No.3613

Solar Power Market in Japan: Key Research Findings 2024

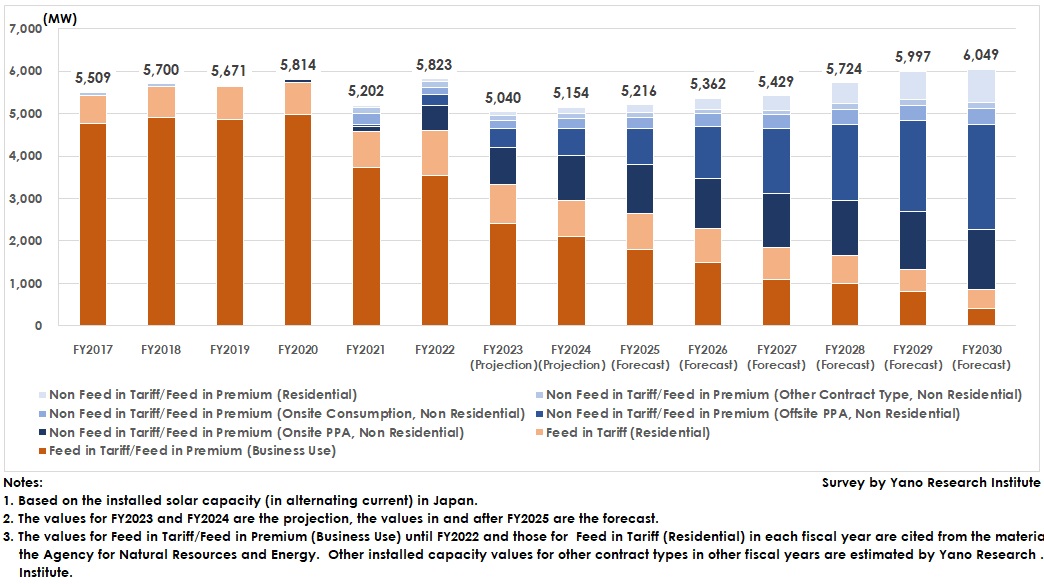

Domestic Installed Solar Power Capacity Projected to Achieve 6,049MW by FY2030

Yano Research Institute (the President, Takashi Mizukoshi) has conducted the research on domestic solar power market (new installations & secondary). Here highlights the forecast on installed solar capacity until FY2030.

Market Overview

The domestic installed solar capacity in single year of FY2023 has been estimated at 5,040MW (in alternating current [AC]), a considerable shrinkage from the previous fiscal year, owing to diminished capacity at solar power deployments under feed-in tariff scheme. The shrinkage in capacity is most prominent in business-use feed-in tariff solar installations with the trend continuing since FY2021, due to the decreasing selling price of electricity and commencement of the tender system in FY2017. In the case of low voltage installations, local utilization requirements for onsite consumption have been established since FY2020, requiring at least 30% of power produced to be used for onsite consumption, which has escalated the declining pace of capacity.

Meanwhile, Power Purchase Agreement (PPA) installations that do not rely on feed-in tariff scheme are increasing in the domestic solar power market. Backed by trends toward decarbonization and a sharp rise in electricity prices, installed capacity of the non-residential onsite solar PPA is estimated at 870MW, occupying 17.3% of entire installed solar capacity. For capacity of the offsite PPA, too, is estimated at 445MW (projection), accounting for 8.8% of all solar capacity, on account of increased deployments by demanders who respect environmental values.

*1): A Power Purchase Agreement (PPA) refers to a scheme in which a PPA provider constructs a renewable power installation by its own fund, etc., and owns, operates and maintains while supplies power generated to demanders at a long-term fixed price. As the power system is owned not by the electricity demander or the powerhouse but the third party, it is called a third-party ownership model. Many of PPA contracts due long-term such as 20 years, during which demanders pay for electricity and environmental value at fixed price.

Noteworthy Topics

Trend of Non-Residential PPA Market

When observing installed solar capacities by contract type, the onsite PPA is rapidly expanding the installed capacity year by year ever since its launch in Japan in FY2020, fueled by the recent marked rise in electricity prices, in addition to decarbonization initiatives at companies and other demanders. At an onsite PPA, a PPA provider constructs, owns, operates, and maintains the solar power system installed on the rooftop or within the premise of a power demander. The demander has an advantage of dispensing with initial costs as well as operational expenses on the solar power system.

Since its launch in Japan in FY2022, the installed capacity under offsite solar PPAs has also been on the rise, backed by the rising needs from environmentally friendly demanders. An offsite PPA allows a PPA provider to establish, own, operate, and manage a solar farm at the location away from electricity demanders. While letting power demanders to enjoy the similar benefits with onsite PPA contracts, an offsite PPA allows a PPA provider to construct a solar farm without any scale limitations, which enables to supply a large capacity of electricity from renewable sources in the long-term run.

Note that offsite PPA profiles have a model that supplies low voltage electricity from small power plants distributed, in addition to a model that supplies from a large-scale solar farm.

Future Outlook

The domestic installed solar capacity in single year of FY2030 is projected to achieve 6,049MW (in AC). It is because of gradual increase is expected until FY2030 in solar installations by onsite and offsite PPAs that do not rely on the feed-in tariff scheme. This is particularly true for offsite PPA installations that tend to be enormous in capacity scale per deployment, with the pace of increase accelerating. By FY2026 the offsite PPA installations are likely to exceed the capacity of the onsite PPA.

On the other hand, as the installed solar capacity under feed-in tariff continues declining, the solar capacity by feed-in tariff and feed-in premium schemes (both residential and business-use) for FY2030 is projected to decrease to 850MW, 14.1% of the entire solar installations.

Research Outline

2.Research Object: Solar panel businesses, EPC (engineering/procurement/construction) businesses, solar power generation companies, electricity retailers, PPA (Power Purchase Agreement) businesses, Photovoltaic power O&M (Operation &Maintenance) service providers and traders, other companies that deal in solar-power related business

3.Research Methogology: Face-to-face interviews (including online) by specialized researchers, and survey via telephone, and literature research

About Installed Solar Capacity

Installed solar capacity under feed-in tariff or feed-in premium schemes until FY2022 are cited from the materials by the Agency for Natural Resources and Energy. Other capacity values in annual bases or those by contract type are the estimation by Yano Research Institute.

About Onsite and Offsite Power Purchase Agreement (PPA)

The onsite power purchase agreement (PPA) refers to an agreement where a PPA provider constructs renewable power installations such as solar power systems on rooftop or on the property of an energy demander. The demander, after having offered the land, can directly use electricity generated from the installation through the onsite network built between the power system and the building.

The offsite PPA, on the other hand, refers to an agreement for the electricity demander to use power from a renewable power plant built outside of the demander’s property through the power transmission and distribution network. In the offsite PPA, a PPA provider sells renewable electricity via an electricity retailer to the demander, so that the power demander needs to pay not only for electricity itself, but also for consignment charge for power transmission as well as commission fee for the power retailer.

<Products and Services in the Market>

Solar power market, solar power installations (new & secondary) market

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.