No.3496

Global Market of Major Four Lithium-ion Battery Components: Key Research Findings 2024

Global Market of Major Four Lithium-ion Battery Components in Doldrums Once Again - Amid Slowdown in Demand for Li-ion Cells for Automotive and Small Consumer Equipment, Strategy Optimized in Respect of Term & Geography Will Be The Key to Success for Li-ion Battery Component Manufacturers

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the global market of major four lithium-ion battery components, and found out the trends regarding the major four Li-ion battery components in view of applications (automotive and small consumer equipment), shipment value, capital investment status by country, and component price.

Market Overview

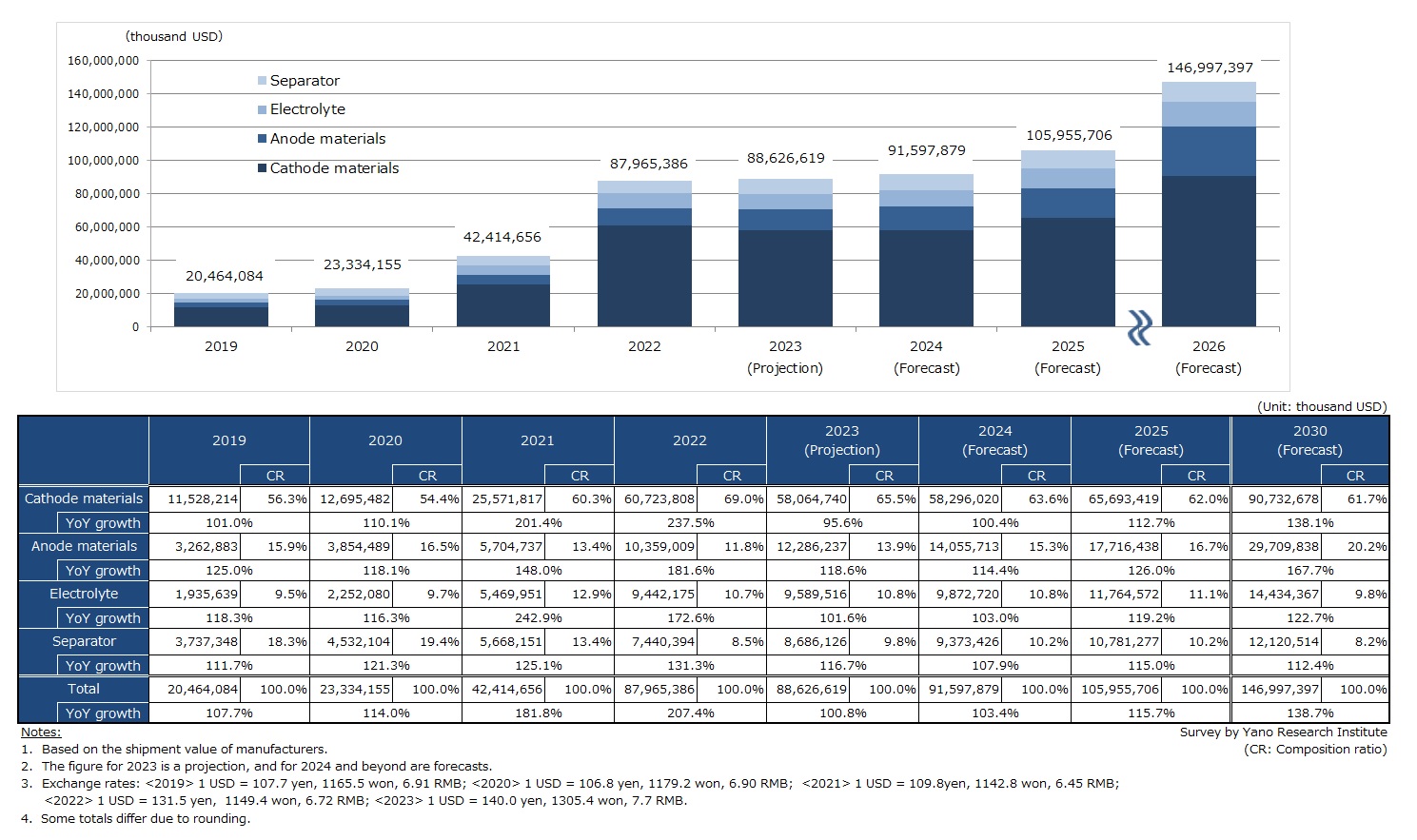

The global market size of major four Li-ion battery components in 2023 was estimated at 88,626,619,000 USD, 100.8% of the preceding year (based on the shipment value of manufacturers).

The growth of the automotive Li-ion cell market slowed globally in 2023.

In Europe, OEMs (automakers) shifted their focus from EV to PHEV due to termination/reduction of subsidies, soaring energy costs, and high inflation. In North America, despite the expectation that subsidies backed by the Inflation Restraint Act of 2022 propels EV sales, the result failed to meet the level that OEMs (automakers) hoped for, and thus some automakers deferred EV fabrication schedule and called off a joint venture with Li-ion cell manufacturer. In China, Chinese consumers were seemingly less dependent on subsidies when purchasing EVs when compared to consumers in other countries. However, deterioration of economy and lack of sufficient charging infrastructure started to drag EV sales. The growth of the global automotive Lithium-ion cells market was restrained by these factors.

