No.2593

Insurance Brokerage Shops Market in Japan: Key Research Findings 2020

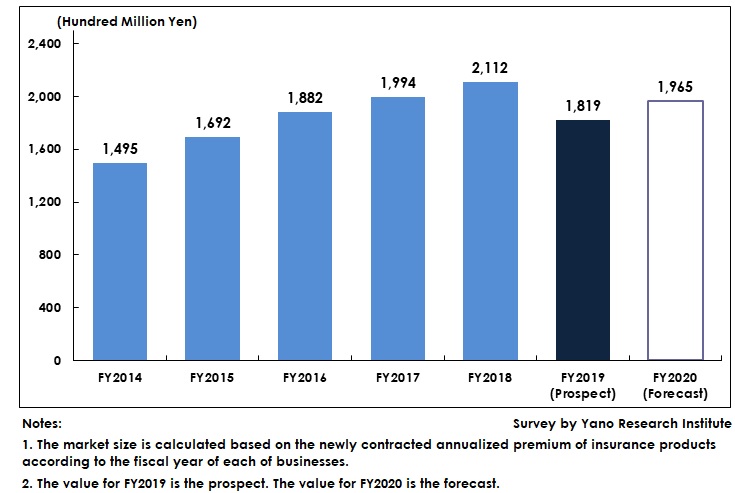

Insurance Brokerage Shops Market for FY2019 Projected to Decrease by 13.9% to 181,900 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic insurance brokerage shops market and found out the market trends, the market size (based on the newly contracted annualized premium of insurance products according to the fiscal year of each of businesses), number of new contract deals, and the future outlook.

Market Overview

Insurance brokerage shops are generally operated by joint insurance agencies dealing in insurance products from multiple insurance companies. Revision of the Insurance Business Act enacted in 2016 was a significant turning point for the insurance brokerage shop industry, as it encouraged many major insurance brokerage shop operators to consociate with life insurance companies and to form alliance with local major banks or stock brokerage firms. In FY2017, the market suffered from some of discontinued products and risen insurance premium rate, which stemmed from reduction in the standard yield for life insurance. On the other hand, the sales of insurance products especially asset-building types and those with the benefits to be paid before the death of insured have expanded, boosting the insurance brokerage shops market in FY2017 to 199,400 million yen, based on the newly contracted annualized premium of insurance products according to the fiscal year of each of businesses. The number of new contract deals concluded at insurance brokerage shops during FY2017 was 1,960 thousand. The market potential in FY2018 remained high and continued expansion. However, the growth rate slightly slowed down as the number of insurance brokerage shops decreased due to fewer visits by clients than before. The insurance brokerage shops market size for FY2018 was estimated as 211,200 million yen, up by 5.9% on a year-to-year basis. The estimated number of new contract deals concluded at insurance brokerage shops during FY2018 was 2,080 thousand.

In addition to decreasing number of insurance brokerage shops scaling down the market size, the COVID-19 pandemic led insurance brokerage shops to temporary close or to shorten the business hours, and led people from going outside which reduced the number of client visits. On the other hand, some insurance brokerage shop operators benefitted by introducing online consultation services, but not so much as to retrieve all the clients just like before. The insurance brokerage shop market size for FY2019 based on the newly contracted annualized premium of insurance products according to the fiscal year of each of businesses is projected to considerably decline by 13.9% to end up with 181,900 million yen.

Noteworthy Topics

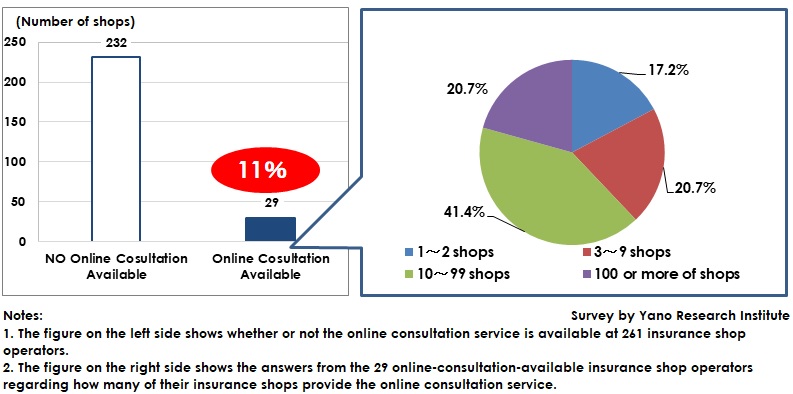

11% of Entire Insurance Brokerage Shops Introduced Online Consultation Services in COVID-19 Calamity

The COVID-19 pandemic has affected insurance brokerage shops to close the shops temporarily or to shorten the business hours and reduced the number of client visits as people were asked not to go outside unless any essential or urgent matters occur. Some stores recorded only half of the usual number of client visits and some even had absolutely no visitors during April to June 2020. A new attempt to breakthrough such a situation was online consultation service.

This research found out that 11.1% (29 companies) out of 261 insurance brokerage shop operators provided online consultation services as of August 2020. Web consultation services were said to have a potential to cover the loss of sharply dropped visits by new clients. While a certain level of face-to-face consultation demand potentially exists, online consultation services were evaluated as an attempt successfully diversified consultation channel.

When surveyed the number of shops offering online consultation services operated by 29 insurance-shop operators, which ranged from small operators operating the shops at limited local areas to those major companies operating the shops nation-wide, many of those that provide online consultation services were operated by major companies developing 10 or more of insurance brokerage shops.

Future Outlook

The industry of insurance brokerage shops has faced decreased opportunities for meeting the clients, because the shops had to temporarily close or to reduce the business hours. On the other hand, it has been groping for new ways such as online consultation services to attract clients and to enhance customer contact points for encouraging more clients to buy insurance or to review the insurance they bought in the past.

The Life Insurance Association of Japan (LIAJ) started applying common evaluations to all agencies dealing in insurance products, aiming at optimization of insurance sales by introducing standardized commission fees throughout the industry. When commission fee income is adjusted to level out, which is likely for the income to go through just like the “L” character form, opening of insurance brokerage shops may be discouraged, as retrieval of the initial and prior costs is expected to be more difficult. By June 2020, the amendment bill for the Act on Sales, etc. of Financial Instruments was enacted and a financial services intermediary business was established, reflecting how the demand for financial services has substantially changed from conventional ones, against the backdrop of rapid market penetration of internet and progress of paperless and cashless in the society. Those insurance brokerage shop operators that implemented financial digitalization may need to change the shop locations, the size, management methods and type of employees, in order to conform to behaviors and demands of new clients. There seem to be no end for insurance brokerage shops to go through business integration among the same industry or to be affiliated to life insurance companies. With such restructuring has been still underway, the insurance brokerage shop market is expected to require further augmentation of business foundation as well as enhancement of governance.

Research Outline

2.Research Object: Joint agencies operating insurance brokerage shops, life insurance companies developing insurance brokerage shop business, or developing products for insurance brokerage shops, etc.

3.Research Methogology: Face-to-face interviews (including online interviews) by expert researchers, and literature research

What are Insurance Brokerage Shops?

Insurance brokerage shops in this research refer to the joint agencies selling insurance products from multiple insurance companies. The market size is calculated based on the newly contracted annualized premium of insurance products according to the fiscal year of each of businesses.

<Products and Services in the Market>

Life insurance and property insurance for individuals, Life insurance and property insurance for corporations

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.