No.3526

Human Resources/General Affairs Outsourcing Market in Japan: Key Research Findings 2024

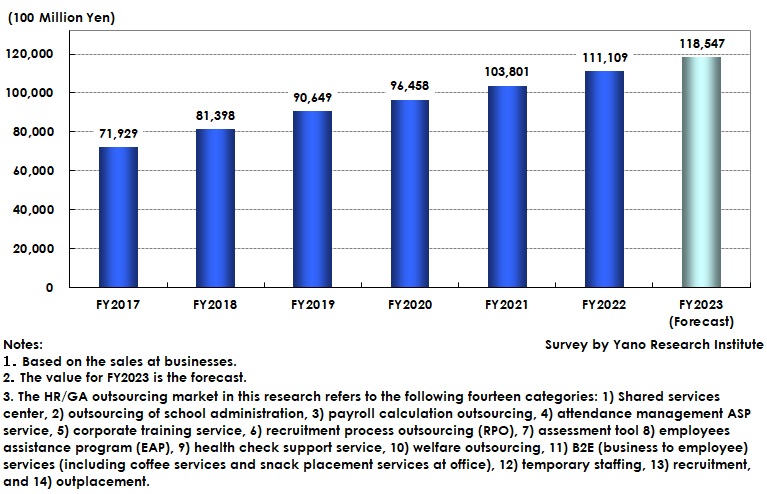

HR/GA Outsourcing Market Size for FY2022 Rose by 7.0% on YoY, Projected to Rise by 6.7% on YoY for FY2023

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic outsourcing market for human resources and general affairs and has found out the trends of total major 14 service categories, trends of market players, and future perspectives.

Market Overview

The human resources (HR)/general affairs (GA) outsourcing market size (total major 14 markets) in FY2022 increased by 7.0% on a year-on-year basis to 11,110,900 million yen. The breakdown by each market was as follows: the shared service market (comprised of shared service centers and school administration outsourcing) rose by 1.6% on a YoY basis to 567,000 million yen, HR operation outsourcing market (comprised of payroll calculation outsourcing, attendance management ASP services, corporate training services, RPO, and assessment tools) expanded by 4.0% on a YoY to 1,016,500 million yen, GA outsourcing market (comprised of EAP, health check support services, outsourcing of welfare tasks, and B2E services) increased by 4.1% on a YoY to 291,900 million yen, and recruiting market (comprised of temporary staffing, recruitment, and outplacement) rose by 7.8% on a YoY to 9,235,500 million yen, indicating that recruiting market occupies more than 80% of the entire HR/GA outsourcing market.

Noteworthy Topics

Companies Concentrate Management Resources on Main Business, Demand for Services Boosted by Digital Transformation Promotions

Since FY2020, COVID-19 crisis caused many companies and businesses to deteriorate their performances. However, since around the second half of FY2022 when economic activities fully resumed, new services catering to the recent business environment have been thriving in the “With COVID” era, gradually increasing the service demand to the pre-COVID level. In addition, constant labor shortages caused by waning working population has accelerated companies to allocate valuable in-house personnel to engage in core business rather than back-office work, encouraging outsourcing of back-office tasks, which is backed by an increasing number of employees reaching retiring ages, boosting the outsourcing demand. Furthermore, teleworking has widespread after COVID crisis, which has infiltrated the idea of outsourcing back-office work being more efficient and productive than necessitating employees to commute for such work and has increased those companies to take a step to use outsourcing services. Therefore, for the HR/GA outsourcing market COVID-19 has fueled the service demand, rather worked for the better than worse.

Concentration of limited management resources on main business while working on human resources management (*1) the way the government propels has been observed especially in major companies. On the other hand, moves to scale down the indirect work costs are increasing, fueling those companies to set out to choose outsourcing services as a way for cost shrinkage. In recent years, however, more companies tend to utilize outsourcing services not only for diminishing costs but also for promoting digital transformation, which, in turn, digital transformation (*2) promotions are encouraging the service demand year by year.

*1) Human resources management: the way of business management that improves corporate values from the mid-to-long term view by considering labor as one of corporate capital and by optimizing each value of human resources.

*2) Digital transformation: Operational reform by utilizing digital technologies.

Future Outlook

What is most influential to HR/GA outsourcing industry is the economic trends that affect performances at user companies. In recent years, however, because of increasing numbers of companies addressing workstyle reform and digital transformation, the service demand is prosperously expanding in many fields, outperforming the concerns over economic recession.

Decreasing working population also looms large in the market. Japanese major companies that have insourced every department see the retirement of experienced HR personnel as the right timing to adopt HR outsourcing services. The services have widespread in recent years, as they are in demand by various customers from repeaters, those companies looking for deeper services, and those that have not yet deployed the services, mainly the middle-size companies. Therefore, service providers are enhancing to meet the needs especially by Japanese companies and SMEs, where market expansion is promising. With the emerge of reasonable cloud services, demand by middle-size companies is rapidly standing out, which contributes to market invigoration and further market growth for the future.

Research Outline

2.Research Object: Major businesses providing outsourcing services for HR (human resources and GA (general affairs)

3.Research Methogology: Face-to-face interviews by expert researchers (including online), surveys via telephone & email, and literature research

The Human Resources/General Affairs Outsourcing Market

The HR/GA outsourcing market in this research refers to the following fourteen category markets: 1) Shared services center, 2) school administration outsourcing, 3) payroll calculation outsourcing, 4) attendance management ASP service, 5) corporate training service, 6) recruitment process outsourcing (RPO), 7) assessment tool 8) employees assistance program (EAP), 9) health check support service, 10) welfare outsourcing, 11) B2E (business to employee) services (including coffee service and snack placement service at office), 12) temporary staffing, 13) recruitment, and 14) outplacement.

The data for temporary staffing business until FY2021 are quoted from “the Worker Dispatch Business Report (the sales at general worker dispatch businesses)” by MHLW.

<Products and Services in the Market>

Shared services center, school administration outsourcing, payroll calculation outsourcing, attendance management ASP service, corporate training service, RPO (recruitment process outsourcing), assessment tool, EAP (employees assistance program), health check support service, welfare outsourcing, B2E (business to employee) services (including coffee service and snack placement service at office), temporary staffing, recruitment, and outplacement.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.