No.3451

Beverage Container Market in Japan: Key Research Findings 2023

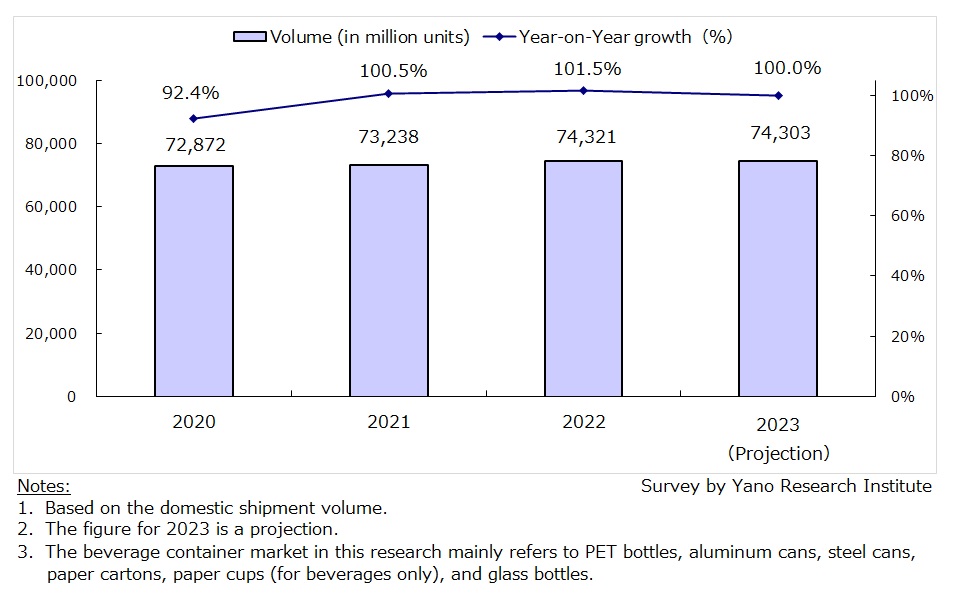

Domestic Beverage Container Market Size in 2023 Expected to Attain 74,303 Million Units, 100.0% of Preceding Year

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic market of beverage and food containers and found out the trends by product segment and the trends at market players. This press release denotes the domestic shipment volume of beverage containers.

Market Overview

The market size of beverage containers in 2023 is expected to attain 74,303 million units (based on the domestic shipment volume), 100.0% of the previous year.

2023 saw multiple conditions that increase demand for soft drinks, including the recovery of tourism industry and inbound tourist demand, which are propelled by reclassification of COVID-19 as Class 5 infectious diseases and easing of border measures, as well as warm climate since spring and boiling-hot summer. However, the market growth is expected to stay flat as warm winter brought uncertainty in sales trend of hot beverages in winter, while repeated price hikes in a wide range foods, beverages and daily necessities have led consumers to stop buying products.

Noteworthy Topics

In Addition to Appealing Product Value, Containers are Expected to Serve as A "Face" to Showcase Enterprise's Sustainable Initiatives

Nowadays, containers do not just appeal taste, convenience, or premium feel of the beverages or foods. Brand owners and retailers are expected to add “environmental value” to their products by selecting containers that are made of sustainable materials. Brand owners and retailers like CVS (convenience stores) that directly engage with consumers are conscious in particular about switching containers, the ‘face’ of products, to sustainable materials, because environmental impact of their products shape their corporate image.

Efforts to make containers more sustainable have so far been made mainly from two directions: (1) switching from fossil-based plastics to products made from sustainable plant-derived materials, and (2) collecting and recycling used containers.

In initiatives (1) to reduce the use of fossil-based plastics, a shift to non-fossil-based container with a cap (caps that can be put back on) is promoted, such as a switch from PET bottles to aluminum bottles and drinkable-sized paper carton with spout. For food containers, implementation of biomass plastic, pulp mold, and paper cups are increasing.

In attempts for (2) recycling, container manufacturers, recyclers (including recycled resin suppliers), and material makers are involved vigorously as it is positioned a mainstream of making containers sustainable. Since the Containers and Packaging Recycling Law went into effect in 1997, a scheme for recycling has been established domestically, through sorting of recyclables when disposing (by consumers), sorted collection (by municipalities), and recycling (by enterprises). Initially, the emphasis was on reducing waste volume and thermal recycling (TR), in which used containers were collected and used as energy. As globalization of recycling business proceeds, material recycling (MR) and chemical recycling (CR) are increasing significance. However, MR is the main method for container recycling, for CR is only partially deployed on a commercial basis.

Future Outlook

As the domestic food and beverage market matures and consumption is not likely to expand, brand owners have attempted to improve profits by raising retail price by launching high value-added items. Brand owners are introducing premium products that emphasize "taste" and "aroma" through innovative manufacturing methods. Amidst a series of price hikes for food and beverage products from 2022 to 2023, it is a matter of life and death for brand owners whether they can convince consumers in purchasing their products even if the prices are higher.

Food and beverage containers are not just "cases" but the "faces" of the product. Container makers are in a position to support the premium strategies of brand owners, and this is where their value lies in the mature market.

Container manufacturers are expected to create containers that benefit all parties involved, such as energizing brand owners with whom they collaborate on products, bringing delight to consumers who pick up their products, and raising the value of contents so that the products can be sold at higher prices.

Research Outline

2.Research Object: Manufacturers of beverage containers and food containers

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews) and literature research

What is the Beverage Container Market?

The beverage container market in this research mainly refers to PET bottles, aluminum cans, steel cans, paper cartons, paper cups (for beverages only), and glass bottles. The market size has been calculated based on the domestic shipment volume.

<Products and Services in the Market>

Light weight plastic containers (PSP containers, A-PET containers, OPS containers, PP filler containers), PET bottles, metal cans (aluminum cans, steel cans), paper containers (paper cartons, paper cups, paper packages), glass bottles

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.