No.3342

Funeral Business Market in Japan: Key Research Findings 2023

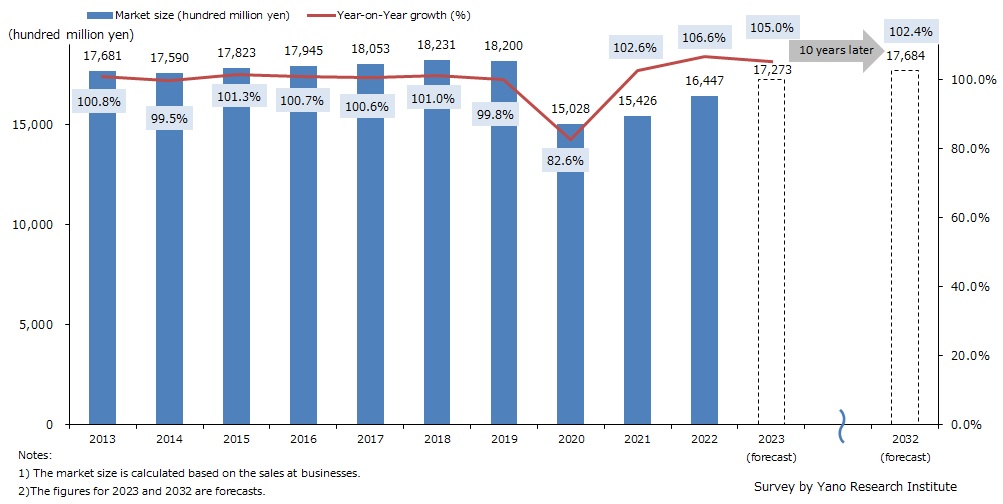

Funeral Business Market in 2023 Forecasted to Reach 1,727.3 Billion Yen, 105.0% of Previous Year

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on funeral businesses in Japan, and found out the market size, the trends by segment, and future perspective.

Market Overview

The funeral service business market in 2022 was estimated at 1,644.7 billion yen, 106.6% of the previous year (based on sales at businesses). It is speculated that the growth stemmed from a rise in the number of deaths. While precautions during the pandemic caused a serious drop in 2020, down almost 20% from the previous year, along with the lifting of the restrictions, the market showed recovery trend in 2021 and 2022.

However, as the COVID-19 crisis and the penetration of “shukatsu” (act of preparing for “end-of-life”, including preplanning of funeral arrangements for oneself) provoked people to rethink about the funeral types and options. As a result, a small-scale funeral called "family funeral" (in which only family members, close relatives, and close friends of the deceased attend the service) has now become a new standard. Moreover, as more people started to choose even smaller family funeral, especially "chokuso (or kaso-shiki)”, where wake and funeral are held solely by family members, the demand for "funeral foods", such as foods served at wake (“tsuya furumai”) or funeral (“shojin otoshi” after Buddhist funeral, etc.), diminished significantly. For these reasons, the market for 2022 did not recover to the pre-pandemic level.

Noteworthy Topics

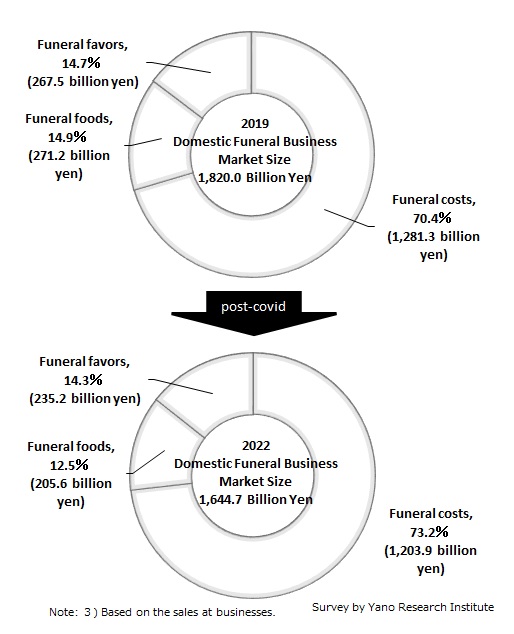

Changes in Composition Ratio by Item

Of the total size of the funeral business market in 2022 (1,644.7 billion yen), “funeral costs” accounted for 73.2%, followed by “funeral foods” at 12.5%, and “funeral favors” at 14.3%.

Looking at the market size by category, “funeral cost” is estimated at 1,203.9 billion yen (94.0% of that of 2019), “funeral foods” at 205.6 billion yen (75.8%), and “funeral favors” at 235.2 billion yen (87.9%). As pandemic restrictions led people to refrain from holding traditional funeral ceremonies that involves serving of foods to attendees, sales of “funeral foods” considerable decline.

Future Outlook

Size of the funeral business market in 2023 is estimated at 1,727.3 billion yen, 105.0% of that of the preceding year (based on the sales at businesses). In ten years from now (2032), the market is forecasted to attain 1,768.4 billion yen, 102.4% of the 2023 level.

Although the number of deaths continues to rise in line with the growth of the elderly population, because people are shifting from the traditional funeral (with many attendees, high price) to small funeral like “family funeral” (limited attendees, lower price), it is assumed that the drop in unit cost of funeral outpaces the incremental sales stemming from the increase in the number of deaths. Because of the solid demand, the market is projected to make an upward turn.

Still, recovery to the 2019 levels cannot be expected even in ten years from now (2032). In fact, the funeral business market is likely to diminish in the long term. Expansion of the funeral business market depends on how much the funeral homes can streamline operations through digital transformation, and how new initiatives can succeed, such as the “preneed arrangement businesses” for elderly, including services related to housing and nursing.

Research Outline

2.Research Object: Funeral businesses

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), online questionnaire, and literature research

What is the Funeral Business Market?

In this research, the funeral businesses market is calculated as a total of the “funeral costs”, “funeral foods”, and “funeral favors (giveaways)”, based on the sales at funeral businesses. The market size does not include direct payments to temples, shrines, or churches (such as “offertory” for temples officiating the service and “sotoba” [a wooden grave post with a name of deceased]” for Buddhist cemetery), cremation, Buddhist home altars, cemetery, or headstone/gravestone.

*Translator’s note: This market research stands on the presumption that majority of Japanese funerals are either Buddhist style or non-religious style.

<Products and Services in the Market>

1) “Funeral costs” - items/services directly related to a funeral, such as alter, coffin/casket, portrait picture (portrait photo of the deceased to be displayed at a wake or funeral), urn (and a special pair of long chopsticks used to place bones in an urn after cremation), dry ice, funeral alter arrangement items, funeral floral arrangements (floral alters, flower wreath, etc.), service staffs [dispatched professionals that serves as receptionist, food server, cleaner, etc. at funerals], hot washcloths (oshibori rentals), ihai (a wooden tag with Dharma name of the deceased, used in Buddhist funeral), fleet services (hearses for the deceased, courtesy buses for funeral attendees), funeral service fee, signboards/paper supplies, and memorial cards 2) “Funeral foods” - foods and beverages served to attendees at wake and funeral, described as ‘tsuya furumai’ and ‘shojin otoshi’ 3) “Funeral favors” - giveaways to show gratitude for attending the service and/or for condolence money for a funeral

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.