No.3310

17 Categories of Logistics Industry in Japan: Key Research Findings 2023

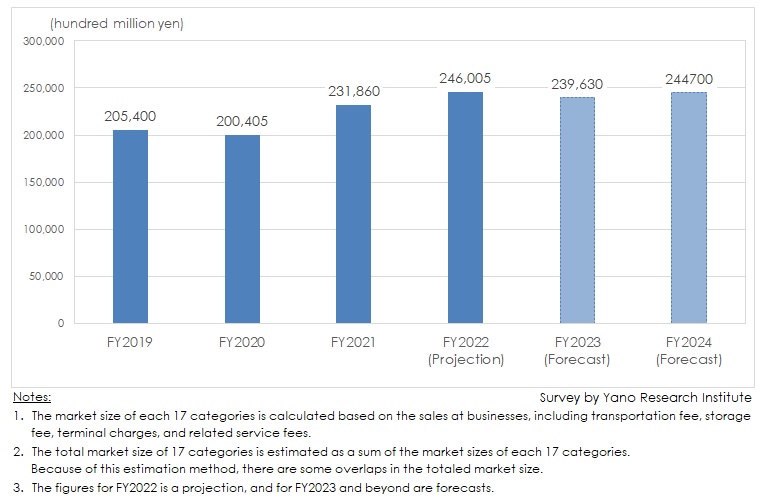

With International Transportation Fee Still Hovering High in First Half of the Year, Total Market Size of 17 Categories of Logistics Industry for FY2022 Grow by 6.1% on YoY Basis to 24.6 Trillion Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the 17 categories of logistics industry and found out the trends by each category, the market player trends, and future perspectives.

Market Overview

The total market size of 17 categories of logistics industry added up to 23,186 billion yen for FY2021, 115.7% of the preceding fiscal year.

Despite the market shrinkage in FY2020 due to the pandemic-induced global economic stagnation, cargo movements and its quantity recovered in each category as business activities resumed in FY2021 in many industries. However, the remarkable expansion of the market size (to 112.9% of that of FY2019) owes more to the steep rise in transportation fees than to the increase of cargo volume. Because high transportation fee due to tight supply-demand balance in maritime and airfreight transportations in FY2020 remained in FY2021, the markets related to international transportations, such as maritime transportation, airfreight transportation, and freight forwarder, grew significantly and uplifted the total market size of 17 categories.

In view of the domestic logistics, auto industry is recovering cargo movement despite of unsolved semiconductor shortage, and a trend of recovery is also observed in business category like third-party logistics provider (3PL). Moreover, the home delivery market continued to enjoy solid sales in FY2021, stemming from a rise in demand for cargo delivery associated with e-commerce. Nevertheless, the market has not fully recovered to the pre-pandemic FY2019-level in terms of cargo shipping volume, and thus the recovery from the COVID situation is considered still halfway.

Noteworthy Topics

Logistics Market Trends

Changes in logistics industry have been accelerated by dramatic changes in the market environment due to the spread of novel coronavirus.

[International Logistics]

Let’s focus on the maritime transport, which has been the main player in international logistics. Due the US-China trade conflict and Covid-19 crisis, which threw port and harbor transportation into chaos and caused major container shortage, FY2020 saw a tight supply-demand balance of maritime transportation. While the demand growth was witnessed for transportation in FY2021 in line with the resumption of economic activities in many industries including automotive, the maritime freight fee skyrocketed to unprecedented level because of limited supply. Although the situation continued to the first half of FY2022, it is expected to stabilize during FY2023 with the supply-demand balance finding more balance.

While the international logistics thrives, the power of ocean shipping is indispensable as it accounts for more than 99% of the cargo shipment volume (based on the cargo volume reported in the data by Ministry of Finance & Ministry of Land, Infrastructure, Transport and Tourism). Considering that the market growth in FY2021 owed mostly to the increase of transportation fee, and now that the supply-demand imbalance has been solved, it is important to address expansion of ocean shipping by incorporating both domestic and international demand for logistics.

[Domestic Logistics]

A majority of domestic long-distance transportation is carried out by heavy-duty trucking. Against the backdrop of increasing awareness of achieving carbon neutrality and so-called “2024 Problem”, moves to reassess transportation method and means of delivery is spreading widely in recent years. While working population is generally declining, recruiting drivers for long haul trucking - which requires a driver to have a license specific for driving large size vehicles - has become one of the most challenging tasks for the industry. There is a concern that the conventional business model, which takes for granted that “a driver drives a heavy-duty truck alone for hours during midnight to carry cargos”, will not be practical in the near future.

While enterprises seek for more efficient trucking method or consider adopting autonomous driving vehicles instead of long haul trucking, at the same time, there are moves to shift to rail freight transportation or coastal shipping. Since the change of transportation method or adoption of alternative delivery vehicle requires shipper’s consent, expansion of the domestic transportation industry hereafter lies on how much the logistic companies and consigners can collaborate.

Future Outlook

The total of market sizes of 17 categories of logistics industry for FY2022 is estimated to reach 24,600.5 billion yen, 106.1% on a year-on-year basis.

In international logistics, the market size is expected to expand due to the strong demand for automobile transportation led by the recovery of semiconductor shortages, as well as to freight and other logistics fees that still hovers high due to tight supply and demand for maritime and air transportation through the first half of the year.

On the other hand, even though a gradual recovery from pandemic impact is anticipated, the cargo shipment volume for domestic logistics is forecasted to level off due to sluggish consumption as a consequence of price hikes for cost of living such as foods. Nonetheless, in terms of market size, it is projected to expand because of the inflation in distribution fees such as transportation fee.

Research Outline

2.Research Object: Domestic leading logistics companies and organizations

3.Research Methogology: Face-to-face interviews by our expert researchers (including online), survey via telephone, and literature research.

What are the 17 Categories of Logistics Industry?

In this research, 17 categories of logistics industry indicate: 1) maritime freight transportation, 2) third-party logistics provider (3PL), 3) domestic home delivery service, 4) special loading motor truck transportation [special transportation by trucks that load some goods in regularly delivered goods], 5) warehousing/storage, 6) freight forwarder, 7) general port & harbor transportation, 8) refrigerated warehousing, 9) moving services, 10) airfreight transportation, 11) cargo service using railway transportation, 12) small van delivery, 13) international parcel delivery, 14) rail freight transportation, 15) motorcycle courier, 16) delivery agency business, and 17) other businesses.

A total market size of 17 categories of logistics industry is estimated by adding the each category’s market size, which is calculated based on the sales at businesses including transportation fee, storage fee, cargo handling fees, and related service fees. Because of this estimation method, there are some overlaps in the totaled market size.

<Products and Services in the Market>

1) maritime freight transportation, 2) third-party logistics provider (3PL), 3) domestic home delivery service, 4) special loading motor truck transportation [special transportation by trucks that load some goods in regularly delivered goods], 5) warehousing/storage, 6) freight forwarder, 7) general port & harbor transportation, 8) refrigerated warehousing, 9) moving services, 10) airfreight transportation, 11) cargo service using railway transportation, 12) small van delivery, 13) international parcel delivery, 14) rail freight transportation, 15) motorcycle courier, 16) delivery agency business, and 17) other businesses

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.