No.3652

Account Transfer Market in Japan: Key Research Findings 2024

Account Transfer Market Projected to Stay Robust

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic account transfer market, highlighting the strategies, challenges, and future directions of third-party payment providers.

Market Overview

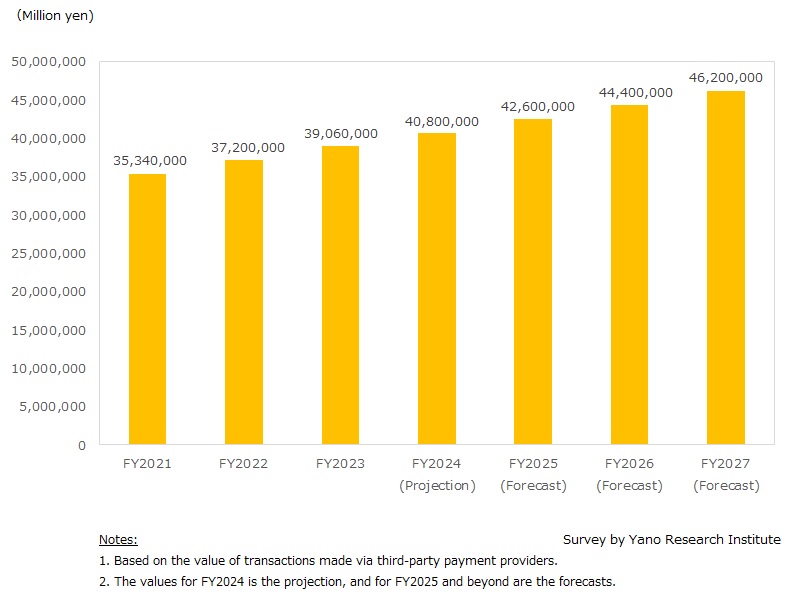

The account transfer market in Japan in FY2023 has expanded to 39,060,000 million yen, based on the value of transactions made via third-party payment providers.

Account transfer is used in the payments for recurring bills like utility, subscription, insurance, mortgages, and credit cards. This process had been popular mainly for large enterprises, done through direct transaction with their banks. Meanwhile, third-party payment providers - the target of this survey – are widely used by enterprises of all sizes, mainly in educational and cultural businesses (e.g., scam schools and culture classes) and subscription service providers of all kinds.

Although account transfer via third-party payment provider may be slightly inconvenient for payers, it is expanding steadily for payment recipients (payees) because, depending on the amount of payment, service fee can be cheaper than that of credit cards.

Noteworthy Topics

Account Transfer Going Paperless Further

While account transfer was traditionally paper-based using payment slips, web-based system is expanding as it provides more convenience for both payers and recipients (payees). Although the introduction of online system is still limited to large enterprises because of its cost, third-party payment providers are also establishing digital infrastructure, promoting their services to broader segments.

Future Outlook

The size of domestic account transfer market is projected to grow to 46,200,000 million yen by FY2027, based on the value of transactions made via third-party payment providers. Underpinned by the strong needs for collection of payments, the market is forecasted to expand further.

SMEs tend to choose account transfer via third-party payment provider, as it is usually inexpensive compared to other cashless payment methods (for certain payment range in particular). Macrotrends of digital transformation (DX) further propels the moves to go paperless with the introduction of web-based account transfer systems. Given the increase of various applications, we believe the market for account transfer (via third-party payment providers) will expand robustly hereafter.

Research Outline

2.Research Object: Third-party payment providers

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), questionnaire, and literature research

What is the Account Transfer Market?

In Japan, account transfer is a common method for processing recurring bills on a set schedule (usually monthly). Account transfer allows the recipient (‘payee’) (e.g., a utility company, retailer, or mortgage lender) to initiate the payment, pulling the agreed payment automatically from the payer’s account (e.g., for utility bills, subscription fees) on a set date. The recipients (payees) have two options for processing account transfer: 1) direct transaction with the banks, or 2) transaction via third-party payment provider that facilitates the collection of payments. In this report, the size of the account transfer market is calculated based on the value of transactions made via third-party payment providers. In other words, it does not include the value of direct transaction between the recipients (payees) and their banks.

<Products and Services in the Market>

Account transfer, electronic collection for payments made at convenience stores

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.