No.3230

Global Market of Electric Four-Wheel Vehicles: Key Research Findings 2023

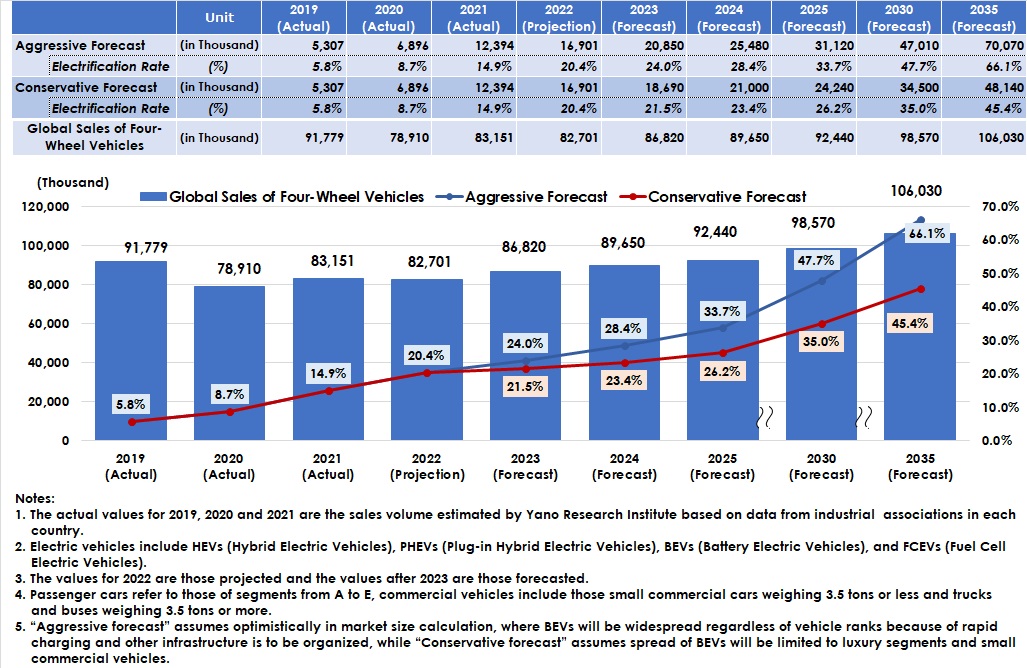

Global Sales of Electric Four-Wheel Vehicles Projected to Reach 98,570,000 by 2030, with Electrification Ratio Grows Up to 50%

Yano Research Institute (the President, Takashi Mizukoshi) surveyed the market of global electric four-wheel vehicles, and found out the market trends in major countries and major manufacturers. This paper discloses the forecast of global four-wheel vehicle sales and electric four-wheel vehicles (passenger cars and commercial cars), and the rate of electric vehicles until 2035.

Market Overview

The global four-wheel vehicle sales for 2022 is projected to be 82,701 thousand, down by 0.5% from 2021, due to supply-chain disruptions stemming from city blockage in China and Russian invasions to Ukraine. Although the market after 2023 is likely to be affected by inflation and higher interest rates, the sales are expected to upturn, driven by emerging countries such as China and India.

The sales of electric four-wheel vehicles i.e. xEVs (HEVs (hybrid electric vehicles), PHEVs (plug-in hybrid electric vehicles), BEVs (Battery electric vehicles), and FCEVs (Fuel Cell Electric Vehicles)) are projected to reach 16,901 thousand in 2022. For 2023 and later, the “Aggressive forecast” assumes the penetration targets set by each country and manufacturer are to be achieved, with the scenario of lower cost for major components such as batteries, which expects the sales of xEVs centered on BEVs to expand to 31,120 thousand in 2025, 47,010 thousand in 2030, and 70,070 thousand in 2035.

The “Conservative forecast” assumes slowdown in spreading of xEVs due to soaring natural resources prices, with the carbon neutrality scenario to include utilization of alternative fuels, which expects the sales of xEVs to be only 24,240 thousand in 2025, 34,500 thousand in 2030, and 48,140 thousand in 2035.

By powertrain, BEVs attracts the most attention. The Aggressive forecast assumes the market size calculation to be optimistic, as BEVs will be widespread as rapid charging and other infrastructure is to be organized, while the Conservative forecast assumes the spread of BEVs to be limited to luxury segments and small commercial vehicles.

