No.2962

Digital Printing Market in Japan: Key Research Findings 2022

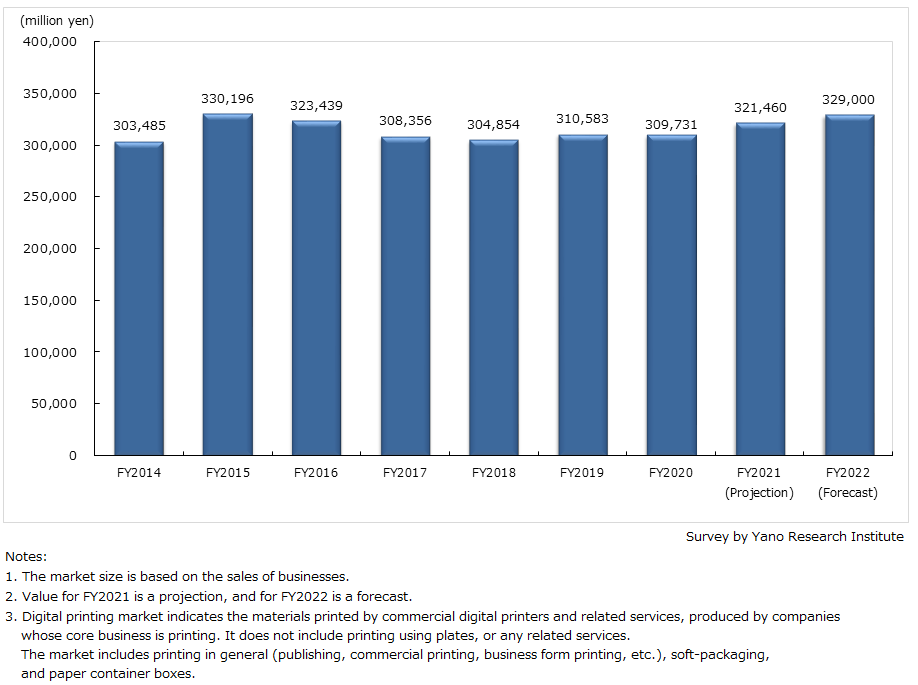

The Digital Printing Market Size in FY2020 is Anticipated to Remain Almost Unchanged Even in the COVID-19 Pandemic, and That in FY2021 is Expected to Increase Approximately 4% from the Previous Year

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the digital printing market in Japan, and has found out the market trend by category, the trend by market players, and the future outlook.

Market Overview

Regarding the domestic digital printing market size in FY2020, the photobook market and the office convenience store market* declined sharply since people started to refrain from going outside due to the spread of the COVID-19 infection, and the print on demand (POD) market, excluding the foregoing two markets, also declined due to a decrease in demand for sales promotions. On the other hand, the data print service (DPS) market expanded by gaining outsourcing demand related to various economic measures implemented during the COVID-19 pandemic, vaccination tickets, and the like. As a result, the digital printing market (based on sales of businesses) in FY2020 is expected to remain almost flat at 309,731 million yen (decreased by 0.3% from the previous fiscal year), barely maintaining the market size even in the pandemic.

In FY2021, the digital printing market is expected to increase to 321.46 billion yen, 3.8% increase from the previous year as the POD market is on a track to recovery amid resumed economic activities and the DPS market is also expected to expand.

*The office convenience store market is the market for unmanned “convenience stores,” which are small cabinets filled with snacks and beverages installed on company premises

Noteworthy Topics

New Proposals Increases Sales at Some Companies and the Publication Printing Market Expands; The Disparity Among Companies Widens

In the digital printing market for publication printing, the use of digital printing is being promoted in two directions: proposals to reduce inventory management costs by producing a small number of copies at the time of reprinting (short-run), and proposals to use BOD process, which prints and ships one copy per order, mainly for titles not yet in reprint, out-of-print books, and new books that are published simultaneously with e-books (new publications).

In the publishing industry, an increasing number of publishers, especially major publishers, are making use of digital printing, and store-type POD in online bookstores is also becoming established. In this trend, printing companies are also promoting their proposals, but several issues have become barriers and the market has not got out of its dawning period for many years.

One of the barriers is printing costs. In the current situation where no progress has been seen in lowering costs, printing companies have been presenting the approach of reducing total costs, including inventory management costs, by conducting simulations comparison of their business model with the conventional business model of using offset printing. However, since they have not been able to get inventory data disclosed, it has been difficult to guarantee the effectiveness of this approach, and proposals have not progressed as smoothly as they expected.

However, in the past year or two, as some printing companies have been promoting electronic data interchange (EDI) in collaboration with publishers to prevent over-ordering from distributors and bookstores and to reduce the number of returning goods, they have been able to see inventory data and present cost reduction effects more easily than before. As a result, short-run printing is expanding among some of these printing companies, and the disparity in sales results with other printing companies that have not yet made proposals is beginning to widen.

Future Outlook

In FY2022, when a full-fledged economic recovery is expected, the digital printing market is forecasted to expand again, as the POD market is expected to recover again and the DPS market is also expected to expand further, gaining outsourcing demand for vaccination tickets and other measures to stimulate consumption.

Research Outline

2.Research Object: Major and second-tier printing companies, print-related service companies, and other related companies

3.Research Methogology: Face-to-face interviews by the expert researchers (including online interviews), survey via phone, and survey via questionnaire by mail

The Digital Printing Market 2022

Digital printing market in this research refers to the materials printed by commercial digital printers and related services, produced by companies whose core business is printing. However, the market does not include printed materials produced by traditional printing devices or any services related to such printing.

*The data print services (DPS) and print on demand (POD) markets are included in the digital printing market.

<Products and Services in the Market>

Digital Printing Services [DPS, BPO, publishing, commercial printing, business form printing, office printing (business cards etc.), soft-packaging, and paper container boxes]

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.