No.3184

Logistics Robotics Market in Japan: Key Research Findings 2022

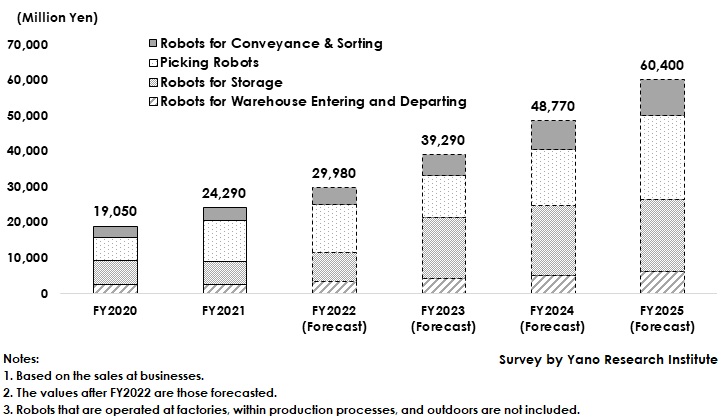

Logistics Robotics Market Size for FY2021 Reached 24,290 Million Yen, 127.5% on YoY, Projected to Achieve 29,980 Million Yen for FY2022, 123.4% on YoY

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic logistics robotics market, and found out the market size, trend of market players and future perspectives.

Market Overview

The logistics robotics market size (based on the sales at businesses) for FY2021 was estimated as 24,290 million yen, 127.5% of that of previous fiscal year.

Against a backdrop of increased demand for ecommerce and labor shortage in the logistics industry, automation needs in warehouses have been increasing year by year. Continued from FY2020, FY2021 was uncertain in the corona crisis, shown by those negative factors such as suspension or postponement of large-scale investment, increase in lead time until purchase of robots due to semiconductor shortages. On the other hand, in addition to big-scale robotic deployment including Goods-to-Person AGVs that had been delayed in the corona shock, increase in newly-entered logistics robots mainly from overseas, as well as diversified methods (advent of RaaS) for selling and providing of robots having somewhat solved one of the reasons for hesitant deployment, expanded the market as a whole.

Noteworthy Topics

Robots will be Utilized from being Owned

Many of deployments for logistics robots are expensive, which sometimes prevents companies from investing in it, though depending on the type. The company size often decides whether or not to invest. In recent years, however, an era is about to come for companies to utilize robots rather than to own. Increasing numbers of businesses have started providing robots on a subscription basis as RaaS (Robot as a Service). For the case of RaaS, users can use a necessary number of robots during a necessary period. Many of such services include from implementation to maintenance supports, in addition to rental of robotic hardware. Users are able to concentrate on the optimization at the site, without the need to mind about the purchase and maintenance of the hardware.

While conventional purchasing of robots may be appropriate for the cases of large-scale logistics warehouses at manufacturers or of those that need an elaborate layout on an assumption of long-term operations, more companies are likely to become flexible, such as using RaaS to the situations where volatile factors exist such as the necessity to respond to fluctuating volume of goods to be distributed. In addition, the dispense of initial cost and allowing of short-term use may encourage the use of robots at small-to middle scale sites where no deployment of robots has been available despite the needs of automation. Because the number of small-to-middle size warehouses is overwhelmingly larger than the number of large-scale ones, whether or not to be able to expand implementation at small-to-middle size warehouses is significant.

Future Outlook

The estimated logistics robotics market size (based on the sales at businesses) for FY2022 was 29,980 million yen, 123.4% of that of previous fiscal year. As FY2022 entered the “With Corona” era, increasing numbers of businesses strategically propelled automation for their logistics, foreseeing the future, which led eagerness for investment to revive. There were those businesses, which had already deployed logistics robotics during FY2018 and FY2020, to horizontally expand the implementations to other in-house bases, or to plan a large-scale deployment of robotics at a new base to be built. Furthermore, implementation of new robotics has been underway, including the advent of robots for devanning, the work that was thought to be difficult to automate, and introduction of conveyance AMRs. The market for FY2023 is projected to show higher growth rate than in FY2022.

