No.3464

Gift Market in Japan: Key Research Findings 2023

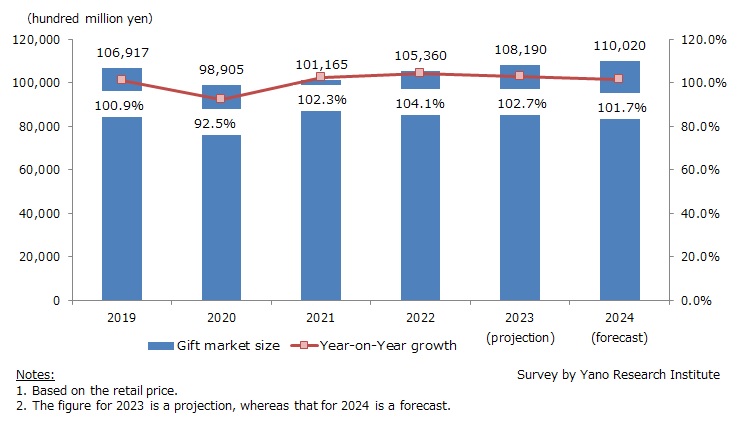

Gift Market in 2023 Projected to Attain 102.7% of Previous Year to 10,819 Billion Yen

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on domestic gift market, and found out the trends by occasion, the trends by channel, the trends by item, the trends at market players, and future perspective.

Market Overview

The domestic gift market is projected to attain 10,536 billion yen in 2022 (104.1% of the previous year) and 10,819 billion yen in 2023 (102.7% of the preceding year).

While the demand for formal gifts to express courtesy has been declining with the times where lifestyle and social attitudes are changing, the method of socializing by gifting has been modified in a way that is more relevant to modern society and has been increasing significance especially in personal or intimate relationships.

In accordance with the decrease of formal gifting opportunities during the COVID-19 crisis, the gift market shrunk considerably. However, instead of meeting family and friends in person, people gave more (casual) gifts were given to convey feelings, such as gratitude. Seeing this trend continue even after the end of the pandemic, we believe that the importance of gifts as a means of communication has increased.

Noteworthy Topics

Changing Consumer Behavior with Flow of The Times & COVID / Will “Meaning Consumption Gift” Trigger Growth of Entire Gift Market?

Changes of the times and COVID-19 crisis have affected consumer values and behaviors. A marked trend witnessed in the gift market in 2023 was the V-shaped recovery for the demand for "experiential gift", which is giving someone experience through a product or a service. ‘Experiential consumption (“koto shohi” in Japanese)’ is a term that indicates a ‘consumption behavior that emphasizes actual experiences (as opposed to ‘material consumption’). When activity restrictions to prevent spread of infections were lifted, many people began visiting tourist sites, event venues, lodging facilities and restaurants, seeking "experience" they missed during the pandemic. Against the background, we believe the value of "experiential gifts", which may fulfil the people’s wants, to increase further hereafter.

In recent years, ‘experiential consumption’ has evolved into ‘moment consumption (“toki shohi” in Japanese)’ and ‘meaning consumption (“imi shohi” in Japanese)’. While the ‘moment consumption’ is a linear extension of ‘experiential consumption’, which is "embracing joy of one-time experience" such as going to an event that is hold only once, ‘meaning consumption’ is “selection with an emphasis on social and cultural meaning of a product or service.

In the gifting market, ‘meaning consumption’ means selecting gifts that conform with the giver’s values regarding social justice and consumption, such as products and services that are “eco-friendly”, “contributes to charity”, “emphasize history/cultural traditions”, or “health conscious”. ‘Meaning consumption’ in gifting, for example, by choosing a piece of craftsmanship that leads to the preservation of artisan or community, or by selecting a gift at a store that put efforts into reducing CO2 emission in logistics, is starting to spread mainly among young people.

There is great potential for growth in demand for “value-based” gifts, instead of occasion-based or price-based gifts, as consumers become acquainted with various consumption values.

Future Outlook

The domestic gift market is forecasted to grow to 101.7% of the previous year to 11,002 billion yen in 2024.

While material gifts were given as an alternative to face-to-face meet ups and celebrations during the pandemic, experiential gifts regained momentum as people became free to meet. Although the year-on-year growth rate of casual gifts is projected to decline in 2023, experiential gifting is increasing value whilst quite a few gifting occasions are showing two-digit growth from pre-pandemic 2019 level. Furthermore, the demand for hostess gifts and travel souvenirs, as gifts associated with the increase of opportunities to meet people in person, is expected to grow significantly in 2023. Even though the economy has not recovered fully to pre-pandemic levels, the gift market is expected to grow hereafter.

Research Outline

2.Research Object: Wholesalers and makers of gifts, and retailers (department stores, mass merchandisers, specialty stores, mail orders, etc.)

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), surveys by telephone, mailed questionnaire, and literature research

What is the Gift Market?

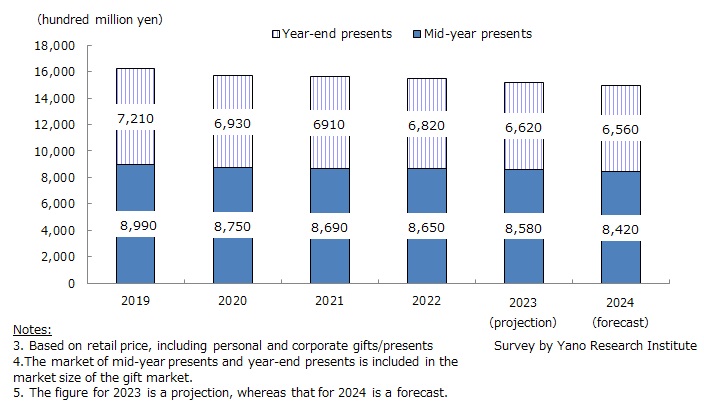

In this research, the gift market refers to personal and corporate gifts/presents, including demands for mid-year presents and year-end presents.

<Products and Services in the Market>

The gifts here include items given with an intention, such as to celebrate, to show gratitude, to greet, or to express an apology. Givers of the gifts include not only individuals but also corporate entities. Corporate gifts include products given to customers as novelty or campaign giveaway, as well as gifts given by employers to employees as anniversary gifts, company benefit gifts, or incentives.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.