Meanwhile, the market growth of Li-ion cells for small consumer equipment also decelerated in 2023, due to a year-on-year demand decline in cell demand for notebook computers and smartphones.

In spite of the stable growth in preceding years, 2023 saw the decline in price of all four major Li-ion battery components, due in part to the falling prices of materials including lithium, the oversupply of cells caused by the slowdown in the market growth (of small consumer equipment), and intensifying price competition.

Noteworthy Topics

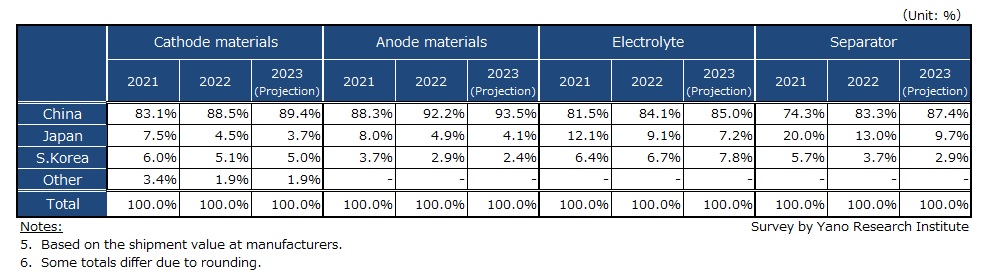

Chinese Makers’ Share Surpass 80% in All Four Major Li-ion Battery Components - Japanese and South Korean Makers Losing Their Shares

When observing the major four Li-ion battery components by shipment volume per country, the market share of China surpassed 80% for all four components, with the market share for separators exceeding 90%.

Multiple Chinese Li-ion battery component manufacturers that ranked high by market share showed 140% to 200% year-over-year growth, presumably due to expansion of the new energy vehicle (NEV) market and automotive Li-ion cells market in China. In the market of Li-ion cells for consumer small equipment, while the sales of cells for notebook computers and smartphones declined in 2022 from the previous year, in turn, it propelled the shipment of price-competitive Chinese separators, contributing to the rise of Chinese manufacturers’ market share.

As per automotive Li-ion cells, it is presumed that in China there was a gap between the estimated number of Li-ion batteries installed on xEVs and the production volume at Li-ion battery manufacturers in 2022. For 2023, one to two months' worth of ‘stock’ may exist. With regard to cathode and anode materials, in addition to the view that production capacity utilization rates may have declined because of the oversupply stemming from the sluggish Li-ion battery market and intense price competition, excessive shipment including the ‘stock’ as mentioned earlier may have caused the discrepancy.

Japanese and South Korean manufacturers of the four major Li-ion battery components continued to see decline in the market share by shipment, both in 2022 and 2023, except for Korea's electrolyte. Although some Korean Li-ion battery component makers showed robust growth in shipment volume by supplying to growing Korean Li-ion battery manufacturers, in most cases their growth rates do not compare to those of Chinese Li-ion battery component makers.

Future Outlook

Global Li-ion battery components market is leveling off once again. All Chinese Li-ion battery component makers interviewed said it was due to the "oversupply” that was repeated once again. However, it left us with a slightly different impression from the past situations.

In China, NEV subsidy ended in 2022 and market economy of NEV progressed. It can be said the market is nurturing a healthy competitive landscape. On the other hand, in Europe, amidst the strategic shift to PHEV from the second half of 2023, some automakers (OEMs) put off the time schedule of sales plan for EVs and PHEVs. In North America, automakers deferred EV launch, cut back EV production, withdrew a joint project to build cell plant with a Li-ion battery maker, called off EV production plan, or increased production of HEVs.

Conventionally, baseline scenario among Chinese players was to expand the market of EV, the Li-ion batteries, and the Li-ion battery components respectively within their homeland, then to succeed in overseas business, in areas including Eurupe and the United States, to maintain the market growth.

Nevertheless, in light of the situation above, we presume that Chinese Li-ion battery and Li-ion battery components manufacturers will not fall into excessive investment from 2024 that may cause oversupply, regardless of changes in the policies in target countries.

Research Outline

2.Research Object: Lithium-ion battery components manufacturers (Japan, South Korea, China, and Taiwan)

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews) and literature research

About Major Four Lithium-Ion Battery Components

Lithium-ion battery (Li-ion battery), which is used for power sources of smartphones and other telecommunication devices and of vehicles like EVs and plug-in HEVs (PHEV), consists of more than ten components and materials. This research targeted the following four components among such materials: Cathode materials, anode materials, electrolytic solution/electrolyte, and separator.

The market size was calculated based on shipment values in US dollars (USD). For 2019, 1 USD was converted to 107.7 yen, 1165.5 won, and 6.91 RMB. For 2020, 1 USD was converted to 106.8 yen, 1179.2 won, and 6.90 RMB. For 2021, 1 USD was converted to 109.8yen, 1142.8 won, and 6.45 RMB. For 2022, 1 USD was converted to 131.5 yen, 1149.4 won, and 6.72 RMB. For 2023, 1 USD was converted to 140.0 yen, 1305.4 won, and 7.7 RMB.

<Products and Services in the Market>

Cathode materials, anode materials, electrolytic solution/electrolyte, separator

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.