No.3799

Wedding Market in Japan: Key Research Findings 2025

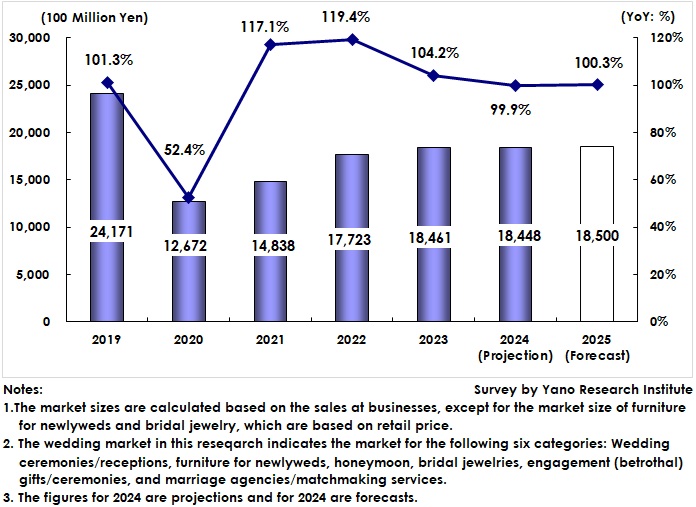

Wedding Market (Total of Major Six Categories) Projected to Reach 1,844,800 Million Yen in 2024, 99.9% of Preceding Year

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic wedding market, and found out the trends by category, the market player trends, and future outlook.

Market Overview

The size of the wedding market (total of major six categories) is estimated at 1,844,800 million yen in 2024, 99.9% of that of the preceding year.

The market size for wedding ceremonies and receptions, the largest category, is expected to grow only slightly due to a declining number of ceremonies and a slower recovery in the number of attendees. Meanwhile, the bridal jewelry market continues to expand due to rising product prices stemming from increased material and labor costs. Despite their moderate growth, marriage agencies and matchmaking services (described as “marriage information/matchmaking services” in previous reports), contribute limitedly to market expansion, though they are expected to generate married couples and boost the wedding market.

The projected size of the wedding market in 2024 is 76.3% of its size in 2019, the pre-pandemic year. This indicates that the market has not fully recovered.

Noteworthy Topics

Wedding Ceremony Facilities Are Shifting to an Asset Light Business Model

Traditionally, companies that operate and arrange wedding ceremonies and banquets have attracted customers and grown their businesses by opening new wedding venues and renovating facilities, such as chapels and banquet rooms. However, soaring construction costs and longer construction work periods have made this difficult, especially for new construction.

Under these circumstances, new venues are more likely to open as part of revitalization or public-private partnership projects, as tenants in existing buildings. Another possibility is for upscale hotels and restaurants to outsource their wedding business. An increasing number of companies are paying attention to wedding business operations contracted from hotels and restaurants, because the brand power of clients can improve the corporate image of wedding ceremony operators.

Future Outlook

The size of the wedding market (total of major six categories) is estimated at 1,850,000 million yen in 2025, which is a 0.3% increase from the previous year.

Significant growth in the wedding ceremony and reception market, the largest category, is difficult to forecast, considering the stalled recovery of wedding ceremonies at hotels with strong parent companies and brand images, as well as the declining number of marriages and ceremony rates. Recent newlyweds tend to be either extravagant or thrifty due to changes in values and economic anxiety about daily life and the future. Those who are relatively extravagant spend certain sums on wedding ceremonies while the latter opt for simpler options, such as taking photos in wedding attire.

Research Outline

2.Research Object: Enterprises and organizations in the wedding industry (chiefly services and product sales)

3.Research Methogology: Face-to-face interviews by our specialized researchers (including online interviews), surveys via telephone and email, mailed questionnaire, and literature research

What is the Wedding Market?

The wedding market in this research indicates the market of the following major six categories: Wedding ceremonies/receptions, furniture for newlyweds, honeymoon, bridal jewelries, engagement (betrothal) gifts/ceremonies, and marriage agencies/matchmaking services (which used to be described as “marriage information/matchmaking services” in our previous market reports). The market size of wedding ceremonies/receptions include the sales of overseas ceremonies planned and arranged in Japan.

<Products and Services in the Market>

Wedding ceremonies/receptions, furniture for newlyweds, honeymoon, bridal jewelries, betrothal gifts/ceremonies, and marriage agencies/matchmaking services

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.