No.3542

Global ADAS/Autonomous Driving System Sensors Market: Key Research Findings 2023

Global Market Size of ADAS/Autonomous Driving System Sensors Estimated at 3.7 Trillion Yen by 2030

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the global markets of key devices and components geared to ADAS (Advanced driver-assistance systems) and self-driving systems and has analyzed sensors embedded in ADAS or autonomous driving systems to find out the market statuses, technological trends, and installation trends at auto parts manufacturers. Here highlights the forecasts of global market sizes by sensor type by 2030.

Market Overview

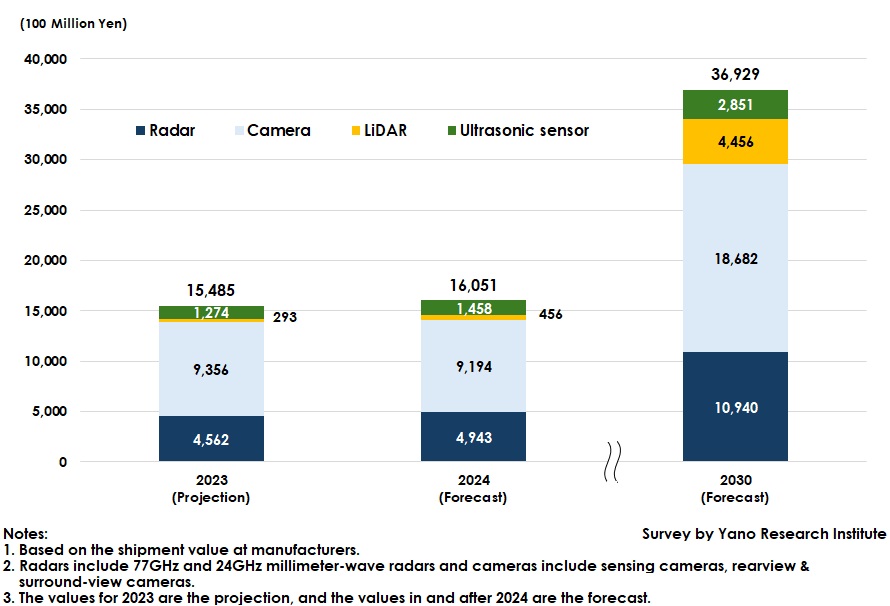

The global market size of sensors for advanced driver-assistance systems (ADAS) and autonomous driving systems by shipment value at manufacturers is estimated at 1,548,500 million yen for 2023. Car models equipped with automatic emergency braking (AEB) systems are increasing in the Chinese market, just like in Japan, Europe and the US where they are a standard feature.

This has expanded the shipment volume of radars and cameras used for ADAS to detect anything in front of the vehicle and has increased the 2023 global market sizes of radars (including 77GHz and 24GHz millimeter-wave radars) and of cameras (including sensing cameras, rearview & surround-view cameras) to 456,200 million yen and 935,600 million yen, respectively, both based on the shipment value.

As ADAS sensors centered on radars and cameras are expected to keep on being in demand in 2024 and beyond, the global market size of ADAS/autonomous driving system sensors in 2024 by shipment value at manufacturers is projected to rise by 3.7% to 1,605,100 million yen.

Noteworthy Topics

Higher Pixels for ADAS Cameras and Increased Cameras Equipped on Sides and Rear

The pixel of ADAS cameras improves in 2025 or later. While the pixel for the current vehicle models is 1.7 or 5.4 MPs (megapixels), 8MP cameras are likely to increase the availability in the US, Europe, China, and Japan. By adopting 8MP cameras, 120-degree angled field of view (FOV) can be realized, which is expected to raise the safety performance of ADAS through improved camera perception abilities. As some vehicle models by European, Chinese and Japanese automakers have already adopted 8PM cameras, the applications are to fully start from the vehicles with new electrical/electronic (E/E) architecture (*).

The launch of battery electric vehicles (BEVs) with ADAS cameras installed on sides and rear, in addition to front, has invigorated in the Chinese market, aiming at realizing self-driving Level 2+ (L2+) that is to enable driver assistance on urban (paved) roads or for advanced parking i.e., hands-free parking by using the memory function. The global market formation centered on high-end BEV models, that is projected to be in around 2024 to 2026, will boost the ADAS camera market (by shipment volume).

* New electrical/electronic (E/E) architecture refers to domain-oriented configuration, where each ECU, sensors, actuators, etc. are brought together and controlled by domain (technical area). (The domain-based control is expected to move toward zone-oriented structure, where a central computer controls across domains in the future.)

Future Outlook

The global market size of ADAS/self-driving system sensors by shipment value at manufacturers is forecasted at 3,692,900 million yen by 2030. Because the installation rate of ADAS by 2030 will be close to 100% in the US, Europe and Japan and will exceed 80% in China, and because the full launch is expected in ASEAN countries and India after 2028, the shipment volume of ADAS radars and cameras are projected to grow steadily.

To respond to new car assessment programs (NCAP), the number of radars equipped in cars is trending to rise. The assessment tests on AEB at crossings, that has already been introduced in Euro NCAP, is to be done also in J-NCAP and C-NCAP from 2024, not only against the vehicles but also pedestrians and bicycles. Therefore, to enhance AEB functionality when the vehicle is at crossroads for turning right/left or as running into each other, the installation rate of radars in front/rear corners is likely to grow, increasing the ADAS radar market size to reach 1,094,000 million yen by 2030.

Furthermore, after new E/E architecture is deployed mainly in luxury vehicle models from around 2026, the applications are expected to grow to middle-class models by 2030. The shift of E/E architecture from conventional distributed structures to domain-oriented architecture allows various sensors to be controlled in an integrated manner, which enables ADAS/self-driving systems to have more diverse features and higher performance and increases the number of sensors equipped per vehicle. Therefore, steady demand continues to be expected for ADAS/autonomous driving system sensors (radars, cameras, LiDAR sensors) and sensors for parking assistance (bird-view cameras, ultrasound sensors).

Research Outline

2.Research Object: Automakers, manufacturers of auto parts/automotive semiconductors

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, surveys via telephone, and literature research

ADAS/Autonomous Driving System Sensors

Advanced Driver Assistance Systems (ADAS) aim to prevent road accidents and associated casualties by monitoring the surrounding environment through sensors installed at front, sides, and rear parts of the vehicle. Self-driving systems are an advanced development of ADAS technologies, and controls driving of a vehicle on behalf of the driver by using sensors, a high-precision map, and telecommunication functions and are defined into six levels according to driving-assistance or automation levels.

This research indicates sensors for ADAS /autonomous driving systems as each of sensor modules (radars, cameras, ultrasonic sensors, LiDAR (Light Detection and Ranging), etc.) that are installed at front, sides, and rear of the vehicle. Both sensor modules equipped in automobiles and those commercial cars weighing 3.5 tons or less are included, but those sensors for MaaS vehicles with L4 or higher, or those for low-speed vehicles (LSVs) without passengers are not.

<Products and Services in the Market>

77GHz medium range millimeter wave radar, 24GHz millimeter-wave radar, sensing camera, rear-view/surround-view cameras, infrared laser, LiDAR, ultrasonic sensor

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.