No.3133

POS (Point-of-Sale) Terminal Market in Japan: Key Research Findings 2022

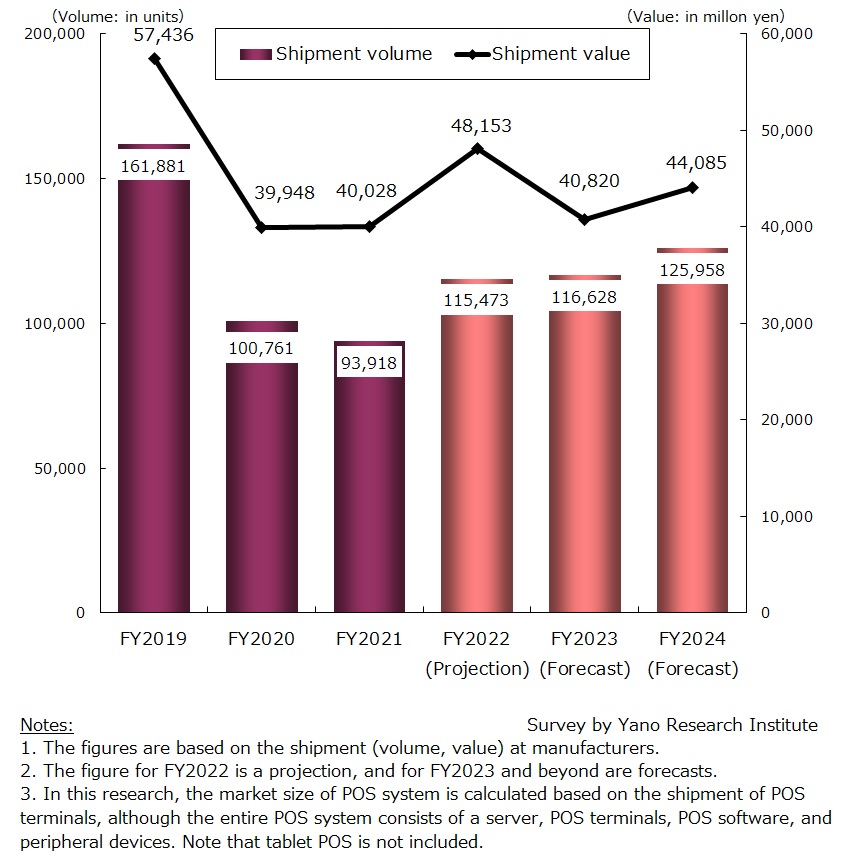

Domestic POS Terminal Shipment Volume in FY2021 Remain Low at 93,918 Units

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic point-of-sale (POS) terminal market and found out the trend of retail solutions, the strategies at POS system related enterprises, and the future outlook of the market.

Market Overview

Replacement needs at leading convenience store chains from FY2017 contributed to the significant growth of the domestic point-of-sale (POS) terminal market. The demand has been expanded further in FY2019 by the incidents that required the user companies to cope with, such as the consumption tax hike (to 10%) coupled with a reduced tax rate of 8% applied to the supply of certain goods, and the introduction of EMV (the unified standard of credit cards embedded with IC chips). Nevertheless, the POS terminal market in FY2020 was slashed down to 100,761 units in volume and 39,948 million yen in value, based on the shipment at manufacturers, as it faced a reactionary decline from the last few years, as well as a temporary slump in economic activities led by the spread of COVID-19.

Shipments decreased further in FY 2021 to 93,918 units in volume, although it grew marginally by value to 40,028 million yen. Reasons for the deterioration include the last-minute surge in demand, slowdown in IT investments due economic uncertainty led by the pandemic, and poor business performance at users, especially those in food service industry. In addition, expansion of the tablet POS market that replace POS devices, the increase of cashierless stores, and the penetration of delivery services such as home delivery of foods are assumed to have caused the market shrinkage.

Noteworthy Topics

Trends of Unmanned Stores, and Labor-Saving/Cashierless Stores

While Amazon led the transformation to self and automated checkout by setting up its Amazon Go cashier-less stores, new players like the startup in China that tried to start unmanned stores stumbled. In the last couple of years, market players find it too unrealistic to operate stores that are fully unmanned, thus moving on to reduction of the number of staffs and/or simply to cashierless (e.g. Grab & Go Goodies).

At present, out of all the unattended payment systems, TOUCH TO GO is the only system that is actually adopted in full-scale. Other IT vendors have not been successful in reaching the phase of full-scale implementation. In fact, systems that had gone through proof-of-concept at multiple stores in the past have been terminated. The failure mostly owes to the outbreak of COVID-19, which occurred shortly after the time when these solutions gained traction. As the pandemic led to an increase of telework, which in turn decreased the flow of people in the city center, business of stores implemented with experimental unattended payment systems became sluggish. In particular, stores and convenience stores that had been set up for the urban micro-market (extremely small commercial areas such as offices and hospitals) were impacted considerably by the sharp decline in the number of businesspeople and hospitalized patients/outpatients.

Meanwhile, Telwel East Japan Corporation made an entry to the market in a different approach, by developing a system that streamlines the operation of brick-and-mortar stores that suffer from the decline in the number of customers. The company insists that their payment system enables store operation with smaller number of staffs.

Future Outlook

The shipment of POS terminals for FY2022 is expected to edge upwards to 115,473 units by volume and 48,153 million yen by value (123.0% and 120.3% of the previous fiscal year). The market is forecasted to make a leap from FY2024, as user companies that installed their POS system around FY2017 will be replacing the systems. The market is expected to grow in value faster than in volume, since the unit price per system is expected to rise as POS terminals become more adaptable to self and automated checkout. On the other hand, however, competition among hardware manufacturers is expected to intensify, while the unit price per system may not rise as much as expected.

Research Outline

2.Research Object: POS terminal manufacturers, vendors of POS software/tablet POS, etc.

3.Research Methogology: Face-to-face interviews by the expert researchers (including online interviews), surveys via telephone/email, and literature research

What is the POS (Point of Sales System) Terminal Market?

A POS (Point of Sale) is a sales management system used at the time when the products or services are sold. It tabulates and manages the merchandize sales by each item. The entire POS system consists of a server, POS terminals, POS software, and peripheral devices.

The market size in this research indicates the market size of only POS terminals and has been calculated based on the shipment (volume and value) at manufacturers. Note that tablet POS is not included.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.