No.3156

Code Payment Service Market in Japan: Key Research Findings 2022

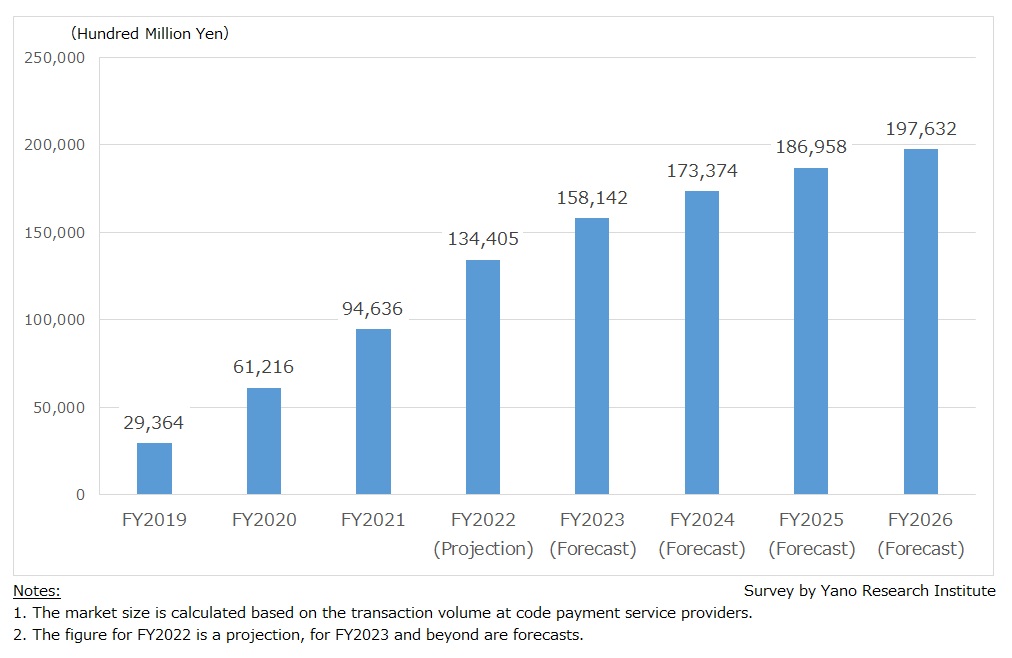

Domestic Code Payment Service Market for FY2021 Expanded to 154.6% of Preceding Fiscal Year to 9,463,600 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the domestic market of code payment services, and found out the current status, the trends of market players, and future perspectives.

Market Overview

Domestic code payment market has soared to 9,463,600 million yen for FY2021, which is 154.6% of that of the preceding fiscal year (based on the billings at code payment service providers). Code payment service providers have leveraged their business by offering participating merchants with free transaction fee, while introducing incentives to consumers through large-scale campaigns. In addition, the government led cashless/rebate programs, and introduced MyNaPoint. By appealing the user benefits, the national campaigns succeeded to expand users of cashless payments including code payments. Furthermore, Coronavirus anxiety has pushed more people towards using cashless payments including code payments.

As of November 2022, the move to waive transaction fee for merchants is seemingly coming to an end. However, because their transaction fees of code payments are lower than other payment methods, code payments were preferred by stores (merchants). For these reasons, the code payment service market is increasing exponentially.

Noteworthy Topics

Trends of Code Payment and Auxiliary Financial Features

Non-financial businesses such as retailers and communication app providers are starting to offer embedded finance. *1 In these cases, code payment services provide payment processing, and thus their apps have a role of customer touchpoint. For this reason, the code payment service providers are adding a variety of services (mini-apps *2) including auxiliary financial features to their existing apps, so as to scale their apps to "super apps".

*1 Embedded finance is the financial tools or services (payment, lending, investing, and insurance) by non-financial companies that provide a seamless user experience for customers.

*2 Mini-apps refer to small apps that exist in a bigger app, which does not require downloading. The larger app is called a super app.

Future Outlook

The code payment market is forecasted to reach 19,763,200 million yen by FY2026.

Services have been added to the code payment apps, such as shopping, food delivery, and taxi booking, and the variety of mini-apps to be embedded is expanding. Having user convenience as a competitive edge, wide adoption of code payment services is expected for years to come.

On the other hand, through the promotion of mini-apps, the providers of code payment and mini-apps can gain access to various lifestyle data of consumers using the apps. In addition, as the cross-use of services provided by group companies is promoted and IDs are linked to other service providers, the state where the use of a wide range of data is enabled, the lifestyle trends of app users can be obtained in multiple layers. With progress of these attempts, it is predicted that code payment service providers will be able to drive their app users to visit merchant’s stores.

Research Outline

2.Research Object: Major code payment service providers

3.Research Methogology: Face-to-face interviews by our specialized researchers (including online interviews) and literature research

What is the Code Payment Service Market?

Code payment (QR codes*/barcodes) is a payment method where payment is completed by merchant (store) scanning payer’s code with their terminal at point of sale, or by payer scanning the payee’s (store’s) code with their mobile gears like smartphone. In this research, size of the code payment services market is calculated based on the billings at code payment service providers.

* "QR code” is a registered trademark of Denso Wave Incorporated.

<Products and Services in the Market>

Code payment services (QR code payment/ barcode payment)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.