No.3234

Personal Car Leasing Market in Japan: Key Research Findings 2023

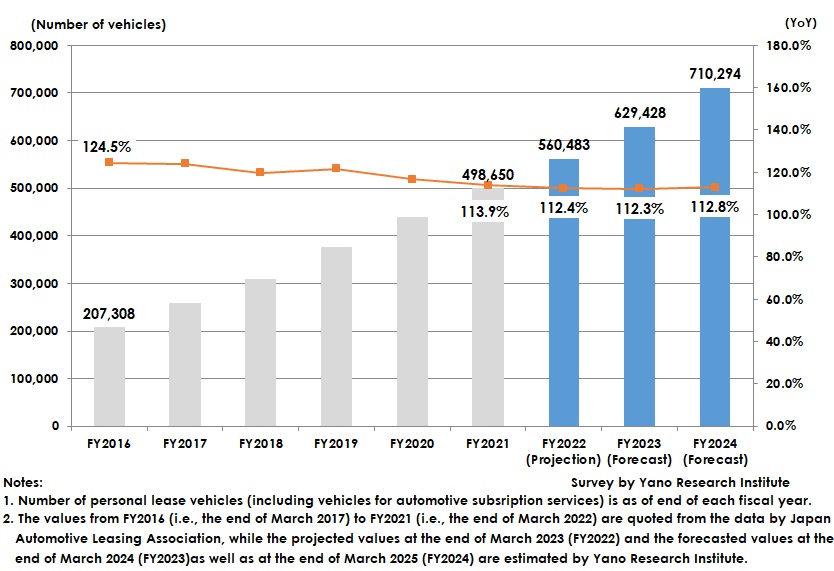

Number of Personal Lease Vehicles Reaches 710 Thousand by March 2025

Yano Research Institute (the President, Takashi Mizukoshi) held a survey on the domestic personal car leasing market and found out the market statuses, trends of market players, and future perspectives.

Market Overview

According to Japan Automotive Leasing Association, the number of personal lease vehicles as of end of March 2022 (at the end of FY2021) was 496,650, 113.9% of that in the previous year. While corporate car leasing occupying 90% of entire automotive leasing market was on the decline, personal car leasing was expanding, showing opposite tendencies.

An enormous change from last research (FY2017) was the “subscription service” provided mainly by automaker-owned companies. The service had many in common with personal car leasing such as product specifications and concept, partly contributing to awareness improvement and attention gathering for personal market.

Noteworthy Topics

Average 25,000 Yen Paid Monthly by Users of Personal Car Leasing or Automotive Subscription Services

In March 2023, an online survey was held to 400 men and women nationwide in their 20s to 60s who were the users of personal car leasing or of automotive subscription services. According to the survey results, the average monthly payment at contracted shops was 24,854 yen (the average of 391 users excluding those who did not respond). When compared to last survey (FY2017), the amount declined by almost 10,000 yen, though simple comparison might not be applicable due to different statistical parameters.

When observing user average monthly payment by contracted shop, the largest amount was paid to “Dealers” and the lowest amount to “Car accessory shops”.

As the survey results indicated that “Ease of payment” and “Low in monthly payment and equality” were the popular reasons (multiple responses) for using personal car leasing or automotive subscription services, it was found out that many of users seemed to enjoy the financial advantages in the services.

Future Outlook

For FY2022 as tight supply in new cars have continued, personal car leasing (including automotive subscription service) at the time of new car purchase is in the spotlight. This as well as the lease of used cars being also on the rise, the domestic number of personal lease vehicles as of the end of March 2023 (end of FY2022) is expected to reach 560,483 vehicles, 112.4% of that in the previous year.

Furthermore, considering multiple factors hereafter such as new car sales, lease ratio when buying vehicles, and lease contract period, the domestic number of personal lease vehicles is projected to be 629,428 by the end of March 2024 (end of FY2023), and 710,294 by the end of March 2025 (end of FY2024).

Research Outline

2.Research Object: Personal car leasing service providers (dedicated companies as well as affiliate companies of credit companies, automotive distributors and maintenance service providers, oil distributors, IT companies, or automakers)

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, surveys by telephone and email, online consumer survey, and literature research.

Personal Car Leasing Market

Car leasing has been developed from the vehicle leasing business mainly provided for corporate customers, and later offered also to general consumers (including sole proprietors) which has steadily expanded into the personal car leasing market in recent years. The market is gaining momentum, due to expanding service portfolios that are similar in product specifications and concept but offered under the new name of automotive subscription service.

For the number of personal lease vehicles from the end of March 2017 to the end of March 2022 are quoted from the data by Japan Automotive Leasing Association, and the projected values at the end of March 2023, the forecasted values at the end of March 2024 as well as 2025 are estimated by Yano Research Institute.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.