No.3471

Global Next-Generation Mobility Market: Key Research Findings 2023

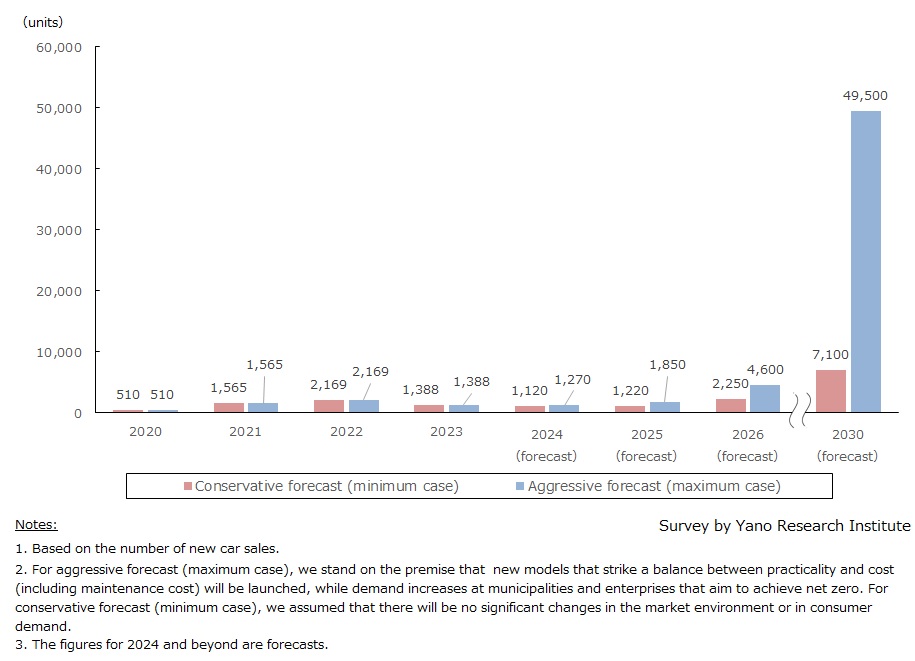

New Car Sales of Next-generation Mobility in Japan (Electric Trikes, Electric Mini Cars, and Micro Mobility) Forecasted to Reach A Maximum of 49,500 Units by 2030

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the global market of next-generation mobility, and found out the overview of the domestic market, status of related market overseas, and the business strategies of major manufacturers of the next-generation mobility. This press release denotes the forecasts of new car sales of next-generation mobility in Japan up to 2030.

Market Overview

Although the world is said to be in the era of VUCA, where volatility, uncertainty, complexity, and ambiguity make future difficult to foresee, the world abides with the challenge of decoupling economic growth and environmental impact. In this context, automakers are expected to create economic value by addressing social issues through corporate shared value (CSV) framework, to act beyond charity and donation (corporate social responsibility [CSR]). Next-generation mobility, the compact vehicles that are easy to drive on narrow roads, can be a solution for various social issues, especially traffic congestion, workforce shortage in logistics including last-mile delivery, and lack of public transit in rural areas. However, there are many challenges for manufacturers to overcome, as the next-generation mobility vehicles are yet to have an advantage over existing vehicles (light cars [kei cars] and motorcycles) in terms of balance between costs (initial investment, maintenance costs) and product characteristics.

In Japan, the standardization of “micro mobility” took almost 10 years. However, outlook of the domestic micro mobility market is uncertain. Toyota announced to terminate C+pod around summer of 2024, the only model that earned type designation as micro mobility in Japan, which is only after 4 years from the initial launch. Meanwhile, the niche market of quadricycles (Category L) is unprecedentedly vibrant in Europe, as the cumulative sales volume of Citroën's Ami in the first three and a half years from the launch reached the level of total sales volume of quadricycle in entire Europe. On the other hand, LSEV sales in China is dropping from the peak, as series of car accidents led to tighter safety standards and limitation of new market entries. Together with a rise of mini-EV, represented by SAIC-GM-Wuling’s “Hongguang MINI (A00 class)”, the LSEV market is shrinking considerably.

Noteworthy Topics

Japanese Micro Mobility on the Rocks / Signs of Emergence of New Electric Mini Cars

In the overseas market, small EVs that are cheaper and with minimal functions, as represented by SAIC-GM-Wuling’s “Hongguang MINI (A00 class)”and Citroën’s Ami, are garnering attention.

