No.2331

Cold Chain Logistics Market in Japan: Key Research Findings 2019

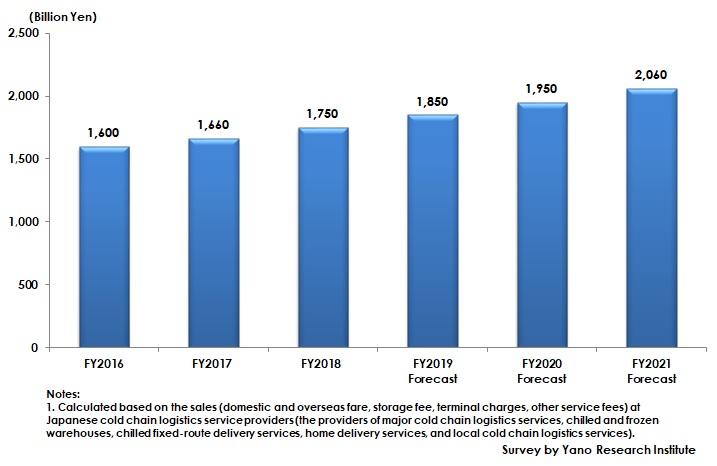

Cold Chain Logistics Market Size for FY2018 Rose by 5.4% to Attain 1,750 Billion Yen

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the cold chain logistics market and has found out the market size, trends of market players, and future perspectives.

Market Overview

The cold chain logistics market size for FY2018, calculated based on the domestic and overseas sales at Japanese cold chain logistics service providers, was estimated as 1,750 billion yen, 105.4% of the size of the previous year. Against the backdrop of quality improvement in advanced freezing technologies, annual consumption of frozen food per capita is increasing year by year, which is bringing about local chilled and frozen warehouses to about to approach maximum capacity. In addition to growth in chilled home delivery by convenience stores and supermarkets, cold chain logistics by drugstores have also increased, contributing to expand the entire cold chain logistics market.

Noteworthy Topics

With Expanding Demand for Frozen Food, Capacity of Chilled and Frozen Warehouses Approaching the Peak

In proportion to expansion in consumption as well as trading volume of meats, frozen food, and ice creams (including popsicles), demand for chilled and frozen warehouses is on the rise year by year. The vacant space of such warehouses nationwide has become smaller and smaller, approaching the limit of warehouse capacity especially in the metropolitan areas. Some major warehouse service providers are planning to build new chilled and frozen warehouses in urban areas.

Generally speaking, stocked products tend to temporarily increase just before large-scale events. In 2020, in addition to usual summer when large volume of products are stocked to prepare for summer, more products for Olympic/Paralympic games have been stored since the beginning of spring, which is likely for such warehouses to become even tighter than last year.

Future Outlook

Although domestic consumption is on the decline due to decreasing population stemming from falling birth rate and aging population, increasing demand for frozen food and meat consumption is expected to thrive the cold chain logistics market hereafter. In addition, the Olympic and Paralympic Games to be held in 2020 are projected to encourage the demand furthermore.

Also, even after FY2020, the logistics expenses are likely to rise due to soaring labor expenses and influence of the Revised Labour Standards Act, which is likely to help raise the market size of cold chain logistics to reach 2,060 billion yen by FY2021, 117.7% of the size of FY2018, based on the domestic and overseas sales at Japanese cold chain logistics service providers.

Research Outline

2.Research Object: Logistics companies, wholesalers, makers in cold chain logistics, and the competent authorities

3.Research Methogology: Face-to-face interviews by the expert researchers, surveys via telephone, and literature research

Cold Chain Logistics Market

The cold chain logistics market in this research refers to a logistics system with the temperature controlled throughout the supply chain from production to consumption. In the system, the temperature must not deviate either from the following fixed ranges, i.e., constant temperature (5°C to 18°C), chilled (-18°C to 10°C), or frozen (-18°C or less).

The cold chain logistics market in this research is calculated based on the sales (domestic and overseas fare, storage fee, terminal charges, and other service expenses) at Japanese cold chain logistics service providers (the providers of major cold chain logistics services, chilled and frozen warehouses, chilled fixed-route delivery services, home delivery services, and local cold chain logistics services). However, the sales of logistics services of imported products (food, raw material, etc.) and perishable food by major trading houses, wholesalers specific to perishable foods, major food wholesalers, and other wholesalers are not included. Those mid-and-small size and individual service providers that mainly receive transportation/delivery orders are also excluded.

<Products and Services in the Market>

Cold chain logistics, chilled and frozen warehouse, logistics of perishable food, cold chain, chilled food logistics, frozen food logistics

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.