No.3469

Global Market of Grid-Scale Stationary Energy Storage Systems (ESS): Key Research Findings 2024

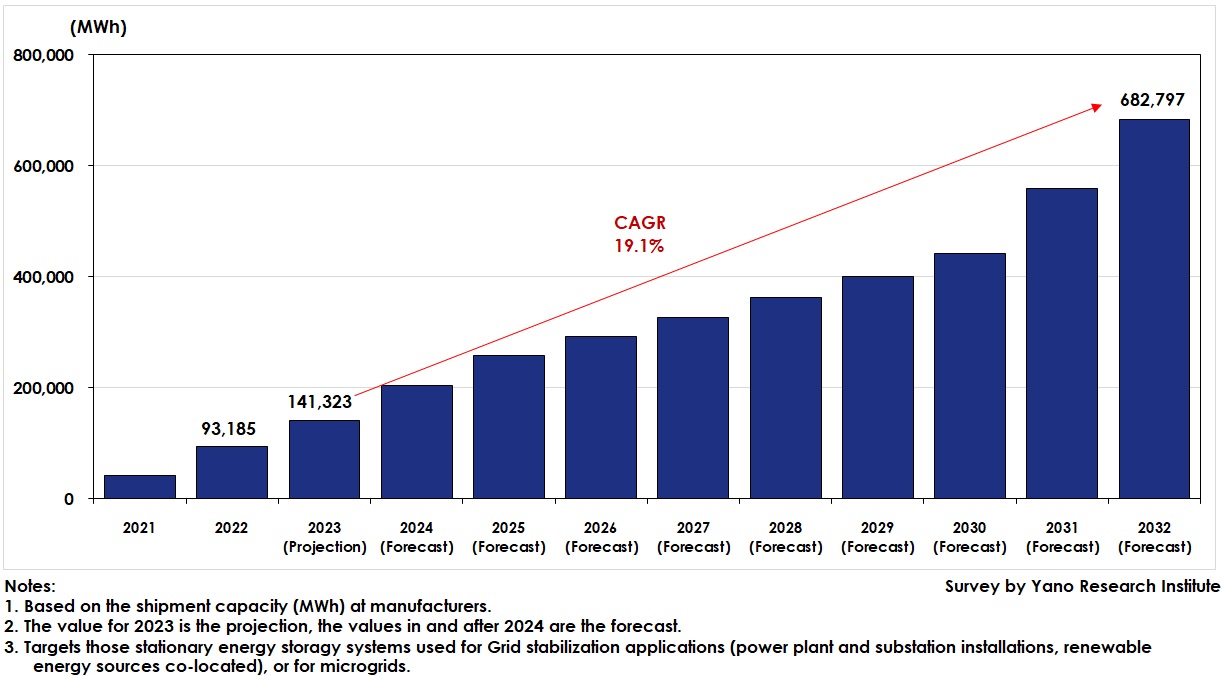

Global Shipment Capacity for Grid-Scale ESS Expects 682GWh by 2032

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the global grid-scale stationary energy storage systems (ESS) in 2024 and found out the market trends by installed location and by application, the trends by battery type, the trends of market players, and the future perspectives.

Market Overview

The estimated global market size of grid-scale stationary energy storage systems (ESS) by the shipment capacity at manufacturers was 93,185 MWh in 2022. The year saw increased ESS shipment, because of enhancement to support installations of ESS in addition to renewable energy plants in major countries aiming at realization of carbon neutrality, and increased household demand for generating and using electricity due to soaring electricity prices, and improved profitability from selling electricity via reduced cost for renewable energy generation.

Catering to increased installations of renewable energy plants, 2023 also expects increase in grid-scale ESS adoptions, making its projection for global market size to achieve 141,323MWh, 151.7% of the size of the previous year. When observing the countries with many grid-scale ESS, three regions, i.e., North America, China, and Europe, occupy 87% of the entire installations.

Noteworthy Topics

Rapidly Increased LFP Overturns NCM and NCS

Currently, nickel cobalt manganese (NCM) or nickel cobalt aluminum (NCA) are mainly supplied by South Korean or Japanese battery manufacturers while lithium iron phosphate (LFP) is supplied by Chinese battery manufacturers for cathode materials of lithium-ion batteries geared to ESS.

Although NCM and NCA used to be the main components until 2020, the shipment of LFP has rapidly increased since 2021 and overturned the situation. This stems from enhancement of LFP sales by Chinese cathode material manufacturers backed by financial support from the Chinese government, as China occupies a large share in the global ESS installation capacities. Other reasons for increased demand for LFP are expansion of LFP applications in overseas markets against the backdrop of lower price of LFP than NCM and shortage of NCM supplies due to increasing demand for lithium-ion batteries for EVs, in addition to Tesla’s policy to use 100% LFP for its lithium-ion batteries.

Shifting to LFP for the main cathode material of lithium-ion batteries will continue, reflected by South Korean manufacturers that used to supply NCM-based lithium-ion batteries having started developing LFP-based batteries.

Future Outlook

To realize carbon neutrality, renewable energy plant installations are likely to accelerate in each country. We consider that this requires stabilization of electricity quality at each installation and fuels the global grid-scale ESS market to leap forward.

In addition, efforts to reduce the storage batteries are underway by changing the materials or improving the design methodologies, etc. at each of ESS manufacturers. If these efforts bear fruit to bring down the battery prices, it is projected for ESS installations to accelerate. Furthermore, development of battery management technology and improvement of system efficiency may reduce grid-scale ESS prices.

The market, therefore, is on the expansion, with the CAGR from 2023 to 2032 being 19.1%, and the global grid-scale ESS market size projected to reach 682,797MWh by 2032.

Research Outline

2.Research Object: Domestic and overseas manufacturers of and related to ESS

3.Research Methogology: Face-to-face interviews (including online interviews) by expert researchers and literature research

Grid-Scale Stationary Energy Storage Systems ESS)

Grid-scale ESS in this research refers to that used for electrical grids and is installed at a power plant including thermal power or nuclear power plant, power distribution station, transmission substation, renewable energy generation plant, microgrid, etc., thereby to secure stability of power supply networks as well as to improve power quality by frequency adjustment and load regulation.

ESS in this research refers to chemical energy storage system utilizing lithium-ion battery, lead storage battery, nickel hydrogen battery, redox flow (RF) battery, or sodium-based batteries (sodium-sulfur battery, sodium-nickel chloride battery, sodium-ion battery, sodium molten-salt battery, etc.)

<Products and Services in the Market>

Grid-Scale Stationary Energy Storage Systems (ESS)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.