No.3494

Biostimulants Market in Japan: Key Research Findings 2024

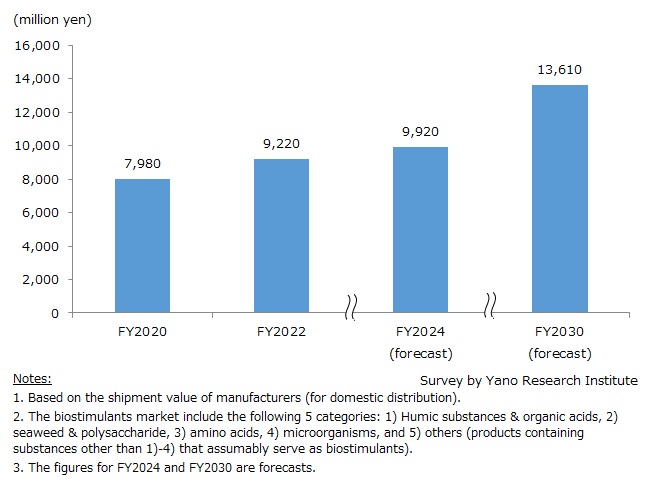

Launch of “Green Food System Strategy” Brought Biostimulants Under Spotlight – Biostimulants Market in Japan Forecasted to Grow to 13,610 Million Yen by FY2030

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the biostimulants market in Japan, and found out the market size, the trends of market players, and future perspective.

Market Overview

While the number of agricultural workers and farm enterprises declines, farm enterprises are shifting to large-scale (data source: the Ministry of Agriculture, Forestry and Fisheries [MAFF]). Meanwhile, there are global climate issues such as warming of average temperature that arouses concern for impact on agriculture.

To establish sustainable agriculture, forestry, and fisheries, the MAFF launched the "Green Food System Strategy" in 2021, which aims to enhance both productivity and sustainability in food sector, agriculture, forestry, and fisheries by utilizing new technologies.

Under the circumstances, biostimulants that increase yield and enhance quality even in harsh environment such as heat and drought are attracting attention. Although the term has not been consensually defined in Japan, as seen in the moves in countries around the world to develop an official consensual definition, biostimulants are increasing significance globally.

The domestic biostimulants market size (as a total of 5 categories) is estimated at 9,220 million yen for FY2022, based on the shipment value of manufacturers (for domestic distribution).

Noteworthy Topics

Moves to Reduce Use of Agrochemicals and Chemical Fertilizers in “Green Food System Strategy”

To enhance sustainability in agriculture, forestry, and fisheries, the "Green Food System Strategy" by MAFF aims to achieve 50% reduction in the use of agrochemicals based on risk-weight *1 and 30% reduction in chemical fertilizer use by 2050.

Along with the technological development of biostimulants as a technology to stimulate plant growth and increase plant’s resistance to abiotic stress and pests, penetration of integrated pest management (IPM)*2 and advancements in breeding for disease resistant crops are also expected as ways to reduce the use of agrochemicals. To reduce fertilization, elucidation of the role of soil microorganisms and establishment of cultivation methods that make effective use of plant growth-promoting activities performed by microorganisms are underway. Moves to achieve 2050 goals are advancing in tandem with the development of these new technologies.

*1. "50% reduction in the use of agrochemicals based on risk-weight" means a 50% reduction by the total environmental impact of agrochemicals calculated in a verifiable manner (risk conversion), as opposed to by the number of times agrochemicals are applied, which has been a commonly adopted criteria in conventional agrochemicals reduction programs.

*2. "Integrated Pest Management" refers to management methods to suppress the occurrence of pests and weeds not only through the use of agrochemicals but also through the improvements of cultivation environment.

Future Outlook

The domestic biostimulants market is expected to continue expansion, reaching 9,920 million yen in FY2024 and 13,610 billion yen in FY2030, by shipment value of manufacturers (for domestic distribution).

There is a rising demand for less-costly alternatives to current fertilizers whose prices are soaring, while reducing the use of agrochemicals and chemical fertilizers is promoted nationally in the "Green Food System Strategy". On top of that, not many producers are currently using biostimulants, meaning there is room for producer demand to expand in the future. Against these backgrounds, we believe the market will continue growing.

Research Outline

2.Research Object: Biostimulants manufacturers, businesses of fertilizers and fertilizer-related products, research institutions, related government agencies, industry bodies, etc.

3.Research Methogology: Face-to-face interviews by our expert researchers, survey via telephone and email, and literature research

What is the Biostimulants Market?

Biostimulants refer to products that stimulate natural processes of plants to increase natural resistance to abiotic stress to enhance crop quality and yield. However, there is no consensual definition in Japan yet. In this research, the biostimulants market include the following 5 categories: 1) Humic substances & organic acids, 2) seaweed & polysaccharide, 3) amino acids, 4) microorganisms, and 5) others (products containing substances other than 1)-4) that assumably serve as biostimulants). The market size is calculated based on the shipment value of manufacturers (for domestic distribution). Detailed description of each category are as follows:

1) Humic substances: The target products are ordinance-designated soil conditioners (solid type) and soluble solids that are used after being dissolving in water.

Organic acids: The target products are organic acids in general including nucleic acids, but not fulvic acids or humic acids.

2) Seaweed: The target products are limited to those that use seaweed or seaweed extracts, which are water soluble or sold as liquids in the first place.

Polysaccharide: The target products are those that are commonly known as liquid fertilizers. However, products with low content of polysaccharide are excluded.

3) Amino acids: The target products are liquid amino acids, which have high concentration of amino acids or high content of organic-derived components. Products that meet criteria originally set by Yano Research Institute. Amino acid fertilizers that have been conventionally used (fertilizers using fishmeal, solid fertilizers like Bokashi, and liquid fertilizers containing organic matter to which amino acids are partially added) are excluded. Glycine betaine is included.

4) Microorganisms: The target products are limited to soil conditioners and root stimulants. Decomposers (agents to decompose residues) for agricultural usage and liquid dethatcher for lawn of golf course etc., are excluded.

5) Others: The target products are those that contain substances that serve as biostimulants, such as minerals, vitamins, phosphoric acid, plant extracts, and yeast. Nonetheless, commercial composite micronutrient fertilizers, products containing substances with plant extracts without sufficiently proven efficacy, and products containing enzymes without sufficiently proven efficacy are not included.

<Products and Services in the Market>

Humic substances & organic acids, seaweed & polysaccharide, amino acids, microorganisms, and other biostimulants (products, processed materials)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.