Meanwhile, makers have many challenges to overcome in order to penetrate next-generation mobility widely in Japan, as the main product is a two-wheeler at the price of kei car with no unique features or added functionalities. Although electric trikes and electric mini cars have tax advantages, reducing maintenance cost of owners, micro mobility do not have such advantage because in the current tax framework, it is categorized as equivalent to kei car.

Tax rate and cost of vehicle inspection are important elements to reduce running cost of car owners. However, the tax rate was set at the same level as kei cars (despite the view that consumers do not satisfy unless the tax rate for micro mobility is set at the level between that of electric mini cars and kei cars). Cost of vehicle inspection of micro mobility was also considered too high, for it is equivalent to kei car. These situations have highlighted the advantage of electric mini cars instead.

Fairness of premium (insurance charge) is also an issue for micro mobility. Under the car insurance rule, vehicles with engine displacement less than 125cc or nominal capacity of less than 1.0kW is defined as motorized two-wheeled vehicle, and thus family bike insurance policy applies. While 50cc electric mini cars falls into this category, micro mobility is out of the scope.

Ambiguous product positioning is stunting the penetration of micro mobility. Some users and manufacturers argue that the true demand is in a “category II four-wheeler motorcycle”, a compact and inexpensive two-seater vehicle capable of loading over 90kg that do not require vehicle inspection, which can be covered by family bike insurance. In fact, an enterprise that develops electric mini cars that strike a balance between practicality and cost burden emerged. The next-generation mobility market is entering a new phase.

Future Outlook

The number of new car sales of next-generation mobility (electric trike, electric mini car, micro mobility) in Japan is forecasted to reach 49,500 units by 2030 (aggressive forecast).

The development of BEV by European and Chinese automakers, the recovery of economic activity from the COVID crisis, and the carbon neutrality declarations by countries around the world had given a frenzy-like momentum for BEVs between 2019 and 2023. However, there is a view that the hyper anticipation for BEVs will come to an end in 2024. This is caused by strong headwinds for BEVs, such as the slowdown in sales in China due to economic stagnation, the postponement of the ban on sales of ICE (internal combustion engine) vehicles in the UK, and the shrinkage of subsidized vehicles in the U.S. due to higher interest rates and IRA (inflation control law) revisions. From a broad perspective, the BEV market is expected to face turmoil further. Still, the demand for vehicles with environmental and economic benefits will remain robust as a means of daily transportation. BEVs to be released in 2024 and beyond need to appeal to the general public by showcasing how they strike a balance between practicality and cost. From this standpoint, we believe there is demand for BEVs that are affordable and practical, in addition to luxury BEVs that had been propelling the market.

Amidst the rise of global interest towards a sustainable society, embracing net zero world is a trend that do not last. We assume that an increase of next-generation mobility is achieved by its adoption as official vehicles, commercial vehicles, and small delivery vehicles, because this can be achievable through political enforcements. In consideration of such scenario, the number of domestic new car sales of next-generation mobility is expected at 49,500 units on aggressive forecast, and 7,100 units on conservative forecast.

Not that, for aggressive forecast (maximum case), we stand on the premise that new models that strike a balance between practicality and cost (including maintenance cost) will be launched, while demand increases at municipalities and enterprises that aim to achieve net zero. For conservative forecast (minimum case), we assumed that there will be no significant changes in the market environment or in consumer demand.

Research Outline

2.Research Object: Next-generation mobility manufacturers, service providers in businesses related to next-generation mobility

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone, and literature research

What is the Next-Generation Mobility Market ?

Backed by the movements for achieving carbon neutrality and improving transportation efficiency, demand is expected to rise for vehicles that are not only ‘greener’ but also smaller and easy to drive on narrow roads, suitable for short distance travel for one or two passengers.

In this research, the domestic market of next-generation mobility indicates electric trikes (motorcycle with a side car), electric mini cars (motorized four-wheeled vehicle), and micro mobility as defined by the MLIT, which are considered as vehicles that fall in the middle of EVs and electric bikes. The number of electric scooters and “Green Slow Mobility”, which may also serve the purpose as the next-generation mobility, are not included in the number of domestic new car sales of next-generation mobility.

In overseas market, the next generation mobility refers to Category L vehicles (L2e, L5e, L6e, L7e) in EU countries and LSEV (Low Speed Electric Vehicle) in China. For India and ASEAN countries, vehicles that may impact the market trends, such as tricycles, are also included.

<Products and Services in the Market>

[Japan] electric trikes, electric mini cars, micro mobility, electric scooters; [Europe] Category L vehicles (L2e, L5e, L6e, L7e); [China] LSEV

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.