No.3418

Global Polarizing Plates and Component Films Market: Key Research Findings (Latter Half of 2023)

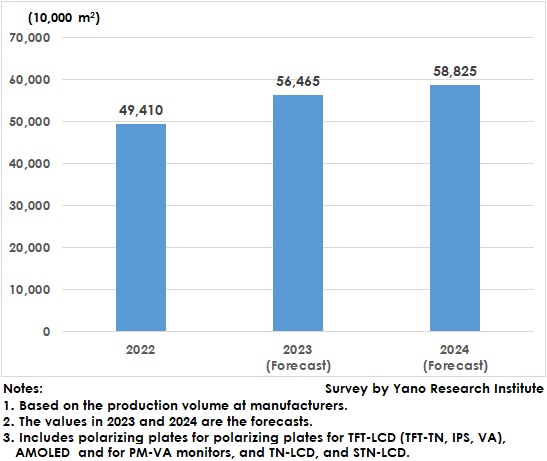

Global Production Volume of Polarizing Plates for TFT LCD & AMOLED in 2023 Forecasted to 564.65 Million m2, 114.3% of Previous Year

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the global market of polarizing plates and their component films for the latter half of 2023 and found out the trends by product segment and future perspectives. Here discloses the forecast on the global production volume of polarizing plates.

Market Overview

The global production volume of polarizing plates in 2023 expects 564.65 million square meters, 114.3% of that of previous year.

2022 saw drop in global production of polarizing plates due to the end of at-home spending during the corona crisis and slump in display sales caused by the deteriorated economy. Since the beginning of 2023 the production of large TV displays has expanded, which increased the orders from display manufacturers to polarizing plate manufacturers, maintaining the favorable demand for polarizing plates from the second quarter (April to June) to the third quarter (July to September) of 2023. Not only Chinese but Taiwanese and Japanese TV screen manufacturers increased their productions, which became a positive factor to have restored the full-scale production operations at polarizing plate manufacturers. The production of large-scale TV displays with 65 inches or larger expanded and recovered until the third quarter (July to September) of 2023, which is projected to expand the global production volume of polarizing plates in 2023, despite different moves shown in the actual sales of TV sets.

Later, however, to prevent from a decrease in the unit selling prices stemming from excessive supply, Chinese TV display manufacturers have adjusted their production volume. This is likely for the average operation rate of polarizing plate production to decline by around 20% in the fourth quarter (October to December) compared to the third quarter of 2023, though the operation rates differ by each manufacturer.

Noteworthy Topics

Unstoppable Extension Race at Chinese Polarizing Plate Manufacturers Leading to Reorganization of Polarizing plate Industry from 2024

In the polarizing plate industry, it is ultimately true about “production capacity = price competing power”. By expanding the production capacities, Chinese manufacturers Shanjin and HMO have urged competitors to withdraw from the market.

The production capacity of polarizing plates at the two manufacturers in total expects more than 400 million square meters in 2024. In addition to Shanjin to start operating the postponed total three production lines in full scale from 2024, HMO is considering the production of polarizing plates with 3,000 mm width at the Kunshan base, which is likely for the production capacity of just these two companies in 2024 to cover a little over 70% of polarizing plate demand.

There is no stopping of the extension race by Chinese polarizing plate manufacturers, which is projected for the reorganization in the industry to become more serious. While other polarizing plate manufacturers in the middle of fierce competition are desperately striving against Shanjin and HMO, some are likely to opt for closing production lines or scaling down a part of LCD TV business from 2024. To focus on selling higher added-value polarizing plates that Chinese manufacturers cannot enter for the time being can be another option for them, rather than sticking to the LCD TV market, the largest market segment.

Future Outlook

The sales of TV products in the Black Friday sales in November or in the invigorated Year-end and New-year shopping period may affect the beginning of the polarizing plate market for 2024.

The inventory adjustment, to prepare for consecutive holidays including Chinese spring festivals that are expected to be ahead of schedule in 2024, and the production adjustment, that may end earlier depending on the recovery in demand geared for sporting events such as the Paris 2024 Olympic Games, both for TV screens and polarizing plates are anticipated to continue from the fourth quarter of 2023 to latter half of the first quarter of 2024 at this stage.

Other than demand for TV displays, that for screens for IT-related (monitor, notebooks, tablet computers) and middle- or small-size screens (smartphones, etc.) has not returned in 2023 after considerable decline in 2022. The above demand is likely to recover to the level before special demand amid the corona crisis from 2024.

In such circumstances, polarizing plates are projected to be well demanded from the second quarter and third quarter of 2024, the advanced season to prepare for new releases of TV products or TV screens. In addition, increased production of currently most favored 65-inch TV panels as well as 75-inch or 85-inch screens that have been earnestly produced since the latter half (July to December) of 2023 contributes to expansion of square meters of polarizing plates. These factors expect the global production volume of polarizing plates in 2024 to reach 588.25 million square meters, 104.2% of the volume of the preceding year.

Research Outline

2.Research Object: Manufacturers of polarizing plates, retardation films, PVA protection films, and surface processed films

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, and literature research

The Polarizing Plate Market

A polarizing plate is an optical filter that passes light that are polarized to specific direction and blocks waves of other polarization. Because polarizing plates are the major component used in all displays, the polarizing plate market is very likely to grow as the display market expands.

Polarizing plates in this research refer to those polarizing plates for TFT (Thin Film Transistor)-LCD, AMOLED (Active-Matrix Organic Light-Emitting Diode) and for PM-VA (Passive Matrix Vertical Alignment) monitors, in addition to those for TN (Twisted Nematic)-LCD, and STN (Super Twisted Nematic)-LCD. The polarizing plate market size is calculated based on the production volume at manufacturers in 10,000 square meters.

<Products and Services in the Market>

Polarizing plate, major component films (retardation film, PVA (polyvinyl alcohol) protective film, surface-processed film, etc.)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.