No.3254

Consumer Survey on Storage Services in Japan: Key Research Findings 2023

Consumer Survey in February 2023 Shows Marginal Decline in Service Usability Rate for All 3 Types of Storage Services Compared to the Results of 2021 Survey

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a consumer survey on storage services. Target of the survey includes both current users and non-users. The results are analyzed by comparing to the results of the same survey conducted in the past. This press release announces the recognition level of storage services, as well as use condition, and intentions of use among non-users.

Summary of Research Findings

The consumer survey about the use of storage service was carried out to 10,000 men and women in their ages between 20s and 70s nationwide. It included questions regarding their service recognition, use experience (at current / in the past), intention to use such services hereafter, criteria for choosing the service, pros and cons, reason(s) for discontinuing the use of service, changes in the way of use, etc.

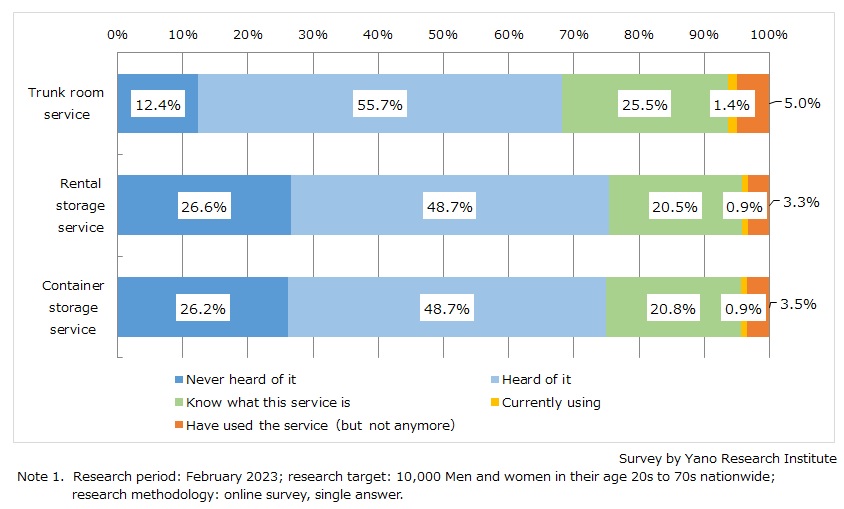

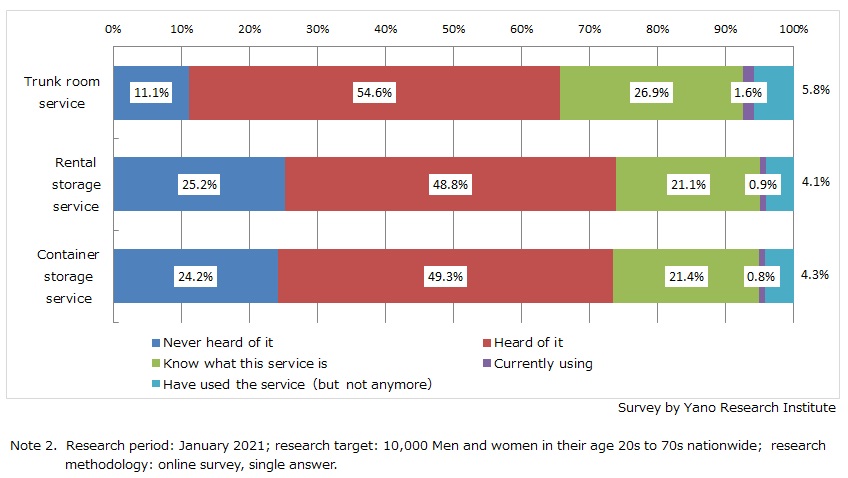

According to the results, respondents with user experience (i.e., respondents that chose the option “currently using the service” and “have used the service in the past (not using at current)”) decreased marginally for all three services compared to the last survey. It accounted for 6.4% for “trunk room services” (7.4% in 2021 Survey, down 1.0 percentage points), 4.2% for “rental storage services” (5.0% in 2021 Survey, down 0.8 percentage points), and 4.4% (5.1% in 2021 Survey, down 0.7 percentage points).

Noteworthy Topics

9 Out of 10 Have Never Considered Using Storage Services

Respondents who had never used storage services (trunk room services, rental storage services, or container storage services) were asked if they had ever considered using a storage service. More than 90% of the respondents answered that they had never considered using any storage service.

This is because of the Japanese lifestyle, where people are not accustomed to storing household goods and belongings away from home, and the fact that these storage businesses tend to be rather passive - they 'wait' for people in need to use a storage service.

To expand the use of storage services, it will be important for the businesses to increase recognition, while promoting the benefit of using the services, such as how it makes users’ home tidier and more spacious.

Research Outline

2.Research Object: General consumers in their ages between 20s and 70s nationwide

3.Research Methogology: Online survey

Consumer Survey on Storage Services

The consumer survey about the use of storage service, which has become one of the daily life assisting services for general consumers, was carried out to 10,000 men and women in their ages between 20s and 70s nationwide.

It aims to explore use status of storage services (recognition, current/past use experience, interest toward use of storage service hereafter, criteria for choosing the service, pros and cons of storage services, reasons for discontinuing the use of service, and changes in usage).

At the same time, a questionnaire survey was carried out to 300 men and women who is aware of the storage services but has never used any, about their intention to use the service in the future (reasons for not using the service, timing for considering the use, storage-unit size, storage-rental rates, acceptable range of distance to storage location, required facility/function of storage, and items they wish to store in the storage space).

The storage services in this survey are defined as paid storage for personal goods (basically those without any purpose to sell) outside of office or home. They are categorized into the following three types: 1) Rental storage services, 2) container storage services, and 3) trunk room services.

1) “Rental storage service” is a service that lends indoor rooms and spaces, including those in storing-only buildings, where individuals or corporate bodies can store things. They are operated mainly by real estate agencies. Safe-deposit boxes at banks, and coin lockers at places such as railway stations are not included in this market segment.

2) “Container storage service” is close to rental storage service, but different in a way that they use containers or metal outdoor storage.

3) “Trunk room service” is operated chiefly by warehousing companies, which provides trunk rooms certified by MLIT (Ministry of Land, Infrastructure, Transport and Tourism) where all kinds of household goods can be stored. Services specific for documents storage and for corporate use are not included in this market segment.

<Products and Services in the Market>

Trunk room service, rental storage service, and container storage service

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.