As increasing numbers of manufacturers are entering the logistics robotics market, the competition has been fiercer as the market expands. The key for the future is the software that controls robotics. While it is general for a machine that does a certain workload to keep the productivity as per standard since its implementation but not to be able to avert from lowering the productivity as the durable year closes by, the lowest productivity status for a robot is when it is initially implemented. Because the software that controls the robot will be updated year by year, the utilization of the robot is structured to increase. Therefore, how to differentiate from others in software is important.

Research Outline

2.Research Object: Manufacturers related with logistics robotics, service providers, and businesses utilizing logistics robots

3.Research Methogology: Face-to-face interviews by our researchers, and literature research

About the Logistics Robotics Market

According to documents in METI (the Ministry of Economy, Trade, and Industry), a robot is defined as an intelligent machinery system equipped with three types of technologies, i.e. sensors, intellect and control, and drive systems.

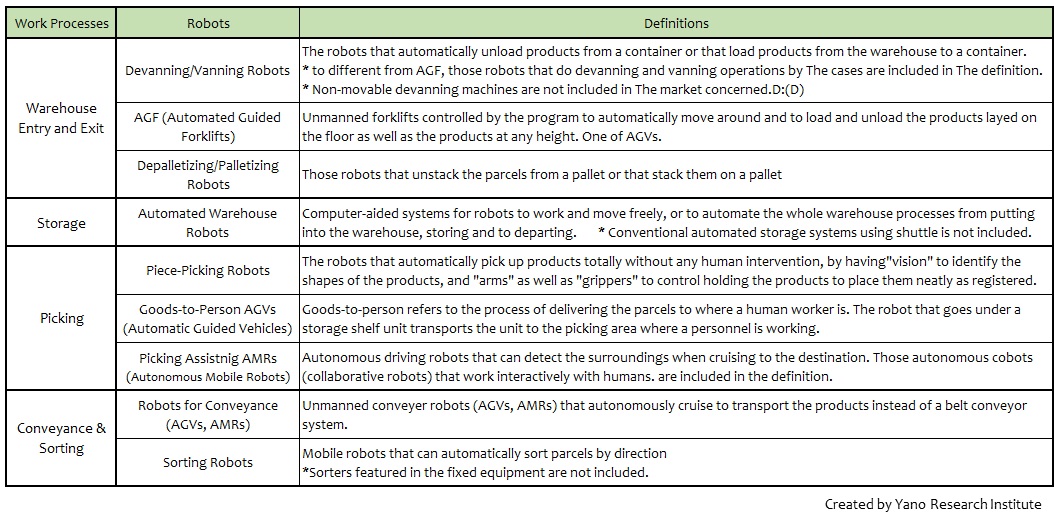

Logistics robotics in this research targets the robots utilized indoors for logistics such as at warehouses and logistics centers, and categorized into the following four types by work process: Robots for warehouse entry and exit, storage, picking, and conveyance and sorting. To be more specific, they include devanning/vanning robots, AGF (Automated Guided Forklifts), depalletizing/palletizing robots, automated warehouse robots, piece-picking robots, Goods-to-Person AGVs (Automatic Guided Vehicles), picking assisting AMRs (Autonomous Mobile Robots), robots for conveyance (AGVs, AMRs), and sorting robots.

The market in this research basically targets the robots deployed at logistics sites, i.e. warehouses, logistics centers for retailers and wholesalers, etc. Therefore, those robots operated at factories, within production processes, and outdoors are not included.

The market size for logistics robotics is calculated based on the sales at businesses, e.g. the sales value for the robot hardware and the systems required for operation).

<Products and Services in the Market>

Devanning/Vanning Robots, AGF (Automated Guided Forklifts), Depalletizing/Palletizing Robots, Automated Warehouse Robots, Piece-Picking Robots, Goods-to-Person AGVs (Automatic Guided Vehicles), Picking Assistnig AMRs (Autonomous Mobile Robots), Robots for Conveyance (AGVs, AMRs), Sorting Robots

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.