No.2770

Proptech Market in Japan: Key Research Findings 2021

Proptech Market Size for FY2020 Rises to 611,000 Million Yen, 108.6% of Previous Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic proptech market and found out the market trends, trends of market players, and future perspectives in terms of both B2C and B2B services.

Market Overview

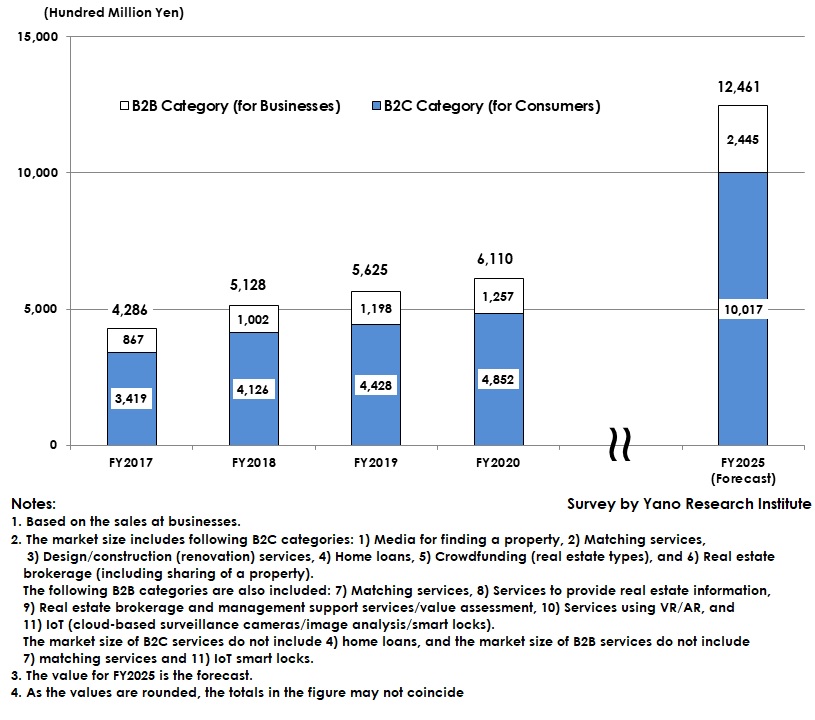

The proptech market size (total size of both B2C and B2B categories) for FY2020 is estimated as 611,000 million yen, 108.6 percent of the size of the previous fiscal year.

Of the total market size, B2C category is estimated as 485,200 million yen which is 109.6 percent of the size of the previous year, while the size of B2B is estimated as 125,700 million yen, 104.9 percent of the preceding fiscal year.

Noteworthy Topics

Considerable Expansion Expected in Matching Services in B2C Category, and Real Estate Brokerage/Management Support/Value Assessment in B2B

Of the proptech market, the promising category that can considerably expand in B2C is “matching services”. The secondhand housing market is one of the few growth-expected markets in the housing industry, associated with rising number of housing stocks. This is highly likely to make the market brisk by increasing the number of those companies achieving efficient matching by means of technologies and those companies dedicating themselves in expanding customer base.

On the other hand, the largest market size and most promising service in the B2B category is real estate brokerage/management support/value assessment. While each enterprise faces to overcome the challenges of streamlining business workflows and improving labor productivity in the country suffering from ever decreasing population, the COVID-19 pandemic has caused even some mid-size to small size enterprises to consider deploying digital transformation. The demand for digital transformation tools that can be used for solving such challenges is another reason for the market to further expand. In addition, the digitalization promotion policy by the government is also projected to boost the market growth.

Future Outlook

The proptech market size is forecasted to expand to 1,246,100 million yen by FY2025, 203.9 percent of the size of FY2020. Among the total estimated market size in FY2025, B2C category occupies 1,001,700 million yen that is 206.5 percent of the size of FY2020, while B2B category is expected to achieve 244,500 million yen that is 194.5 percent of the size of FY2020.

Currently, the companies that have entered the proptech market tend to concentrate the resources specifically in the business domain where they can exert their advantages, by which to raise their positions in the market. On the other hand, there have been some alliances, mergers and acquisitions in progress among market players to generate the synergy effect. From hereon, it is likely for the leading market players in each of domains to accelerate alignment and M&As aiming to offer one-stop value-added services.

Research Outline

2.Research Object: Proptech businesses

3.Research Methogology: Face-to-face interviews and literature research

About Proptech Market

Proptech is the coined word from “real estate” and “technology”, meaning ICT-utilized real estate businesses to best optimize consumers in the services of searching a property, real estate brokerage, utilizing (sharing) a property, etc. or for the enterprises to solve the problems and inconvenience in the real estate business.

Proptech in this research targets the following B2C categories: 1) Media for finding a property, 2) Matching services, 3) Design/construction (renovation) services, 4) Home loans, 5) Crowdfunding (real estate types), and 6) Real estate brokerage (including sharing of a property).

The following B2B categories are also included: 7) Matching services, 8) Services to provide real estate information, 9) Real estate brokerage and management support services/value assessment, 10) Services using VR/AR, and 11) IoT (cloud-based surveillance cameras/image analysis/smart locks).

The market size of B2C services do not include 4) home loans, and the market size of B2B services do not include 7) matching services and 11) IoT smart locks.

<Products and Services in the Market>

B2C services: Media for finding a property, Matching services, Design/construction (renovation) services, Home loans, Crowdfunding, and Real estate sharing B2B services: Matching, Real estate information, Real estate brokerage and management support services/value assessment, VR/AR, IoT (cloud-based surveillance cameras/image analysis/smart locks)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.