No.3608

Automotive Aftermarket in Japan: Key Research Findings 2024

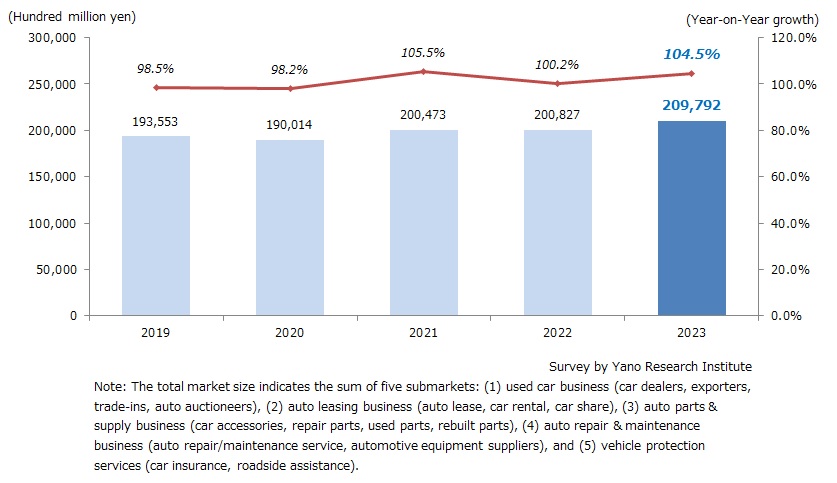

Automotive Aftermarket Size Estimated at 20,979,200 Million Yen in 2023

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey on the (domestic) automotive aftermarket industry for 2023, and found out the trend by segment, the trends of market players, and future perspectives.

Market Overview

In 2023, the automotive aftermarket market was valued at 20,979,200 million yen, marking a 4.5% increase over the previous year.

The growth was driven by a rebound in domestic new car sales, which began to recover as supply chain disruptions eased toward the end of 2022. Both registered vehicles and mini cars (kei cars) saw improved availability, contributing to a rise in new car sales for the first time in four years (source: Japan Automobile Dealers Association, Zenkeijikyo). This uptick in new vehicle sales, along with the broader recovery in the economy and social activities, has helped fuel the growth of the automotive aftermarket industry.

In 2023, the total number of four-wheel vehicles owned increased for the first time in three years, reaching 78,979 thousand units (source: MLIT). This positive shift was driven by the recovery of the new car supply chain and the resumption of economic and social activities, which spurred higher demand for personal vehicles and contributed to a growth in corporate vehicle fleets.

With both new car sales and overall vehicle ownership on the rise, the automotive aftermarket industry expects continued growth. However, the market outlook for 2024 remains uncertain due to the recent safety test scandal, which resulted in the suspension of production and shipments for several vehicle models.

Noteworthy Topics

Domestic Used Car Retail Sales Grew to 4,234,200 Million Yen

As economic and social activities rebounded in 2023, people began using their cars more frequently. Additionally, with global supply chain disruptions—particularly those affecting parts manufacturers like semiconductor producers—starting to ease by fall 2022, new vehicle production and sales picked up. This led to an increase in trade-ins, which in turn drove down used car prices, making them more affordable for consumers. As a result, the used car retail market in 2023 was estimated to have grown to 4,234,200 million yen.

However, 2023 also saw several incidents that tarnished the reputation of the used car industry. In response, regulations were introduced requiring used car dealers to disclose the total price to potential buyers, including both the vehicle price and any additional fees involved in the purchase. To stay competitive, used car dealers will need to offer a broader range of appealing products and services, in addition to competitive pricing, to effectively attract and retain customers.

Future Outlook

As the supply chain recovery led to an increase in vehicle ownership, the automotive aftermarket industry saw growth in 2023.

However, in many segments of the aftermarket, it’s becoming more challenging to sustain operations relying solely on core business revenues. For example, vehicle protection services are diversifying their offerings to adapt and stay competitive. The rise of car subscription services is also intensifying competition in car sales. Additionally, as consumers shift from 'ownership' to 'use' models, and with teleworking becoming more widespread, the automotive industry is likely to experience changes further. For these reasons, retaining existing customers and attracting new ones will become even more crucial for all segments of the automotive aftermarket.

Research Outline

2.Research Object: Companies and groups in automotive aftermarket business and competent authorities

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone and email, and literature research

What is the Automotive Aftermarket Industry?

Automotive aftermarket in this research indicates the following five segments: (1) Used car business (car dealers, exporters, trade-ins, auto auctioneers), (2) auto leasing business (auto lease, car rental, car share), (3)auto parts & supply business (car accessories, repair parts, used parts, rebuilt parts), (4) auto repair & maintenance business (auto repair/maintenance service, automotive equipment suppliers), and (5) vehicle protection services (car insurance, roadside assistance).

The automotive aftermarket size is estimated by Yano Research Institute based on the publicized data.

<Products and Services in the Market>

New cars, used cars, used car export, auto auction, one-off bidding (“nyu-satsu kai”), auto lease, auto lease for individuals, lease maintenance, car financing, car rental, care share, car subscription, car supplies, tires, aluminum wheels, car stereos, GPS navigation systems, drive recorders (dashcams), car interior accessories, oils/solvents, genuine parts, JAPA recommended parts (JAPA: Japan Automotive Parts Association), repair parts, recycled parts, reused parts, rebuilt parts, car repair, vehicle inspection, periodic maintenance, collision repair, prepaid maintenance plans, car inspection equipment, car insurance, compulsory automobile liability insurance, voluntary insurance, direct non-life insurance, roadside assistance, gasoline, self-service fueling

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.