Beverage Market in Japan: Key Research Findings 2015

Research Outline

- Research period: From June to august, 2015

- Research target: Beverage manufacturers, distributors, and retailers

- Research methodologies: Face-to-face research by the expert researchers, surveys via telephone, and literature research

<What is the Beverage Market?>

The beverage market in this research include sodas, coffee drinks, mineral waters, beverages with fruit juice, various types of teas (Japanese tea, English tea, Oolong tea, etc.), sports/functional drinks, energy drinks, dinking milks, fermented lactic-drinks, soy milk, etc.

Summary of Research Findings

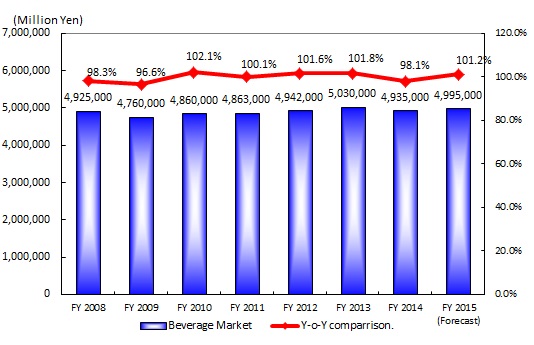

- FY2014 Domestic Beverage Market Size Declined at 4,935.0 Billion Yen, 98.1% on Y-o-Y Basis, Projected to Recover in FY2015 at 4,995.0 Billion Yen, 101.2% on Y-o-Y

Influenced by slump in consumer demand caused by the consumption tax increase and by the unsettled weathers in the summertime, which supposed to be the best-selling season for beverages, the domestic beverage market in FY2014 did not exceed the previous-fiscal-year size for the first time in five years and ended up at 4,935.0 billion yen, 98.1% on year-over-year basis. When looking at the market by category, whereas sodas and many other categories went below the preceding-year results, soy milks, energy drinks, mineral waters, and Japanese tea drinks rose smoothly. Since the declined market in FY2014 owed to provisional factors such as stagnant consumer sentiment stemming from consumption tax increase and bad weathers in summertime, the market is projected to recover in FY2015 to 4,995.0 billion yen (based on the shipment value at manufacturers), 101.2% of the size in FY2014.

- Favorable Sales of “Tokuho” Products or Food for Specified Health Uses Progressed to Joint Development with CVS, Although no Hot Sellers Produced from Existing Categories

Stagnancy in the domestic beverage market was one of the reasons why the market in FY2014 was not able to generate new hot selling products, which made the manufacturers rather to focus on maintaining their main brands. In spite of such environment, Tokuho beverages (or food for specified health uses) have sold well, especially the Japanese tea drinks market, which flourished after the promotion of sugar-free tea drinks. Also on the rise are the collaborated double-named products of beverage makers and convenience stores (CVS), and limited number of products sold at CVS, as a result of the enhanced PB products strategies in CVS.

- Figure 1: Transition and Forecast of Beverage Market Size