Noteworthy Topics

Environment surrounding Entire Mobility Market

The entire mobility market (passenger cars, commercial vehicles, two-wheel vehicles, off highway vehicles, and micro mobilities), has the challenges of the environmental issues and safety improvement. The total CO2 emissions in the transportation sector are mainly occupied by passenger cars and freight train cars, making it highly effective if decarbonization of passenger cars and freight train cars is implemented. Therefore, in order to reduce CO2 it is beneficial to popularize BEVs that can drive only by motors that dispense with fossil fuels, FCEVs, e-fuels (synthetic fuels produced from hydrogen and carbon dioxide) and hydrogen engines.

Because of increasing traffic accidents worldwide, implementation of ADAS (Advanced Driver Assistance System) including AEBS (Advanced Emergency Braking System) geared to passenger cars, commercial cars and two-wheel vehicles have become obliged in the legislation, aiming to improve safety. The measures to reduce traffic accidents are also observed in the forms of demonstration of autonomous driving and the sales of level-three self-driving cars.

In such a situation, the mobility market is needed to change from the aspects of the environmental issues and of safety improvement. For better environment, xEVs are likely to increase the popularity. Among them, BEVs are expected to increase the sales.

Future Outlook

As income in those emerging countries such as in Southern Asia or in Africa is expected to increase, passenger cars are projected to be more in demand over the years through 2035. BEVs, in particular, are likely to be questioned for their actual convenience, as the grant of subsidies will be suspended after 2023 in Germany and China that have driven the whole market. In addition, Europe has drafted a plan to allow sales of new cars with internal combustion engines after 2035 if they run only on climate neutral e-fuels or synthetic fuels, no longer sticking only to BEVs.

In association with increase in transportation demand, the sales of commercial cars are likely to expand. Conversions to BEVs in buses and small commercial vehicles are in progress, but the electrification ratio in sales is only less than 5%*. Because of heavier cargoes to transport and longer distances to drive, carbon neutrality of trucks is likely to be in progress by means of utilization of alternative fuels and hydrogen in addition to replacement to EVs.

Although not included in the market size, the trends of off highway vehicles and next-generation mobility are analyzed as follows.

Off highway vehicles is expected to increase the demand due to growing population and economy in emerging countries such as in Africa. As electrification is underway for small farming machines and in small as well as large construction machinery, their deployment at companies may increase as a part of carbon neutrality strategies.

Though the market size is small, next-generation mobility shows easiness in BEV conversion due to the lightness and short distances to drive. Because of its high affinity with MaaS (Mobility as a Service), it can widespread if it can take part in the urban transportation.

*Reference: Press Release for “Global Electric Commercial Vehicle Market: Key Research Findings 2022” by Yano Research Institute

URL:https://www.yanoresearch.com/en/press-release/show/press_id/3165

Research Outline

2.Research Object: Manufacturers of mobilities (passenger cars, commercial vehicles, two-wheel vehicles, off highway vehicles, and micro mobilities), system suppliers, industry groups, etc.

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, survey via telephone, and literature research

The Electric Four-Wheel Vehicle Market

Electric four-wheel vehicles (xEVs) in this research include HEVs (hybrid electric vehicles), PHEVs (plug-in hybrid electric vehicles), BEVs (Battery electric vehicles), and FCEVs (Fuel Cell Electric Vehices), passenger cars with the segments from A to E, small commercial vehicles weighing 3.5 tons or less and commercial trucks and buses weighing 3.5 tons or more. In addition to passenger cars and commercial vehicles, two-wheel vehicles, off highway vehicles (construction machinery, farm machines), and micro mobilities are included as the mobilities, but those mobilities such as airplanes, railways, and marine vessels are not included.

There are two forecasts prepared for electrification rate of four-wheel vehicles: The “Aggressive forecast” is based on optimistic assumption where BEVs are projected to widespread regardless of vehicle ranks, as infrastructure such as rapid charging is to be organized, while the “Conservative forecast” is based on a less optimistic assumption where spread of BEVs will be limited to luxury segments and small commercial vehicles.

<Products and Services in the Market>

ICE commercial vehicles, HEV (hybrid electric vehicle), PHEV (plug-in hybrid electric vehicle), BEV (Battery electric vehicle), and FCEV (Fuel Cell Electric Vehices)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.