No.3453

Sleep Tech Market in Japan: Key Research Findings 2023

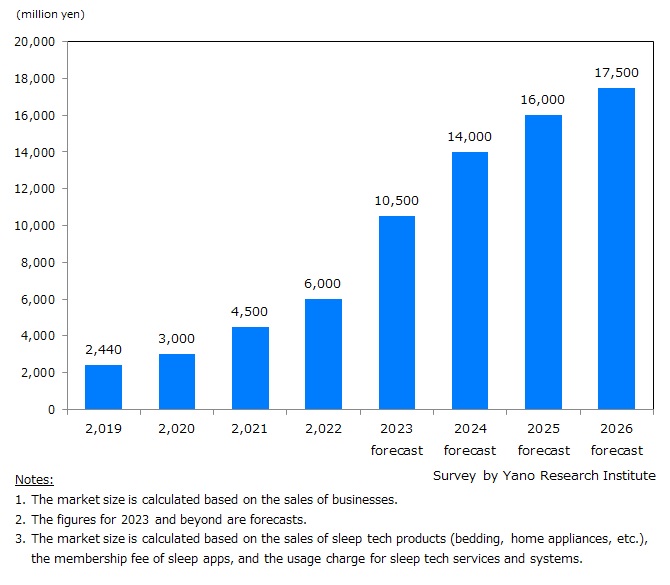

Domestic Sleep Tech Market Estimated at 10,500 Million Yen in 2023

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic business of sleep, and found out the trends of products and services, the business development status of market players, and future directions. This press release denotes our forecasts on the sleep tech market.

Market Overview

Sleep health is keenly recognized social issue. In addition to medical devices and medicines, products like bedding and food with functional claims and services have been released to improve people’s sleep. Under these circumstances, the sleep tech market developed.

Sleep tech is a coined term of “sleep” and “technology”, which refers to devices, systems, and services to improve sleep, through monitoring and analysis of data during a person's sleep with IT and AI technologies such as sensors and apps.

Based on the sales of businesses, including the product sales of sleep tech bedding and home appliances, membership fee of sleep apps, and the usage charge for services and systems, the sleep tech market size in 2022 was estimated at 6 billion yen.

Sleep conditions can be sensed and analyzed on various metrics, such as body movements, breath (respiratory rate), heart rate, snoring, body temperature, bedding temperature, brain waves, and myoelectric signals. In recent years, sophistication and downsizing of sensors has diversified the tracking devices into various forms, such as smartphones, wristbands, rings, headsets, and earphones. It became easier to visualize sleep patterns.

New services targeted to corporations have been launched, where expert tips and evidence-based advice for better sleep are provided based on sleep conditions of their employees. Stemming from the idea of "Health and Productivity Management", companies are making efforts in improving employees’ sleep for the purpose of solving various managerial issues associated with employees’ wellbeing.

Noteworthy Topics

Market Entrants Broadened: From Manufacturers of Medical Devices and Beddings to University Ventures

Development of sleep tech products were centrally promoted by medical device manufacturers. Nevertheless, in addition to the healthcare companies, bedding makers, electric appliance makers, and telecommunication services, new market entrants such as university ventures are witnessed in the last few years.

The ventures are collaborating with manufacturers of bedding, air conditioners, home appliances, medicines, and food in product development. By incorporating scientific evidence regarding sleep data, they aim to improve product reliability and differentiate their products from that of competitors.

For corporate customers, services that focus on sleep as a part of health and productivity management is increasing. The services vary by the type of monitoring devices and in how advice is provided. For example, there is sleep advisor service, in which an expert provides tips for improving sleep based on the subjective assessment of sleep condition by the person getting the advice.

It should also be noted that, in the last couple of years, there is a trend of establishing a platform for joint development of products and services between companies from various industries.

Future Outlook

Size of the domestic sleep tech market in 2023 is forecasted to expand to 175% of the preceding year to 10,500 million yen.

The sleep tech market has extended from products for individuals (such as bedding, home appliances, apps, games) to corporate services that adapt to the needs of Health and Productivity Management. In addition to the fact that a plenty of research shows sleep is linked to health and productivity, we believe that rising societal interest toward sleep wellness is one of the market drivers.

Technological innovations in the development of sleep monitoring devices are very fast. Trends of expanding the range of devices, improving precision of sensors, and enhancing the quality and quantity of biometric data obtained from sensors, are expected to continue hereafter.

Research Outline

2.Research Object: Manufacturers (of bedding, food & diet supplements, medicines, and medical electronics) and other providers/developers of sleep tech related systems and services

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews) and literature research

What is the Sleep Tech Market?

Sleep tech are the devices, systems, and services for recording biological data and analyzing sleep condition using IT and AI, for the purpose of improving person’s sleep.

In this research, the size of the sleep tech market was calculated based on the product sales of sleep tech related bedding and home appliances (for the bedding, only those with some kind of ICT functions; bedding in general are not included in the market size), the membership fee of sleep apps, and the usage charge for services and systems.

<Products and Services in the Market>

Sleep tech products, membership fee of sleep apps, usage charge for services and systems

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.