No.3329

Global High-Performance Films Market: Key Research Findings 2023

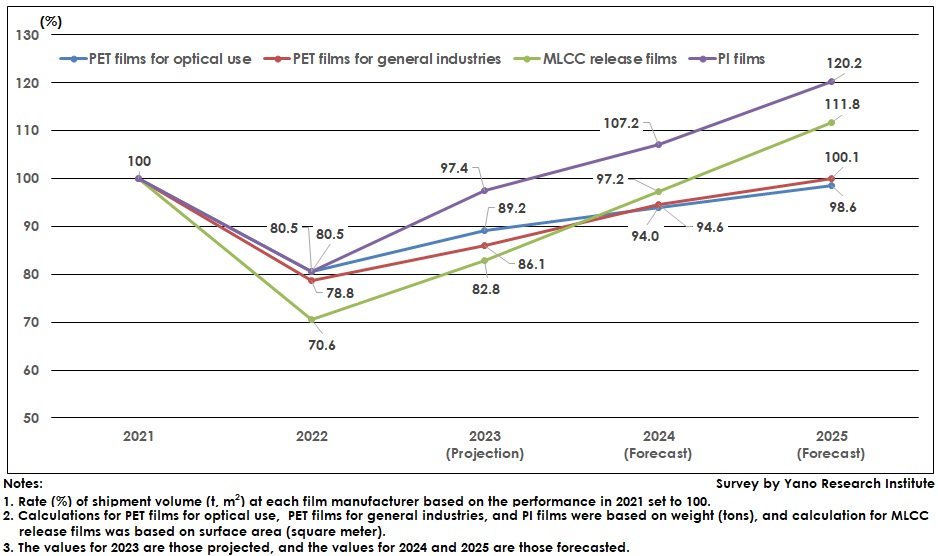

Because of Adjustments to Inventory and Production at Manufacturers, Shipment Volume of High-Performance Films in 2022 Downturned to 70 to 80% on YoY After Special Demand in Corona, Recovery to Level of 2021 Taking Time Until 2024 or 2025

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic and overseas markets of high-performance films which include base films and process films for display & optical use, electrical & electronic use, and for general industries, and found out the trends by product segment, the trends by market players, and future perspective. This press release highlights the increase and decrease in the market sizes for each high-performance film from 2021 performances set as 100.

Market Overview

After enjoying special demand from stay-home spending amid the corona crisis, high performance films markets (Japan, South Korea, and Taiwan) saw a sudden downturn caused by adjustments to excess inventory and to production since around May 2022 at manufacturers producing final products such as smartphones and TVs. This seriously dropped the sales at manufacturers of film components such as display components and FCCL (flexible copper clad laminate) and converters that takes parts in producing sub materials such as protective films and release films used in production processes of the above-mentioned components as well as the film manufacturers that supply the original rolls of those sub material films.

In 2023, as excess inventory at final product manufacturers has been organized and production adjustments have been mostly over, the high-performance films market has upturned once again. However, it is not the level to expect V-shaped recovery, for the recovery speed has been weaker than the momentum of demand shrinkage.

When considering the sales performance in 2021 as 100, the shipment volume of polyimide (PI) films in 2024 is forecasted as 107.2%, multilayer ceramic condenser (MLCC) release films to be 97.2%, polyethylene terephthalate (PET) films for general industries to be 94.6%, and optical PET films 94.0%. It is projected to be around 2024 to 2025 for the market demand to recover to the level of 2021.

Noteworthy Topics

PET Films: V-Shaped Recovery Projected in South Korea in 2023, While Moderate Recovery Expected in Japan

In 2022, because of adjustments to inventory and production were marked since around summer, the demand did not recover even in October when it is supposed to be the demand season in usual years. This enormously reduced the orders for PET films for various applications from the latter half of the year. Some did not even reach 50 or 60% of usual shipment volume. Even totaling the former half of the results which was relatively steady, the PET film market size throughout 2022 (geared for optics and general industries) based on the shipment volume at manufacturers fell to 496,600 tons, 79.5% of the previous year.

Adjustments to inventory and production at final product manufacturers and component manufacturers were marked especially in South Korea, so that the decreasing level of production in PET film manufacturers in South Korea was larger than those in Japan and Taiwan. Nevertheless, as such adjustments were performed at a high pace in South Korea, the speed to hit the bottom was faster than other countries, which led to earlier recovery in demand for PET films, by the end of 2022 to the beginning of 2023, with the recovery speed even faster in around March and April 2023.

On the other hand, Japan saw the adjustments to inventory and production at product manufacturers and component manufacturers little by little since early 2022 and continued until around March 2023. It is projected to take time for recovery to the level of 2021, to around 2024 or 2025.

Future Outlook

As a measure to survive, Japanese film manufacturers have started focusing on “Environment” in their technological developments and promotions represented by film-to-film recycling. Circulations of natural resources and carbon neutrality can be the new framework for competition.

Although environmentally friendliness does not directly connect to new application development or new demand acquisitions, now that carbon neutrality and circular economy are the significant issues in every industry, how to respond and what to suggest in an environmentally friendly manner as a supplier either of materials, components and sub-materials can be new competitive edge for film manufacturers.

Film-to-film recycling is not only about returning to resins by remelting the used products but requires film production with thickness precision and film quality meeting the specifications required by users, which is highly difficult in terms of technology. For post-consumer recycled (PCR) films, there are many cases of foreign compounds in accordance with applications or production processes of collected films. Recycling of those products that require high quality management to attain high smoothness, no foreign compounds, and zero defect, such as protection films and release films for polarizing plates or release films used in the production processes of MLCC needs higher technologies to manufacture films and to manage product quality than when using virgin materials. And that seems to be where new business opportunities are for Japanese film manufacturers.

Manufacturing of recycled products requires more costs than that from virgin materials, because of the needs to collect used products, to clean them, and to remove foreign substances. Therefore, film manufacturers and converters are needed to develop technologies that lead to reduce costs, while finding compromising prices between recycling costs and acceptable prices for users. That said however, cost reductions that cannot secure profits must be avoided.

The scheme and technologies of film-to-film recycling that can only be done in Japan, and development with willingness of creating new market price (or values) for recycled products with the quality using the above are required.

* Post-consumer recycled (PCR) materials are those materials that are recycled from collected products used by consumers.

Research Outline

2.Research Object: Film manufacturers, converters (in Japan, South Korea, and Taiwan)

3.Research Methogology: Face-to-face interviews by expert researchers (including online), and literature research

High Performance Films

High performance films in this research refer to base films and process films used for display and optical use, electronic & electric use, and those geared for general industries. They include PET (polyethylene terephthalate) films, PI (polyimide) films (colored, colorless/transparent), MLCC (multilayer ceramic condenser) release films, recycled films, etc.

<Products and Services in the Market>

PET (polyethylene terephthalate) films, PI (polyimide) films (colored, colorless/transparent), MLCC (multilayer ceramic condenser) release films, recycled films (film to film, bottle to film)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.