No.3420

Credit Card Market in Japan: Key Research Findings 2023

Backed by Penetration of Cashless Payment and Growing Corporate Demand, Credit Card Market Forecasted to Attain 158 Trillion Yen by FY2028

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the credit card market in Japan, and found out the current status, the trends of market players, and future perspective.

Market Overview

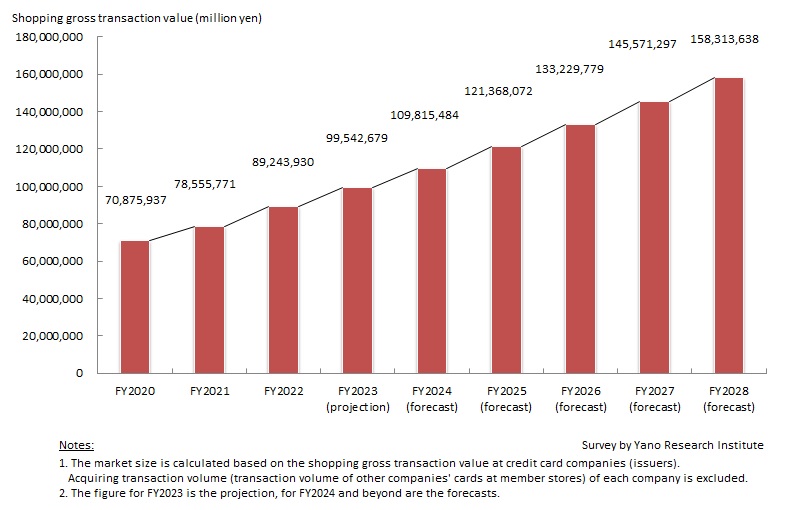

The size of the domestic credit card market expanded to approximately 89 trillion yen in FY2022 (based on the shopping gross transaction value at credit card companies [issuers]).

The expansion of the market size was influenced by the recovery in the frequency of credit card payments for travel, dining, leisure, ETC (Electronic Toll) and gasoline, supported by the removal of pandemic restrictions.

Although the growth of the credit card market is expected to continue in FY2023, it is necessary to closely monitor how changes in the external environment, such as rising prices, will affect the performance of credit card issuers.

Noteworthy Topics

Strengthening Ties with Other Financial Services

In recent years, credit card companies have strengthened their ties with securities and insurance industries. Bank-affiliated card companies have been trying to utilize personal IDs they have to expand the use of credit cards in cooperation with banks. One of the reasons for reinforcing cooperation with securities and insurance companies is that their goal is to acquire customers from both ends through product design, for example with a product that increases the percentage of reward points for cardholder using the service of a partner company. Credit card companies expand their business by cross-selling financial products with banks, securities companies, and insurance companies.

In addition, efforts are underway to strengthen linkages with common reward points, which may accelerate cooperation with businesses in the areas surrounding cashless payments.

Future Outlook

Size of the credit card market is expected to grow steadily to around 158 trillion yen by FY2028.

The market growth drivers include the increased use of credit cards in previously untapped markets such as real estate, weddings, and funerals, as well as the widespread adoption of cashless payments in everyday consumer activities. Given the expansion of marketing activities based on credit cardholders' personal IDs, growing cardholders, or the number of personal IDs, is critical for credit card firms' business growth. Making attempts to become a primary credit card issuer for a cardholder, as well as an issuer of a secondary credit card, is critical.

Research Outline

2.Research Object: Credit card issuers

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), surveys via telephone, mailed questionnaire, and literature research

What is the Credit Card Market?

In this research, the credit card market is the market of transactions via credit cards by the domestic credit card holders who shopped at online shops as well as real shops in and out of the country. The market size is calculated based on the shopping gross transaction value at credit card companies (issuers). Nonetheless, the acquiring transaction volume (transaction volume of other companies' cards at member stores) of each company is not included.

<Products and Services in the Market>

Credit card, corporate card, electronic money, contactless payment

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.