automakers and by lithium-ion battery manufacturers for their production bases, the market growth rate does not seem to reach the aggressive forecast. In the conservative forecast, the global automotive lithium-ion battery market size is projected to be 989 GWh by 2025, 1,536 GWh by 3030, and 2,231 GWh by 2035.

Research Outline

2.Research Object: Automakers, manufacturers of automotive lithium-ion batteries in Japan, Europe, China, and South Korea

3.Research Methogology: Face-to-face interviews (including online) by expert researchers and literature research

About Automotive Lithium-ion Battery Market

Automotive lithium-ion batteries are those installed in electric vehicles (EVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs) for driving the automotive motors.

The automotive lithium-ion battery market in this research targets those lithium-ion batteries mounted on passenger or commercial cars that are either EVs, PHEVs, HEVs, mild HEVs (i.e., MHEVs or SSVs on 48V or on 12V). The market size, until 2022, has been calculated based on the shipment volume of lithium-ion batteries at lithium-ion battery manufacturers. The market size for 2023 bases on the production of xEVs at xEV manufacturers in addition to the shipment volume of lithium-ion batteries at lithium-ion battery manufacturers, and the market size for 2024 and beyond bases on the production of xEVs at xEV manufacturers.

<Products and Services in the Market>

Lithium-ion batteries for Electric vehicles (EVs), plug-in hybrid electric vehicles (PHEVs), hybrid electric vehicles (HEVs), and Mild HEVs

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.