No.3341

Telematics Insurance Market in Japan: Key Research Findings 2023

Backed by Release of High-end Drive Recorders and Steady Sales of Car Insurance Using Smartphone Telematics, Domestic Market of Telematics Insurance Estimated at 262,200 Million Yen for FY2023

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic market of telematics insurance, and found out the trends of market players and future perspectives.

Market Overview

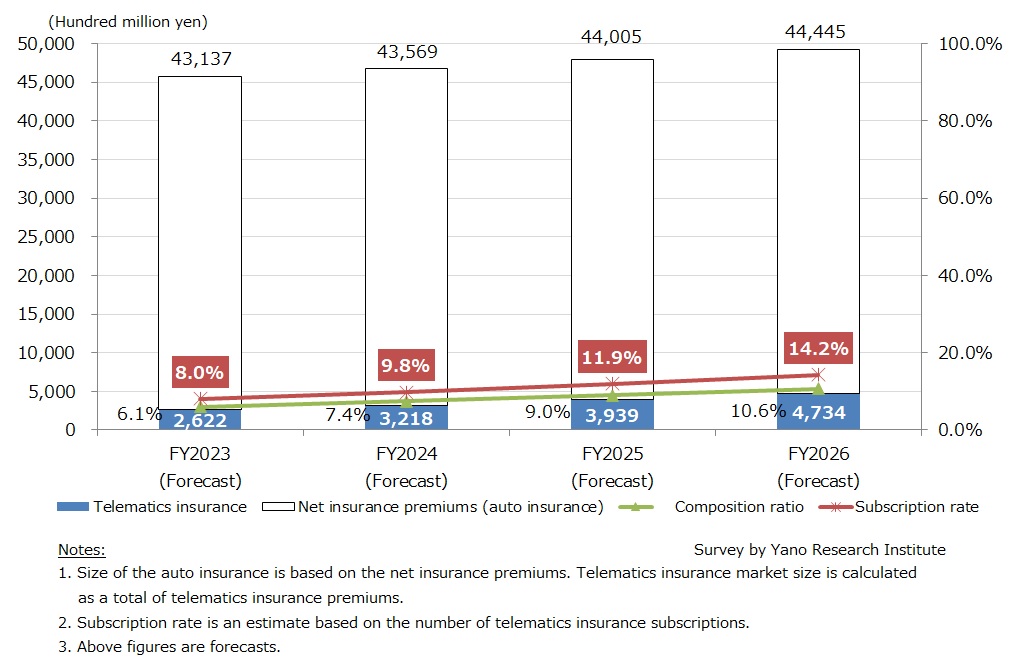

The domestic market size of telematics insurance for individual drivers is estimated at 262,200 million yen for FY2023. In view of the premiums, telematics insurance comprises 6.1% of the net personal auto insurance. Subscription rate of telematics insurance (the composition ratio of telematics insurance policyholders among entire auto insurance policyholders) is projected to be 8.0% for the same year.

Telematics insurance is a type of auto insurance that utilizes telematics technology, which provides safe driving support services and premium discounts based on driving information obtained from communication devices installed in automobiles. A range of insurance product has been expanding to meet varying driver needs. For customers that wish to subscribe to telematics insurance using a telecommunication-type drive recorder that wants to drive even safer, telematics insurance with a high-end drive recorder model, such as those with rear cameras as well as front cameras, became an option. For drivers who already have a drive recorder installed, or drivers that want safe driving support services handily, new telematics insurance that links their drive recorder with smartphone has been developed by non-life insurance companies. Propelled by the availability of broader range of products, subscription of telematics insurance is growing steadily.

Noteworthy Topics

Issues at Hand: Improving Recognition & Increasing Insurance Subscribers

It is a common challenge for all insurers to improve the public recognition level of telematics insurance and increase the number of telematics insurance subscriptions.

While a main type of telematics insurance at present is a car insurance using a communication-type drive recorder, whether or not the driver owns a drive recorder, telematics insurance is still not generally recognized by the public. To increase recognition, it is necessary to approach not only to those who do not have a drive recorder, but also to those who already has a drive recorder by appealing the benefits of the drive recorder provided by non-life insurance companies. For example, non-life insurance companies need to appeal to the drivers to buy a drive recorder provided by an insurance company instead of a commercially available drive recorder at the time of replacement.

Non-life insurance companies need to promote telematics insurance regularly via TV commercials and provide support for insurance agencies to encourage making client proposals. These efforts will eventually lead to the expansion of the telematics insurance market.

Future Outlook

The domestic market size of telematics insurance for individual drivers is projected to reach 393,900 million yen for FY2025 and 473,400 million yen for FY2026. Telematics insurance will penetrate steadily, and the subscription rate of telematics insurance is expected to reach 11.9% in FY2025, and 14.2% in FY2026, respectively. That is to say, approximately 10% of the entire automobile insurance policyholders will be the insureds of telematics insurance by FY2025.

Non-life insurance companies are actively promoting telematics insurance through TV commercials to appeal to new car buyers, while also encouraging existing clients to add telematics insurance as an option when renewing their car insurance. These efforts will contribute to stable expansion of the market size.

Research Outline

2.Research Object: Non-life insurance companies, etc.

3.Research Methogology: Face-to-face interviews by the specialized researchers (including online interviews) and literature research

What is the Telematics Insurance Market?

Telematics insurance refers to a type of car insurance that utilizes telematics technology, which provides services supporting safe driving* and sets discount on insurance premiums based on the driving information recorded on telematics device installed in automobiles. Telematics insurance is provided chiefly by non-life insurance companies.

In this study, the market size of telematics insurance is calculated as a total of automobile insurance premiums paid by telematics insurance subscribers (individuals).

Telematics insurance subscribers refer to the individuals that are either (1) policyholders of the telematics insurance or (2) policyholders of traditional motor insurance policy with telematics services added as an optional coverage to their original contract.

*Example: emergency services notifications in the event of an accident, provide regular feedback on driving performance

<Products and Services in the Market>

Telematics insurance for individuals

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.