No.3481

Financial Performance Trends of Pachinko Parlor Operators in Japan: Key Research Findings 2023

Operating Profit Margin of 117 Pachinko Parlor Operators Was Less Than 1% on Average in FY2022

Yano Research Institute (the President, Takashi Mizukoshi) has found out the financial performance trends of pachinko parlor operators, based on the average values of major financial indicators of 117 pachinko parlor operators.

Summary of Research Findings

For this research, 117 pachinko parlor operators were randomly sampled from a total of 1,842 pachinko parlor operators nationwide listed in the “YANO Pachinko Database”. We analyzed the business performance trends over the three years from FY2020 to FY2022 based on the average value of key indicators based on the financial information of those operators.

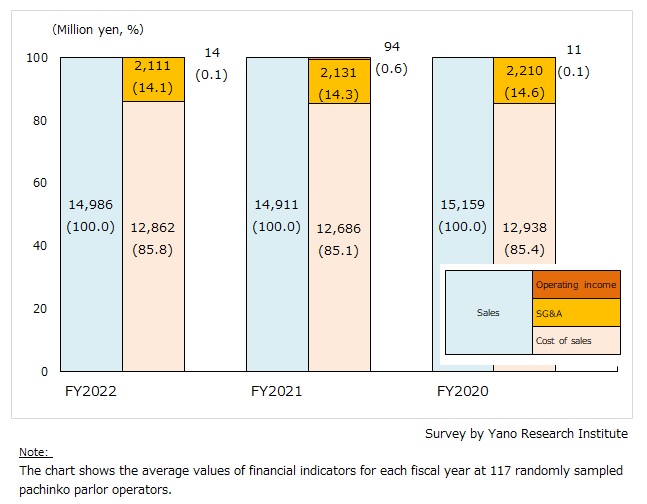

In FY2022, the average amount of sales at the 117 companies was 14,986 million yen. On average, the cost of sales was 12,862 million yen (85.8% as a composition ratio), SG&A was 2,111 million yen (14.1%), and operating profit was 14 million yen (0.1%).

Sales fell in FY2021 by 1.6% from the preceding fiscal year, showing additional decline from a preceding fiscal year that was badly affected by the COVID-19 crisis. As seen by a minimal growth of 0.5%, sales was still rough in FY2022. While the introduction of No. 6.5 machines and “smart pachislot” * contributed to a bounce back in FY2022 for pachislot business, pachinko business struggled to make a full recovery.

* “Smart pachislot” is a pachi-slot machine that uses digital medals to play instead of tangible medals. The revision of the regulations (of Nihon Yugiki Kogyo Kumiai [Nikkoso, the association of pachinko machine manufacturers]) have enabled gaming machine makers to develop gaming machines with a wide range of gameplay.

Noteworthy Topics

Financial Performance Trends of 117 Pachinko Parlor Operators

[Sales & Cost of Sales]

Sales of pachinko parlor operators decreased by 1.6% from the previous fiscal year in FY2021 and barely grew by 0.5% in FY2022. For two consecutive years, the sales fell below the FY2020 level, which was supposed to be fiscal year most damaged by the Covid crisis.

In view of composition ratio, the cost of sales in FY2022 rose by 0.7 percentage points from the previous year to 85.8%. It has been at above 85% for the last couple of years.

[Gross Margin]

Sales slightly increased from the previous year in FY2022. However, as the rise in the cost of sales was 1.4% on year-on-year, exceeding the growth rate of the sales, gross margin dropped by 4.6%. The composition ratio of gross profit also declined by 0.7 percentage points.

[SG&A Expenses]

SG&A expenses decreased both in FY2021 and FY2022, resulting the composition ratio to decline by 0.2 percentage points from the preceding fiscal year to 14.1% for FY2022.

However, by composition ratio, SG&A expenses stayed at 14%-level for three years in a row since FY2020, in contrast to 12.5% in FY2019 (according to the 2022 Survey; aggregation targets are not the same as those of this year’s survey). According to the similar surveys in the past, the composition ratio of SG&A expenses has been exceeding 10% since FY2008. It has been weighing heavily on financials of pachinko parlor operators.

Hovering of SG&A expenses was against the backdrop of a significant rise in purchase of gaming machines and accompanying equipment, stemming from the introduction of new machines (as replacement to old machines to conform to new regulations) due by the end of January 2022 and the introduction of smart-slot machines since November 2022.

Bold cutdown in SG&A expenses is necessary to increase operating income. Nonetheless, to stay competitive, the companies must continue to purchase new machines, including smart-slot and smart-pachinko** that are increasing popularity, to keep up with fast-changing trends of pachinko and pachislot fans.

In addition, in accordance with the issuance of new banknotes in 2024, renewal of equipment and machinery will be required. Investment continues among pachinko parlor operators for the foreseeable future.

[Operating Income]

Operating income in FY2022 plummeted by 85.5% from the previous year, and its component ratio declined by 0.5 percentage points to 0.1%. Considering that gross margin and SG&A expenses have been in the 14% range for years, the composition ratio of operating income is forecasted to remain less than 1%.

**Smart pachinko" is a pachinko machine that allows players to play without directly touching pachinko balls by enclosing them inside the machine and circulating them.

Research Outline

2.Research Object: Pachinko parlor operators

3.Research Methogology: Data aggregation and analysis by our specialized researchers based on the data of “YANO Pachinko Database”

About This Survey

For this survey, we randomly sampled 117 pachinko parlor operators from a total of 1,842 pachinko parlor operators nationwide listed in the “YANO Pachinko Database”. We analyzed the business performance trends over the three years from FY2020 to FY2022 based on the average value of key indicators in their financial statements.

Target pachinko parlor operators include 7 major companies (operating more than 20 parlors), 23 second-tier companies (operating 10 to 19 parlors), 37 mid-sized companies (operating 4-9 parlors), and 50 small-sized companies (operating 1-3 parlors). An average of parlors operated by the 117 companies was 7.0.

Please note that giant operators and those that have rapidly expanded the number of parlor openings in a short term, such as Maruhan, Dynam, Undertree, Gaia, NEXUS, and Niraku, were excluded from the population prior to the sampling of the survey target.

<Products and Services in the Market>

Pachinko parlor operators, pachinko parlors

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.